- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGM:AIOT

The three-year returns have been decent for PowerFleet (NASDAQ:AIOT) shareholders despite underlying losses increasing

PowerFleet, Inc. (NASDAQ:AIOT) shareholders might be concerned after seeing the share price drop 17% in the last month. But don't let that distract from the very nice return generated over three years. In fact, the company's share price bested the return of its market index in that time, posting a gain of 87%.

Since it's been a strong week for PowerFleet shareholders, let's have a look at trend of the longer term fundamentals.

PowerFleet wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually desire strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

In the last 3 years PowerFleet saw its revenue grow at 23% per year. That's much better than most loss-making companies. While the compound gain of 23% per year over three years is pretty good, you might argue it doesn't fully reflect the strong revenue growth. So now might be the perfect time to put PowerFleet on your radar. A window of opportunity may reveal itself with time, if the business can trend to profitability.

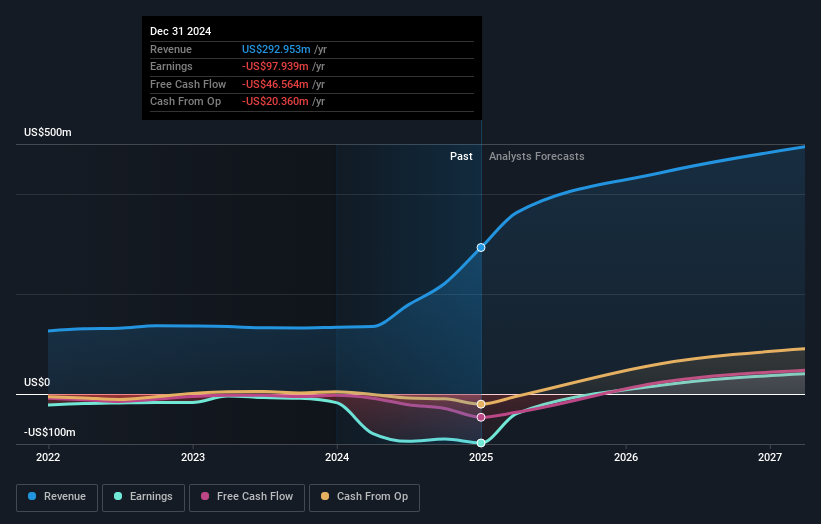

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. If you are thinking of buying or selling PowerFleet stock, you should check out this free report showing analyst profit forecasts.

A Different Perspective

We're pleased to report that PowerFleet shareholders have received a total shareholder return of 29% over one year. That gain is better than the annual TSR over five years, which is 12%. Therefore it seems like sentiment around the company has been positive lately. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Like risks, for instance. Every company has them, and we've spotted 3 warning signs for PowerFleet (of which 2 make us uncomfortable!) you should know about.

PowerFleet is not the only stock insiders are buying. So take a peek at this free list of small cap companies at attractive valuations which insiders have been buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:AIOT

PowerFleet

Provides Internet-of-Things solutions in the United States, Israel, and internationally.

High growth potential and good value.

Similar Companies

Market Insights

Community Narratives