- United States

- /

- Biotech

- /

- NasdaqCM:OCGN

Exploring 3 High Growth Tech Stocks In The US Market

Reviewed by Simply Wall St

Over the last 7 days, the United States market has dropped 2.6%, yet it has risen by 9.1% over the past year, with earnings forecasted to grow by 14% annually. In such a dynamic environment, identifying high growth tech stocks requires an understanding of their potential to outperform in terms of innovation and adaptability amidst fluctuating market conditions.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 26.38% | 39.09% | ★★★★★★ |

| Mereo BioPharma Group | 53.62% | 66.56% | ★★★★★★ |

| Ardelyx | 20.78% | 59.46% | ★★★★★★ |

| Travere Therapeutics | 26.41% | 64.47% | ★★★★★★ |

| TG Therapeutics | 26.46% | 38.75% | ★★★★★★ |

| Alnylam Pharmaceuticals | 23.65% | 61.11% | ★★★★★★ |

| AVITA Medical | 27.28% | 60.66% | ★★★★★★ |

| Alkami Technology | 20.54% | 76.67% | ★★★★★★ |

| Ascendis Pharma | 35.16% | 60.26% | ★★★★★★ |

| Lumentum Holdings | 21.59% | 110.32% | ★★★★★★ |

Click here to see the full list of 233 stocks from our US High Growth Tech and AI Stocks screener.

Let's dive into some prime choices out of from the screener.

Ocugen (NasdaqCM:OCGN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Ocugen, Inc. is a biopharmaceutical company dedicated to the discovery, development, and commercialization of innovative gene and cell therapies, biologics, and vaccines aimed at enhancing patient health, with a market cap of approximately $271.82 million.

