- United States

- /

- Software

- /

- NYSE:YOU

Will CLEAR (YOU) Expanding CLEAR+ Globally Transform Its Competitive Edge in Identity and Travel?

Reviewed by Sasha Jovanovic

- Earlier this week, CLEAR announced the expansion of its CLEAR+ enrollment program to travelers from 40 additional countries across Europe, Asia, and the Americas, allowing these international visitors to complete online enrollment and access expedited security lanes at over 60 U.S. airports.

- This move substantially broadens CLEAR's global reach and underscores its efforts to serve an expanding international customer base ahead of high-profile U.S. events like the 2026 FIFA World Cup and America’s 250th anniversary celebration.

- We'll explore how the widened eligibility for CLEAR+ could shape the company’s long-term growth outlook in the secure identity and travel sectors.

Rare earth metals are the new gold rush. Find out which 32 stocks are leading the charge.

Clear Secure Investment Narrative Recap

To be a shareholder in Clear Secure, you need to believe in the company’s ability to translate its expanding secure identity platform and global airport presence into sustained membership and revenue growth. While the broadened CLEAR+ enrollment to travelers from 40 new countries meaningfully increases international reach, the most important near-term catalyst remains successful integration of new members and steady renewal rates, while the biggest risk continues to be execution challenges tied to recent leadership changes. The news does not materially alter these short-term dynamics, even as it positions CLEAR to further leverage big events and ongoing travel growth.

Of recent announcements, CLEAR’s new biometric eGate pilots stand out for their relevance to the international expansion of CLEAR+. As both security and convenience become top priorities for airports and airlines ahead of high-profile events, scaling automation could help Clear Secure serve a larger and more diverse membership base, while also increasing the complexity of operational execution in the short term.

But while the expansion push may bring in new customers, it remains important for investors to understand how leadership transitions could affect financial performance, particularly if…

Read the full narrative on Clear Secure (it's free!)

Clear Secure's outlook anticipates $1.1 billion in revenue and $149.9 million in earnings by 2028. This forecast assumes annual revenue growth of 9.7%, but a decrease in earnings of $27 million from current earnings of $176.9 million.

Uncover how Clear Secure's forecasts yield a $35.22 fair value, a 12% upside to its current price.

Exploring Other Perspectives

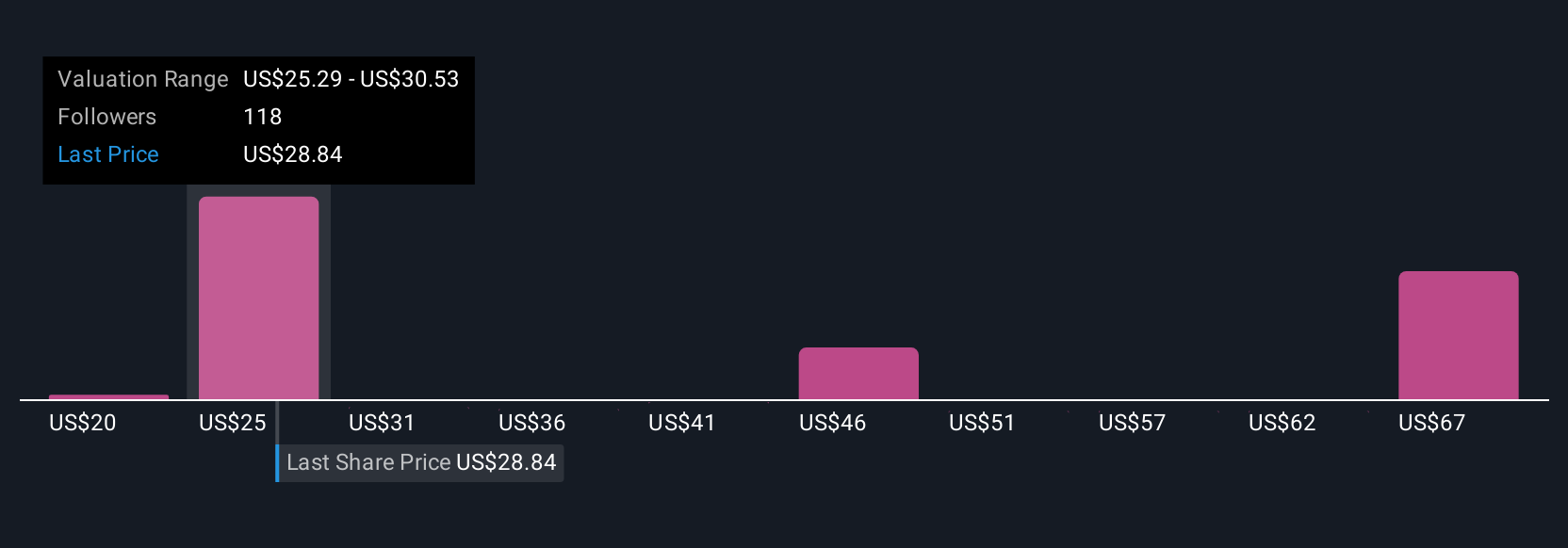

Thirteen unique fair value estimates from the Simply Wall St Community range between US$20.05 and US$70.92 per share. Meanwhile, execution risks from leadership turnover could influence outcomes and are worth considering as you compare these varied views.

Explore 13 other fair value estimates on Clear Secure - why the stock might be worth 36% less than the current price!

Build Your Own Clear Secure Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Clear Secure research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Clear Secure research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Clear Secure's overall financial health at a glance.

Searching For A Fresh Perspective?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:YOU

Clear Secure

Operates a secure identity platform under the CLEAR brand name primarily in the United States.

Outstanding track record and undervalued.

Similar Companies

Market Insights

Community Narratives