- United States

- /

- Biotech

- /

- NasdaqGS:MDGL

Exploring High Growth Tech Stocks in the US Market

Reviewed by Simply Wall St

As U.S. stock markets experience fluctuations with key indices like the S&P 500 and Dow Jones Industrial Average losing ground after a recent winning streak, investors are closely watching earnings reports and economic indicators, including GDP data and inflation readings. In this environment of volatility, identifying high growth tech stocks involves assessing companies' potential to innovate and adapt amid broader market challenges.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 20.27% | 29.79% | ★★★★★★ |

| Alkami Technology | 20.46% | 85.16% | ★★★★★★ |

| Travere Therapeutics | 28.65% | 66.06% | ★★★★★★ |

| TG Therapeutics | 26.06% | 37.39% | ★★★★★★ |

| Arcutis Biotherapeutics | 26.11% | 58.46% | ★★★★★★ |

| Clene | 62.08% | 64.01% | ★★★★★★ |

| Alnylam Pharmaceuticals | 23.08% | 58.85% | ★★★★★★ |

| AVITA Medical | 27.81% | 55.17% | ★★★★★★ |

| Lumentum Holdings | 21.34% | 120.49% | ★★★★★★ |

| Ascendis Pharma | 32.75% | 59.64% | ★★★★★★ |

Click here to see the full list of 233 stocks from our US High Growth Tech and AI Stocks screener.

Let's explore several standout options from the results in the screener.

Lumentum Holdings (NasdaqGS:LITE)

Simply Wall St Growth Rating: ★★★★★★

Overview: Lumentum Holdings Inc. is a company that manufactures and sells optical and photonic products across various regions including the Americas, Asia-Pacific, Europe, the Middle East, and Africa with a market cap of $4.15 billion.

Operations: Lumentum generates revenue primarily from its Industrial Tech and Cloud & Networking segments, with $223.90 million and $1.19 billion respectively. The company focuses on delivering optical and photonic products across multiple regions globally.

Lumentum Holdings, a trailblazer in optical technologies, is poised for significant growth with its revenue expected to increase by 21.3% annually. Despite current unprofitability, the company's earnings are projected to surge by an impressive 120.49% per year over the next three years as it transitions to profitability. A pivotal aspect of Lumentum's strategy involves heavy investment in research and development (R&D), which underpins its technological advancements and future competitiveness in high-speed data transmission for AI and machine learning applications. This focus on R&D is critical as it supports the development of innovative products like the recently showcased 448 Gbps data transmission technology at OFC 2025, setting new benchmarks for efficiency and performance in data centers.

- Click here and access our complete health analysis report to understand the dynamics of Lumentum Holdings.

Assess Lumentum Holdings' past performance with our detailed historical performance reports.

Madrigal Pharmaceuticals (NasdaqGS:MDGL)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Madrigal Pharmaceuticals, Inc. is a biopharmaceutical company dedicated to developing innovative treatments for metabolic dysfunction-associated steatohepatitis (MASH) in the United States, with a market cap of $7.22 billion.