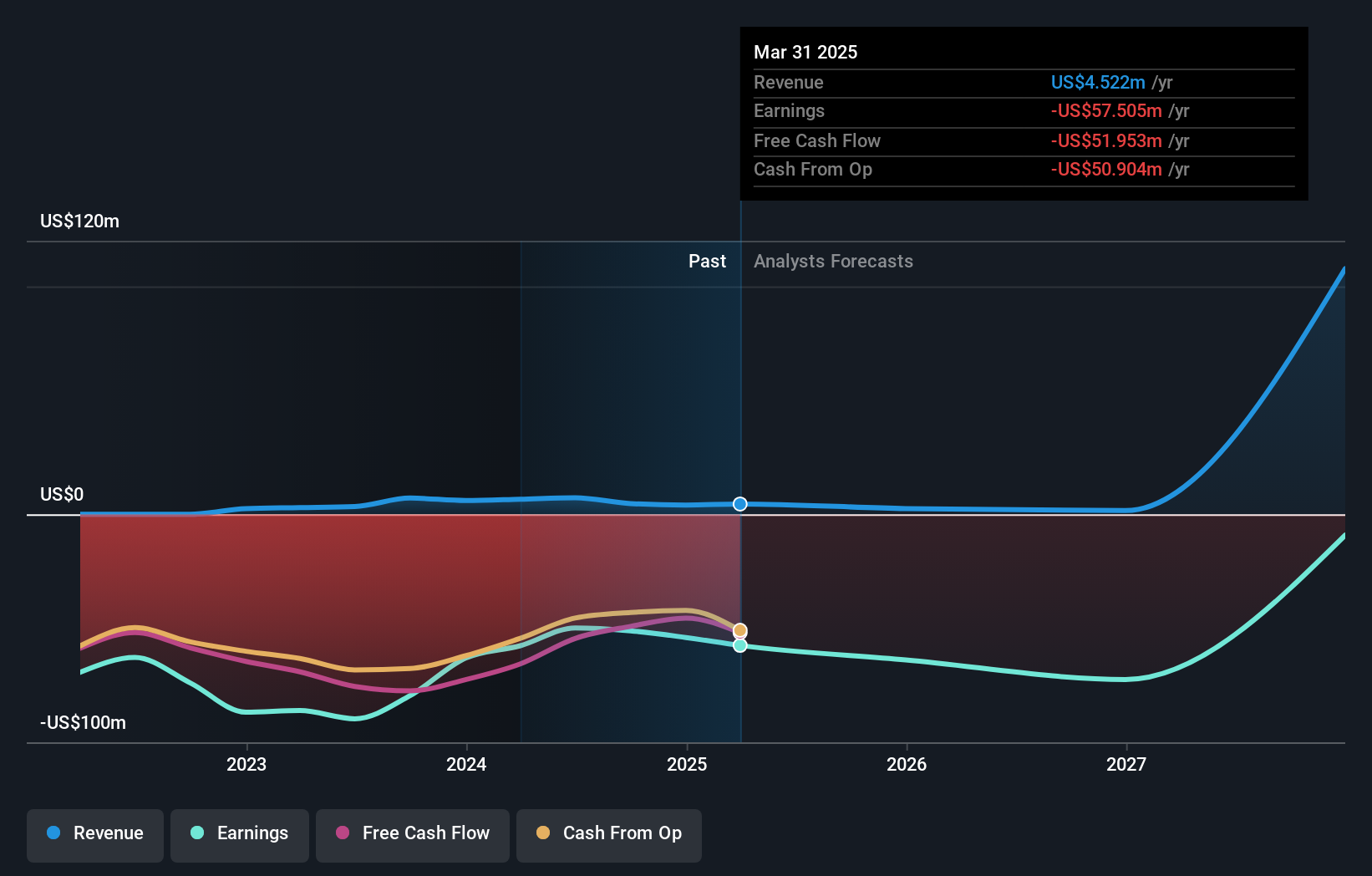

Operations: The company generates revenue primarily from developing innovative therapies for rare and underserved eye diseases, amounting to $4.52 million.

Ocugen's trajectory in the high-growth tech landscape is underscored by a robust 66.7% annual revenue growth forecast, significantly outpacing the broader U.S. market's 8.6%. Despite its current unprofitability, projections suggest a promising shift with earnings expected to surge by 73% annually over the next three years. Recent strategic movements include their ongoing R&D endeavors, notably in advanced biologics for ophthalmology, which could redefine treatment paradigms in diabetic macular edema and related conditions. Their commitment is further evidenced by an R&D expenditure that aligns closely with these innovative pursuits, positioning them potentially at the forefront of biotech advancements.

- Click here and access our complete health analysis report to understand the dynamics of Ocugen.

Gain insights into Ocugen's past trends and performance with our Past report.

CompoSecure (NasdaqGM:CMPO)

Simply Wall St Growth Rating: ★★★★★☆

Overview: CompoSecure, Inc. is a company that specializes in the manufacturing and design of metal, composite, and proprietary financial transaction cards for both domestic and international markets, with a market capitalization of $1.35 billion.

Operations: CompoSecure generates revenue through the production and design of high-quality financial transaction cards, catering to both domestic and international markets. The company focuses on leveraging its expertise in metal and composite materials to deliver innovative card solutions.

CompoSecure's recent strategic initiatives, including the launch of the MetaMask metal payment card and integration with MoneyGram Access, underscore its innovative approach in bridging digital assets with traditional commerce. Despite a challenging profitability path, with a net loss reported in Q4 2024 but a notable recovery in Q1 2025 earnings to $21.49 million from $4.03 million year-over-year, the company is poised for growth. It forecasts mid-single digit sales growth for 2025, supported by new product offerings and enhanced payment solutions that leverage secure technologies like Arculus for seamless financial transactions. This blend of cutting-edge technology and strategic partnerships positions CompoSecure to capitalize on evolving market demands in digital payments and cryptocurrency integration.

- Click to explore a detailed breakdown of our findings in CompoSecure's health report.

Evaluate CompoSecure's historical performance by accessing our past performance report.

Humacyte (NasdaqGS:HUMA)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Humacyte, Inc. focuses on developing and manufacturing off-the-shelf, implantable, and bioengineered human tissues for various therapeutic applications, with a market cap of $392.45 million.

Operations: The company specializes in creating implantable, bioengineered human tissues aimed at treating various diseases and conditions. With a focus on therapeutic applications across multiple anatomical locations, it operates within the biotechnology sector and holds a market cap of $392.45 million.

Humacyte, Inc. has demonstrated a robust turnaround with its Q1 2025 earnings, posting a net income of $39.14 million, a significant reversal from the previous year's net loss of $31.9 million. This financial recovery is underpinned by an aggressive R&D strategy that saw the company investing heavily in innovative biotechnologies, aligning with its revenue growth forecast at an impressive annual rate of 57.8%. The firm's strategic pivot towards high-demand medical applications like Symvess—a vascular conduit approved by the FDA—exemplifies its commitment to addressing critical healthcare needs through advanced solutions, potentially reshaping treatment paradigms in vascular and regenerative medicine.

- Dive into the specifics of Humacyte here with our thorough health report.

Review our historical performance report to gain insights into Humacyte's's past performance.

Seize The Opportunity

- Unlock our comprehensive list of 233 US High Growth Tech and AI Stocks by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:OCGN

Ocugen

A biopharmaceutical company, focuses on discovering, developing, and commercializing novel gene and cell therapies, biologic, and vaccines that improve patients’ health.

High growth potential with mediocre balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion