- United States

- /

- Software

- /

- NYSE:WK

Irenic Capital’s Push for Governance Shake-Up Might Change the Case for Investing in Workiva (WK)

Reviewed by Sasha Jovanovic

- On September 29, 2025, Irenic Capital Management publicly called for Workiva Inc. to overhaul its board, consider eliminating its dual-class share structure, and conduct a broad strategic review that could include a potential sale, following repeated meetings with the company’s management.

- This activist intervention signals a push for substantial corporate governance and operational changes, with the potential for a proxy fight if no agreement is reached.

- We'll explore how Irenic Capital’s campaign for board and structural reform could reshape Workiva’s long-term investment outlook.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Workiva Investment Narrative Recap

Shareholders in Workiva are typically focused on the company’s ability to grow enterprise contracts, benefit from regulatory-driven demand for sustainability reporting, and scale globally through its unified platform. Irenic Capital’s recent push for governance reforms and a potential sale heightens attention around board structure and strategic direction, possibly accelerating or complicating decisions around key catalysts like platform innovation; however, the most pressing short-term catalyst, adoption of new AI features and regulatory tailwinds, remains largely unchanged, while uncertainty around potential board turnover introduces fresh risk to execution.

The company’s September announcement of major AI-powered platform enhancements at Amplify stands out. These additions targeted at CFOs and sustainability teams align with the most important catalyst: deepening enterprise adoption for regulatory and financial reporting, a trend potentially influenced by activist calls for operational focus. But in contrast, investors should be mindful of how governance uncertainty could start to impact...

Read the full narrative on Workiva (it's free!)

Workiva's outlook forecasts $1.4 billion in revenue and $37.9 million in earnings by 2028. This assumes 20.6% annual revenue growth and a $104.5 million increase in earnings from the current loss of $66.6 million.

Uncover how Workiva's forecasts yield a $96.10 fair value, a 10% upside to its current price.

Exploring Other Perspectives

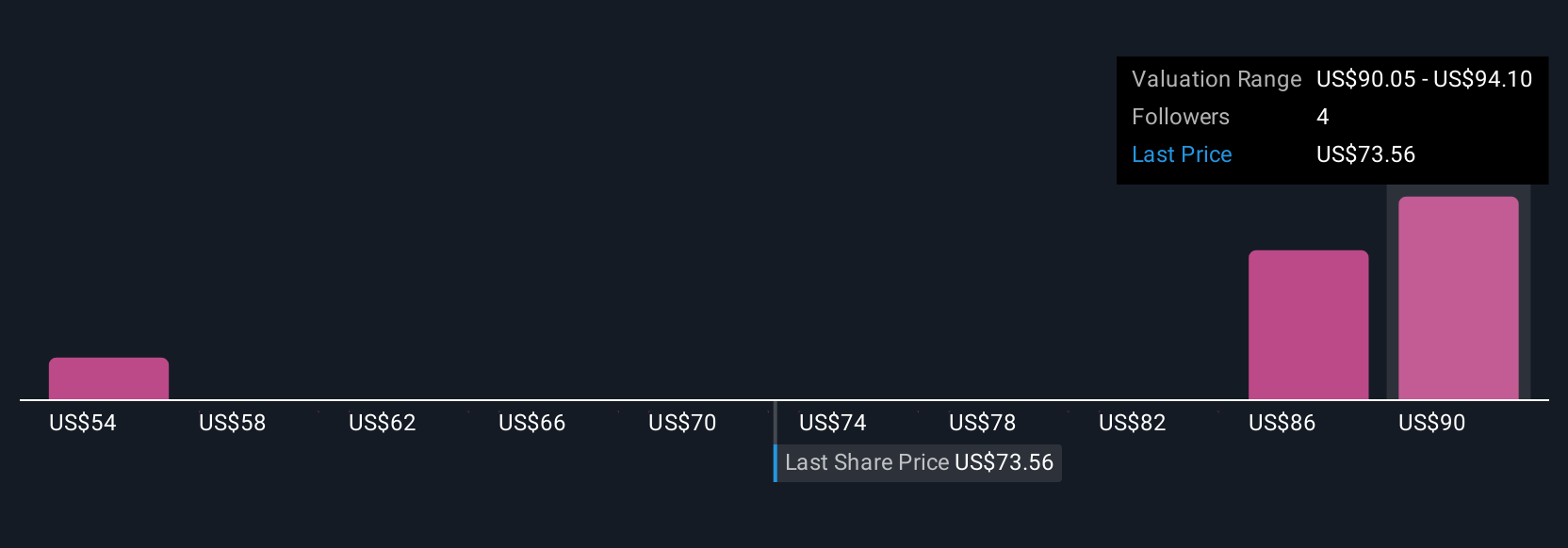

Simply Wall St Community members offered three fair value estimates for Workiva ranging from US$53.57 to US$104.73. While many see rising demand for sustainability solutions as a key catalyst, you can explore the wide range of opinions shaping the outlook for this stock.

Explore 3 other fair value estimates on Workiva - why the stock might be worth as much as 20% more than the current price!

Build Your Own Workiva Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Workiva research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Workiva research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Workiva's overall financial health at a glance.

No Opportunity In Workiva?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 32 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Workiva might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WK

Workiva

Provides cloud-based reporting solutions in the Americas and internationally.

High growth potential and fair value.

Similar Companies

Market Insights

Community Narratives