- United States

- /

- Software

- /

- NYSE:VYX

Is NCR Voyix (VYX) Undervalued? A Fresh Look at Its Recent Share Price Shift and Future Prospects

Reviewed by Simply Wall St

Most Popular Narrative: 17.5% Undervalued

The prevailing narrative views NCR Voyix as currently undervalued, reflecting strong optimism about future earnings growth and margin expansion. This assessment is shaped by expectations of digital transformation trends and a fundamental business model shift toward higher-margin services.

Enhanced digital capabilities and enterprise focus position the company to benefit from global automation and digital transformation trends. These factors are seen as supporting sustained cash flow and earnings growth.

Want to uncover what’s fueling this bullish outlook? The secret sauce involves bold analyst forecasts on the company’s turnaround. You may be surprised by the growth assumptions included in the fair value. Ready to see the projections that have experts placing NCR Voyix well above its current share price?

Result: Fair Value of $15.88 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent declines in hardware sales or cost overruns from the ongoing business shift could present challenges to NCR Voyix's turnaround story and dampen momentum.

Find out about the key risks to this NCR Voyix narrative.Another View: What the SWS DCF Model Says

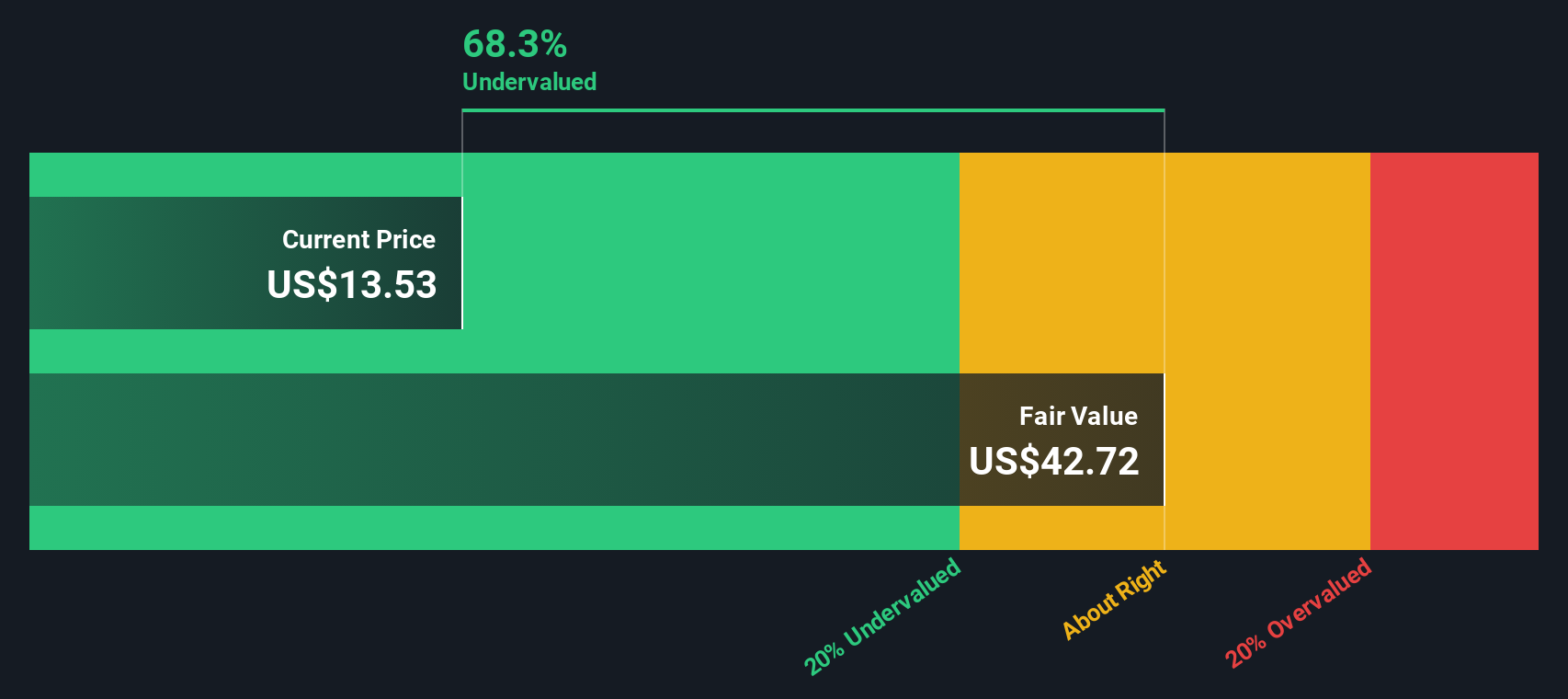

While many focus on market optimism and future growth, our DCF model offers a different perspective by using cash flow forecasts and discount rates. It suggests NCR Voyix’s shares may be even more undervalued than some expect. Which assessment will prove right as events unfold?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own NCR Voyix Narrative

If you see things differently or want to investigate the details for yourself, you can craft your own perspective in just a few minutes. Do it your way

A great starting point for your NCR Voyix research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for More Winning Investment Opportunities?

Smart investors always keep searching for the next advantage. Don’t let great ideas slip by when you can instantly spot exciting opportunities using these handpicked market tools:

- Tap into hidden value plays with undervalued stocks based on cash flows to see which companies could be ready for a breakout, based on strong cash flow potential and attractive valuations.

- Amplify your portfolio’s future focus by targeting innovation leaders. Seek out the next high-growth disruptors through AI penny stocks and stay ahead as artificial intelligence revolutionizes industries.

- Power up your returns with steady income from market-proven companies by choosing dividend stocks with yields > 3%. Identify those delivering yields above 3% to help you grow and protect wealth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NCR Voyix might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NYSE:VYX

NCR Voyix

Provides digital commerce solutions for retail stores and restaurants in the United States, the Americas, the Asia Pacific, Europe, the Middle East, and Africa.

Very undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives