- United States

- /

- Software

- /

- NYSE:XPER

Xperi (XPER) Valuation in Focus After S&P Index Exclusion Announcement

Reviewed by Kshitija Bhandaru

Xperi (XPER) is back in the headlines after news broke that it’s being dropped from the S&P Software & Services Select Industry Index. Losing a spot in a major index isn’t just a piece of financial housekeeping. It is the kind of development that makes investors and market watchers alike stand up and take notice. Index changes often prompt shifts in trading volume and can reflect how the broader market sees a company’s growth prospects.

This index removal comes at a time when Xperi’s performance has been mixed. While there’s been a mild uptick over the past week, the longer-term picture is tougher: the stock is down about 27% in the past year and nearly 72% over three years. Momentum looks limited, and the company’s annual net income and revenue growth figures tell a story of uneven progress, with a small revenue gain but a considerable earnings drop. For anyone tracking recent catalysts, the index news stands out as the latest in a string of challenges.

So after another year in the red, does this move create a window for value seekers, or is the market just catching up to Xperi’s actual prospects?

Most Popular Narrative: 40.8% Undervalued

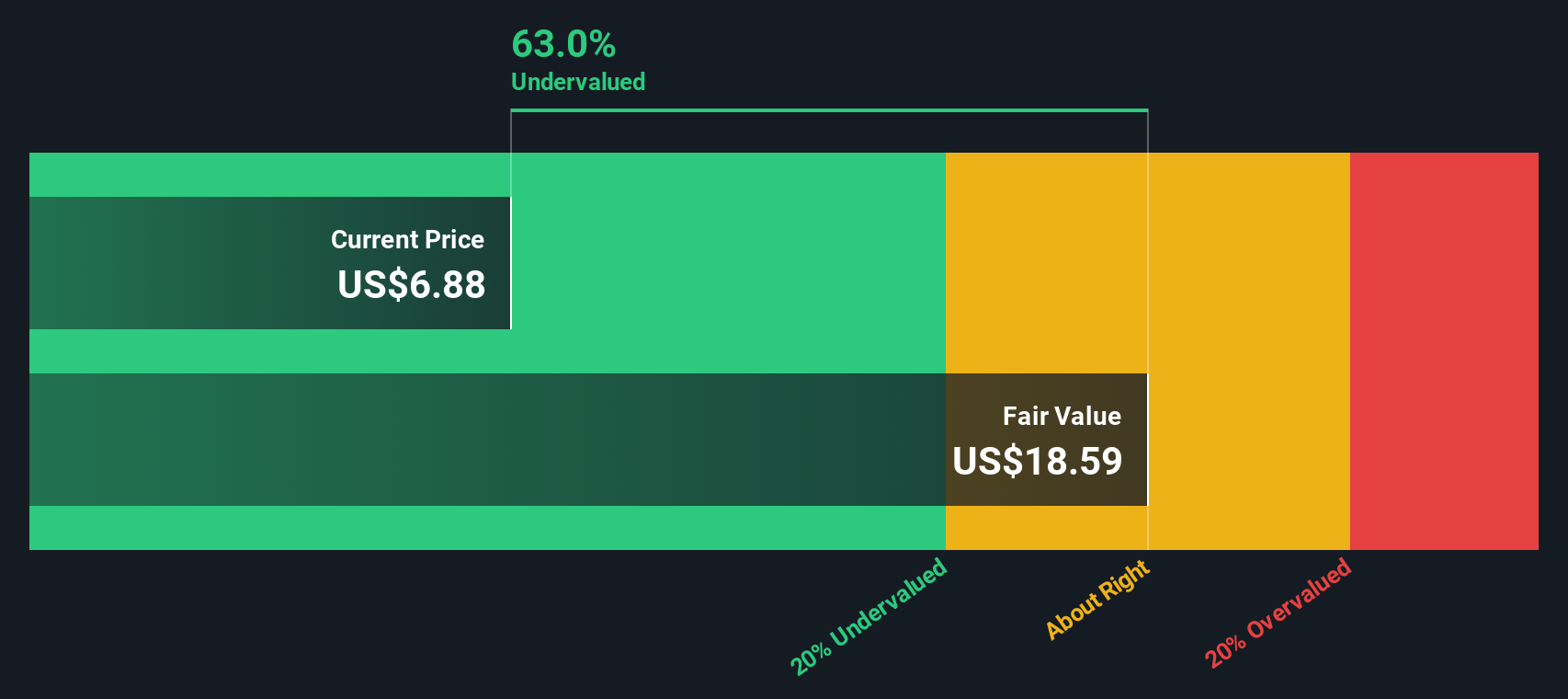

According to the most widely followed narrative for Xperi, the stock is seen as undervalued, with analysts highlighting a significant gap between the current share price and their fair value estimate.

Continued penetration of DTS AutoStage in the automotive sector, as demonstrated by new OEM wins (BMW 5 Series, Kia, Hyundai) and support from global broadcasters, opens recurring revenue streams through licensing, upselling, and in-car digital ad monetization. This directly benefits long-term revenue and margin expansion. Partnerships and international agreements, including the expansion of TiVo OS to 9 partners across 40 countries and IP or metadata deals in Europe and Asia, signal broader global adoption and market share gains. These developments are likely to result in diversified and resilient revenue growth.

Curious how analysts project this bold valuation? The consensus is based on future profit margins and a major shift in where Xperi’s earnings could be in a few years. Can the company make the leap from red ink to robust profit? The narrative outlines the financial journey and the critical numbers that point to much higher potential value.

Result: Fair Value of $11.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, customer concentration and a shift toward open-source platforms could pose significant threats to Xperi’s growth assumptions and future revenue stability.

Find out about the key risks to this Xperi narrative.Another View: What Does Our DCF Model Say?

While multiples suggest Xperi is undervalued, the SWS DCF model paints a similar picture by using projected cash flows rather than market ratios. Both methods highlight value, but do they capture all the risks ahead?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Xperi for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Xperi Narrative

If you're looking to challenge the prevailing view or dig deeper into Xperi's fundamentals, you can craft your own narrative analysis in just a few minutes. Do it your way

A great starting point for your Xperi research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t sit on the sidelines while other investors snap up early opportunities. Put the Screener to work for you and spot companies most investors overlook, fast.

- Spot opportunities in promising, high-growth artificial intelligence ventures when you use the AI penny stocks to zero in on tomorrow’s leaders in AI technology.

- Capture cash flow bargains that could be trading below their true worth by using our tool focused on undervalued stocks based on cash flows, built to highlight value often hiding in plain sight.

- Uncover established businesses rewarding shareholders with robust yields by checking out the pathway to dividend stocks with yields > 3%, a gateway to top dividend payers.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:XPER

Xperi

Operates as a consumer and entertainment technology company worldwide.

Very undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives