- United States

- /

- Software

- /

- OTCPK:RAAS.Y

Natural Health Trends And 2 Other Penny Stocks With Promising Financials

Reviewed by Simply Wall St

The U.S. stock market has been experiencing mixed movements, with the Dow Jones Industrial Average declining for a second consecutive day while technology shares show signs of recovery. Amid these fluctuations, investors are often on the lookout for stocks that offer potential growth opportunities at lower price points. Penny stocks, though an older term, continue to represent a niche investment area where smaller or newer companies can shine. When these stocks boast strong financial health and solid fundamentals, they can present promising opportunities for those willing to explore beyond traditional investments.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Dingdong (Cayman) (DDL) | $1.70 | $370.75M | ✅ 4 ⚠️ 0 View Analysis > |

| Waterdrop (WDH) | $1.60 | $589.51M | ✅ 4 ⚠️ 0 View Analysis > |

| LexinFintech Holdings (LX) | $4.14 | $698.29M | ✅ 4 ⚠️ 2 View Analysis > |

| Puma Biotechnology (PBYI) | $4.95 | $251.45M | ✅ 3 ⚠️ 2 View Analysis > |

| Performance Shipping (PSHG) | $2.14 | $27.23M | ✅ 4 ⚠️ 2 View Analysis > |

| CI&T (CINT) | $4.58 | $598.45M | ✅ 4 ⚠️ 0 View Analysis > |

| Golden Growers Cooperative (GGRO.U) | $5.00 | $77.45M | ✅ 2 ⚠️ 5 View Analysis > |

| Cricut (CRCT) | $4.63 | $1.01B | ✅ 2 ⚠️ 3 View Analysis > |

| BAB (BABB) | $0.8925 | $6.52M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $3.22 | $73.63M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 359 stocks from our US Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Natural Health Trends (NHTC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Natural Health Trends Corp. is a direct-selling and e-commerce company offering personal care, wellness, and lifestyle products under the NHT Global brand, with a market cap of $41.51 million.

Operations: The company's revenue is primarily derived from its Primary Reporting segment at $39.49 million, with additional contributions from China at $0.95 million and Russia and Kazakhstan at $0.44 million.

Market Cap: $41.51M

Natural Health Trends Corp., a direct-selling and e-commerce company, faces challenges typical of penny stocks with its current unprofitability and declining earnings. Despite a market cap of US$41.51 million, the company reported a net loss of US$0.431 million for Q3 2025, compared to a small profit the previous year. Sales have decreased from US$10.69 million to US$9.48 million year-over-year for the quarter, highlighting revenue pressure primarily in its main segment and China operations. The company remains debt-free with strong short-term asset coverage but maintains high share price volatility and an unsustainable dividend yield at 22.6%.

- Jump into the full analysis health report here for a deeper understanding of Natural Health Trends.

- Gain insights into Natural Health Trends' historical outcomes by reviewing our past performance report.

Research Frontiers (REFR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Research Frontiers Incorporated develops and markets technology and devices for controlling light flow globally, with a market cap of $60.57 million.

Operations: The company has not reported any revenue segments.

Market Cap: $60.57M

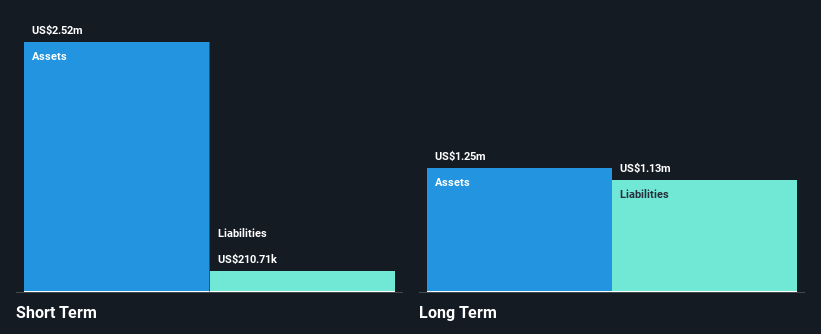

Research Frontiers, with a market cap of US$60.57 million, is pre-revenue and remains unprofitable. The company recently reported a net loss of US$0.298 million for Q3 2025, increasing from the previous year's loss. Despite this, it maintains a strong cash runway exceeding one year and has avoided shareholder dilution over the past year. The firm is debt-free with short-term assets covering liabilities effectively. Recent collaboration with Advanced Impact Technologies Group to debut SPD-SmartGlass at GlassBuild America highlights potential growth avenues in smart glass technology for architectural applications but does not yet translate into significant revenue streams.

- Dive into the specifics of Research Frontiers here with our thorough balance sheet health report.

- Understand Research Frontiers' track record by examining our performance history report.