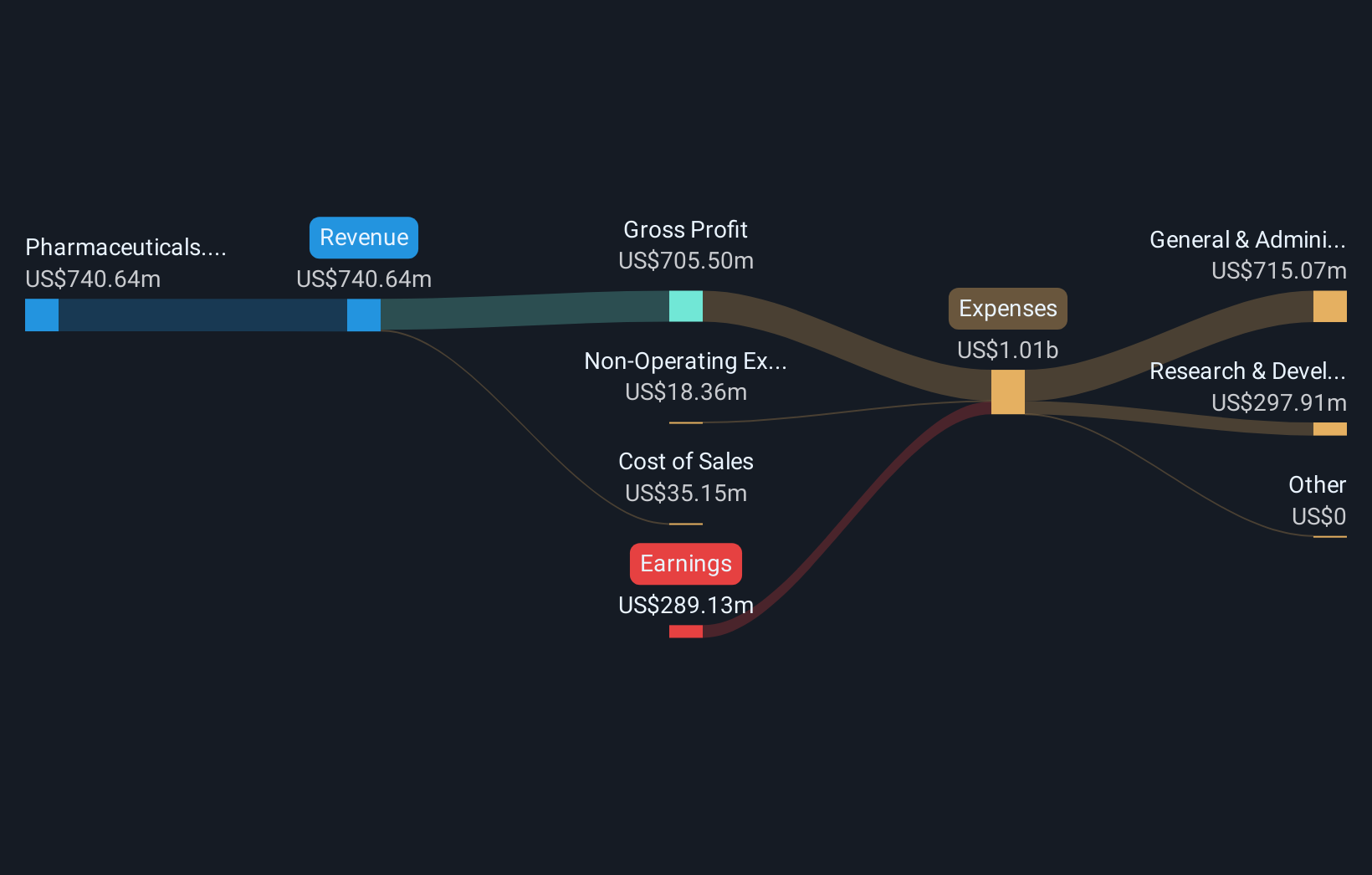

Operations: The company generates revenue primarily from its pharmaceuticals segment, amounting to $180.13 million. With a focus on developing treatments for MASH, it operates within the biopharmaceutical sector in the United States.

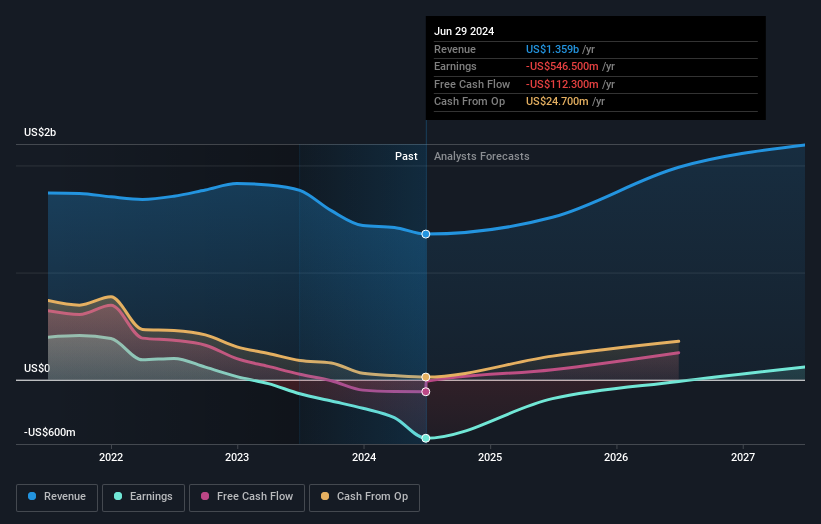

Madrigal Pharmaceuticals has demonstrated a robust commitment to innovation in the treatment of liver and cardiometabolic diseases, marked by a 40.9% annual revenue growth. Recent leadership transitions signal strategic continuity and expertise infusion, with Dr. David Soergel bringing extensive cardiovascular development experience from Novartis to his new role as Chief Medical Officer. Despite reporting a net loss of $465.89 million for 2024, Madrigal's focus on R&D is evident in its successful FDA approval of Rezdiffra for MASH treatment, highlighting its potential pivot towards profitability and sustained growth in its specialized therapeutic area.

- Dive into the specifics of Madrigal Pharmaceuticals here with our thorough health report.

Gain insights into Madrigal Pharmaceuticals' past trends and performance with our Past report.

Zeta Global Holdings (NYSE:ZETA)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Zeta Global Holdings Corp. operates an omnichannel data-driven cloud platform offering consumer intelligence and marketing automation software to enterprises globally, with a market cap of approximately $3.12 billion.

Operations: The company generates revenue primarily from its Internet Software & Services segment, which accounted for approximately $1.01 billion. Its platform supports enterprises by providing consumer intelligence and marketing automation solutions across various channels.

Zeta Global Holdings is redefining the marketing technology landscape with its innovative AI Agent Studio and Agentic Workflows, enhancing automation and campaign efficiency. This strategic pivot is underscored by a robust 17.3% annual revenue growth and an anticipated leap to profitability within three years, reflecting a potential 136.4% earnings growth per annum. Recent share repurchases, totaling $49.78 million for 4,366,643 shares, signal confidence in sustained fiscal health and market position strengthening amidst volatile tech landscapes.

- Delve into the full analysis health report here for a deeper understanding of Zeta Global Holdings.

Evaluate Zeta Global Holdings' historical performance by accessing our past performance report.

Where To Now?

- Discover the full array of 233 US High Growth Tech and AI Stocks right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MDGL

Madrigal Pharmaceuticals

A biopharmaceutical company, focuses on delivering novel therapeutics for metabolic dysfunction-associated steatohepatitis (MASH) in the United States.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives