- United States

- /

- Communications

- /

- NasdaqGM:AAOI

The 24% return this week takes Applied Optoelectronics' (NASDAQ:AAOI) shareholders one-year gains to 605%

The last three months have been tough on Applied Optoelectronics, Inc. (NASDAQ:AAOI) shareholders, who have seen the share price decline a rather worrying 37%. But that doesn't change the fact that the returns over the last year have been spectacular. Few could complain about the impressive 605% rise, throughout the period. So it is not that surprising to see the stock retrace a little. The real question is whether the fundamental business performance can justify the strong increase over the long term. It really delights us to see such great share price performance for investors.

On the back of a solid 7-day performance, let's check what role the company's fundamentals have played in driving long term shareholder returns.

Check out our latest analysis for Applied Optoelectronics

Applied Optoelectronics wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Applied Optoelectronics actually shrunk its revenue over the last year, with a reduction of 8.2%. This is in stark contrast to the splendorous stock price, which has rocketed 605% since this time a year ago. It's pretty clear the market isn't basing its valuation on fundamental metrics like revenue. While this gain looks like speculative buying to us, sometimes speculation pays off.

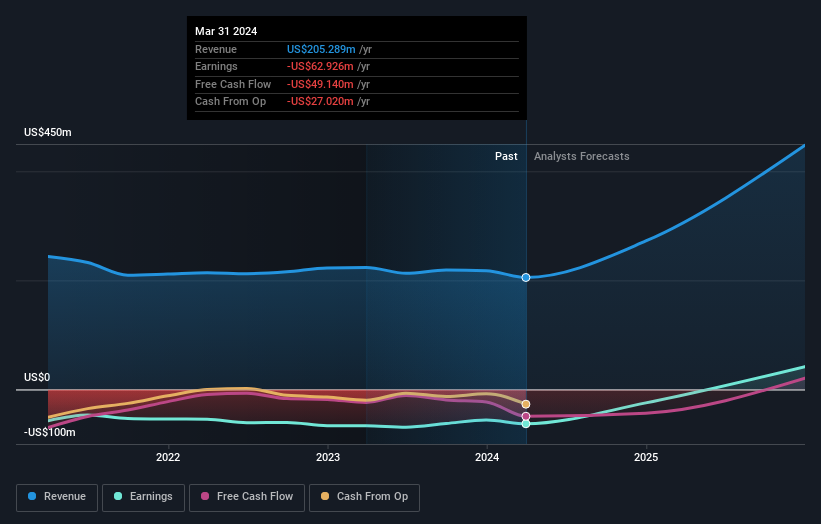

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

It's probably worth noting we've seen significant insider buying in the last quarter, which we consider a positive. That said, we think earnings and revenue growth trends are even more important factors to consider. So we recommend checking out this free report showing consensus forecasts

A Different Perspective

We're pleased to report that Applied Optoelectronics shareholders have received a total shareholder return of 605% over one year. Since the one-year TSR is better than the five-year TSR (the latter coming in at 7% per year), it would seem that the stock's performance has improved in recent times. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. It's always interesting to track share price performance over the longer term. But to understand Applied Optoelectronics better, we need to consider many other factors. To that end, you should learn about the 4 warning signs we've spotted with Applied Optoelectronics (including 1 which makes us a bit uncomfortable) .

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: most of them are flying under the radar).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:AAOI

Applied Optoelectronics

Designs, manufactures, and sells fiber-optic networking products in the United States, Taiwan, and China.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)