Cloopen Group Holding (RAAS.Y)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Cloopen Group Holding Limited offers cloud-based communication solutions in the People’s Republic of China and has a market cap of $71.20 million.

Operations: Cloopen Group Holding Limited generates revenue through its three main segments: CPaaS with CN¥189.41 million, Cloud-Based Contact Center at CN¥268.08 million, and Cloud-Based Unified Communications & Collaboration amounting to CN¥116.08 million.

Market Cap: $71.2M

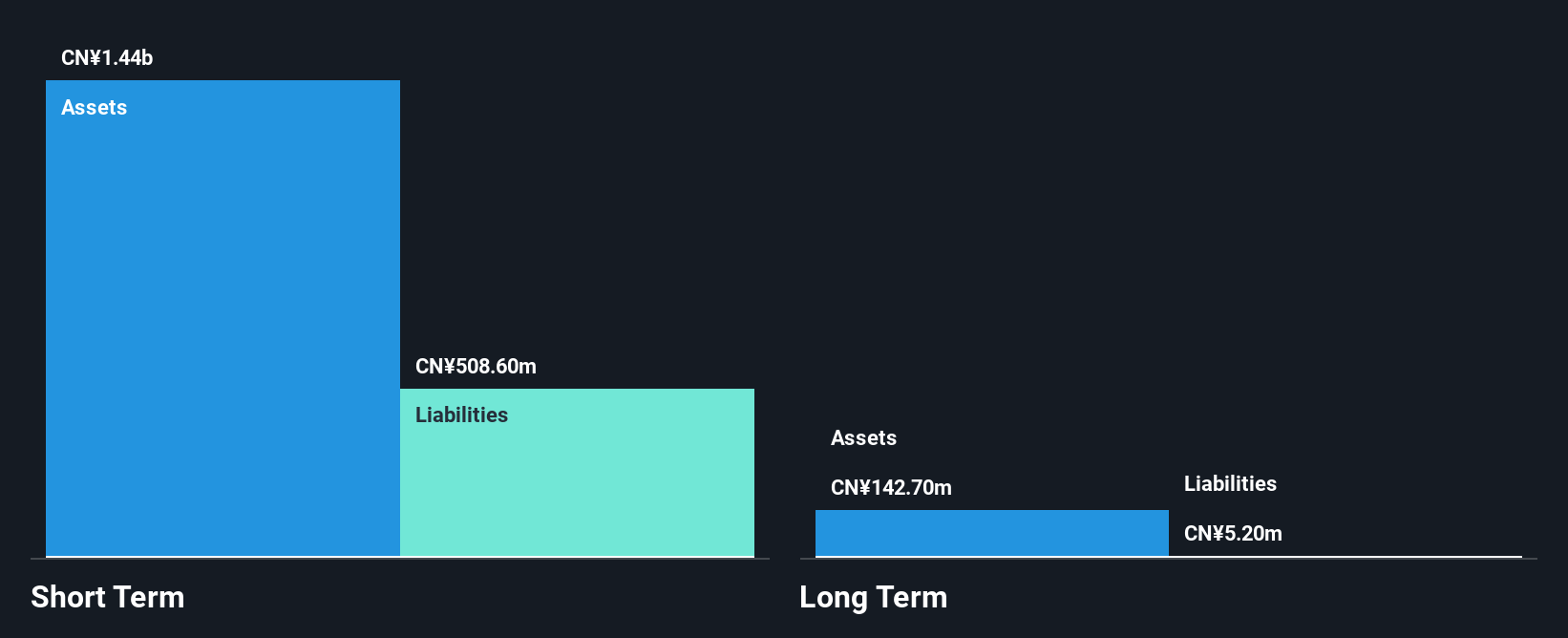

Cloopen Group Holding Limited, with a market cap of $71.20 million, operates in the cloud-based communication sector and reported sales of CN¥573.57 million for 2024, slightly up from the previous year. Despite reducing its net loss to CN¥142.76 million from CN¥409.72 million, the company remains unprofitable with a negative return on equity of -13.79%. The firm is debt-free and has not diluted shareholders recently but faces high share price volatility and an inexperienced board with an average tenure of two years. Its short-term assets significantly exceed liabilities, indicating solid financial management despite ongoing challenges in profitability.

- Navigate through the intricacies of Cloopen Group Holding with our comprehensive balance sheet health report here.

- Learn about Cloopen Group Holding's historical performance here.

Taking Advantage

- Access the full spectrum of 359 US Penny Stocks by clicking on this link.

- Searching for a Fresh Perspective? We've found 15 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OTCPK:RAAS.Y

Cloopen Group Holding

Provides cloud-based communication solutions in the People’s Republic of China.

Adequate balance sheet with very low risk.

Similar Companies

Market Insights

Community Narratives