- United States

- /

- Software

- /

- NYSE:WK

Workiva (WK): Valuation in Focus as Activist Pressure Sparks Board Shakeup and Sale Talks

Reviewed by Kshitija Bhandaru

Workiva (WK) has landed in the spotlight after Irenic Capital Management launched an activist campaign urging major changes, including a board overhaul and potential sale. These moves are raising fresh questions about the company’s future direction and value.

See our latest analysis for Workiva.

After a turbulent stretch earlier this year, Workiva’s share price has surged 12.2% over the past month and 30% in the last 90 days as activist pressure and speculation about a sale fuel investor interest. Even though the year-to-date share price return remains down, the company’s 9.95% total shareholder return over the past year and nearly 20% three-year total return suggest momentum could be building again as the story evolves.

If recent boardroom moves have you rethinking your strategy, now is the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

With Wall Street buzzing about activist pressure and fresh growth catalysts, is Workiva truly undervalued at current levels, or has the market already factored in what comes next, leaving little room for upside?

Most Popular Narrative: 10.9% Undervalued

With Workiva trading at $86.96, the most widely followed narrative believes its fair value is $97.60. This puts today's price significantly below what analysts think is justified, reflecting optimism about future growth and profitability.

Workiva's focus on multi-solution platform deals and larger contracts, particularly with Fortune 50 and Fortune 100 companies, is anticipated to drive revenue growth through increased account expansion and higher contract values. There is a strong demand for Workiva's sustainability reporting solutions in light of new regulations like the CSRD in Europe, along with a growing market for science-based target reporting, which is expected to enhance their subscription revenues significantly.

Want to know what’s fueling this bullish price target? The narrative hints at a future driven by faster revenue growth, robust international expansion, and margins often reserved for industry disruptors. Eager to see which aggressive assumptions underpin this lofty valuation? Take a closer look and decide for yourself if the growth story stacks up.

Result: Fair Value of $97.60 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, uncertain regulations in Europe or a shift in US policy could derail Workiva’s growth story and potentially challenge even the most optimistic assumptions.

Find out about the key risks to this Workiva narrative.

Another View: DCF Model Puts a Higher Value on Workiva

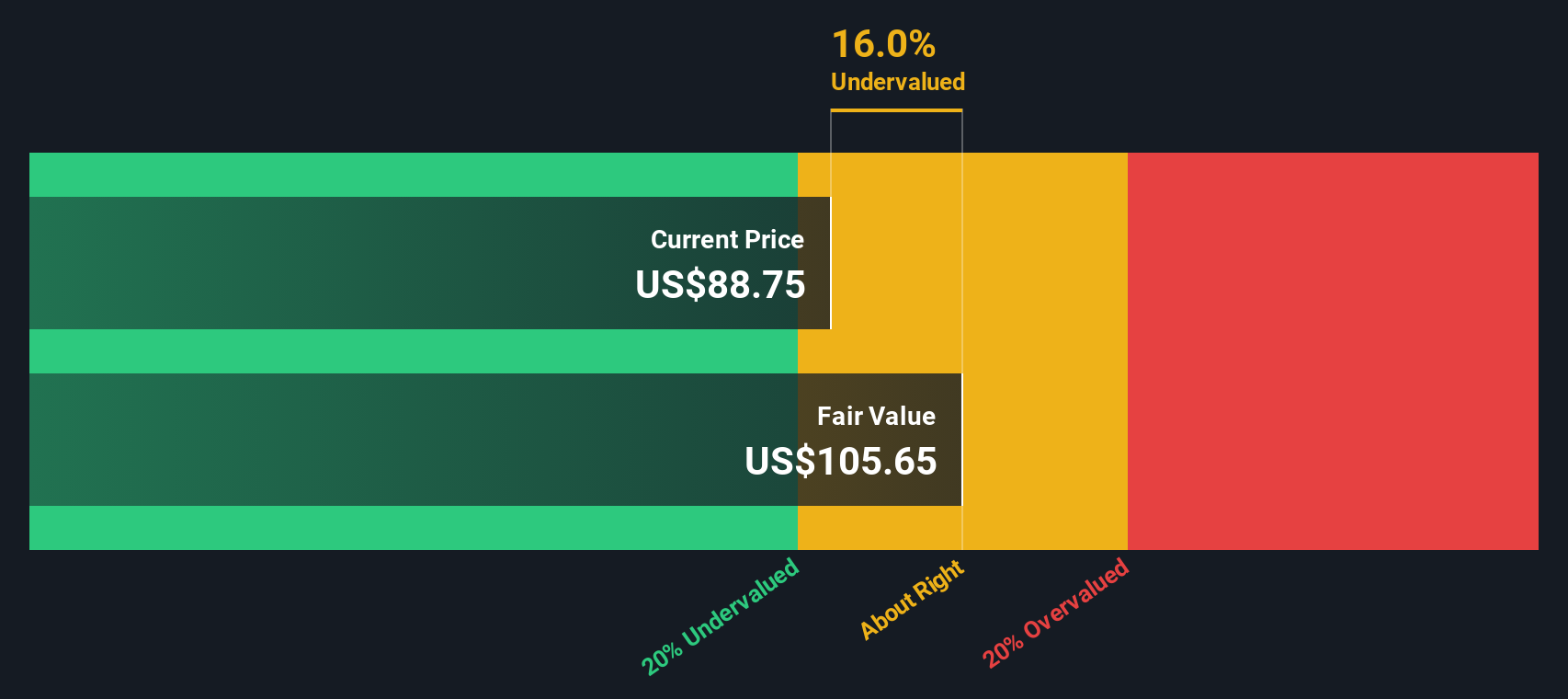

Taking a different approach, our DCF model suggests Workiva is actually worth $106.14 per share. This is well above both its current price and the analyst consensus, indicating even deeper undervaluation. Do these more optimistic cash flow assumptions hold up as the company moves forward?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Workiva Narrative

If you see things differently or want to shape your own story, you can dive into the numbers and craft your personalized narrative in just minutes. Do it your way

A great starting point for your Workiva research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Why settle for just one opportunity when your next big win could be just a click away? Unlock the full potential of your portfolio with these handpicked stock ideas from Simply Wall Street:

- Tap into future megatrends by checking out these 24 AI penny stocks, which are redefining entire sectors through advanced machine learning and automation.

- Capture consistent returns by targeting these 19 dividend stocks with yields > 3%, offering attractive yields and the potential for robust passive income streams.

- Seize ground-floor opportunities with these 3586 penny stocks with strong financials, which have strong financials and the potential for outsize growth before they hit the mainstream radar.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Workiva might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WK

Workiva

Provides cloud-based reporting solutions in the Americas and internationally.

High growth potential and fair value.

Similar Companies

Market Insights

Community Narratives