- United States

- /

- Software

- /

- NYSE:YOU

Clear Secure (YOU) Partners With FNF To Enhance Real Estate Fraud Prevention

Reviewed by Simply Wall St

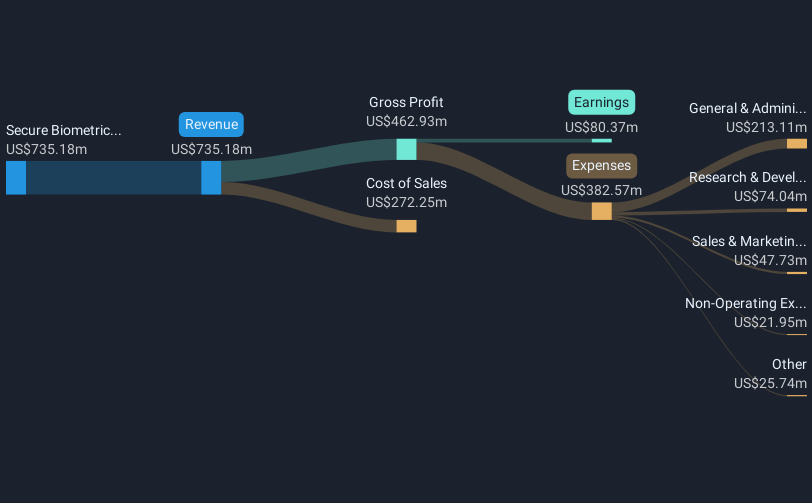

Clear Secure (YOU) recently announced a partnership with Fidelity National Financial to enhance security in real estate transactions using biometric identity verification. This partnership, along with several others in healthcare and automotive sectors, might have contributed to the company's 44% price increase last quarter, as it demonstrates broad application potential for their CLEAR1 platform. This rise came in a market environment where indices like the S&P 500 and Nasdaq hit all-time highs, propelled by an overall optimistic economic outlook. Hence, these events likely added positive weight to the broader upward market movements.

Clear Secure has 1 risk we think you should know about.

The recent partnership announcement between Clear Secure and Fidelity National Financial could significantly influence the narrative surrounding Clear Secure's revenue, considering the expanded application of biometric identity verification beyond airports. This collaboration highlights Clear Secure's potential to tap into additional sectors such as real estate, which may drive future revenue growth. However, the effect on earnings could be moderated by costs associated with entering new segments and potential execution risks following leadership changes.

Over the past three years, Clear Secure's total shareholder return was 68.62%, providing a longer-term perspective on shareholder value creation. Despite this impressive increase, the company's one-year return underperformed the broader US Software industry, which saw a 27.3% increase. This performance context underscores a promising yet cautious outlook as the market evaluates the company's strategic moves.

With the current share price at US$36.67, surpassing the consensus analyst price target of US$34.00, the market seems to price in a degree of optimism, potentially reflecting confidence in Clear Secure's strategic partnerships and expansion efforts. Still, there appears to be a divergence between current market sentiments and analysts' expectations, as revenue is forecasted to grow at 8.7% annually, which is slower than the broader market. This discrepancy might influence future investor sentiment, especially if the integration with new business sectors bolsters revenue and earnings more than currently anticipated.

Gain insights into Clear Secure's historical outcomes by reviewing our past performance report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:YOU

Clear Secure

Operates a secure identity platform under the CLEAR brand name primarily in the United States.

Outstanding track record and undervalued.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026