Positioned in a Growing Industry with Strong Fundamentals - Why Visa (V) and Mastercard (MA) may be Better Together

Analysis summary:

- In the IT processing industry, earnings and revenues are estimated to grow 19% and 12.3% respectively per year.

- Both companies show similar fundamentals and trade closely on a forward PE basis, while Visa seems slightly cheaper.

- Disruptive competitors may further change the technology and pressure future profit margins.

While there are many new businesses taking on the payment processing industry, the two key established players may be primed to provide further investment return to investors as more people move from cash to online payments. In this analysis, we will compare the fundamentals between Visa Inc. ( NYSE:V ) and Mastercard ( NYSE:MA ).

The Growing Payment Processing Industry

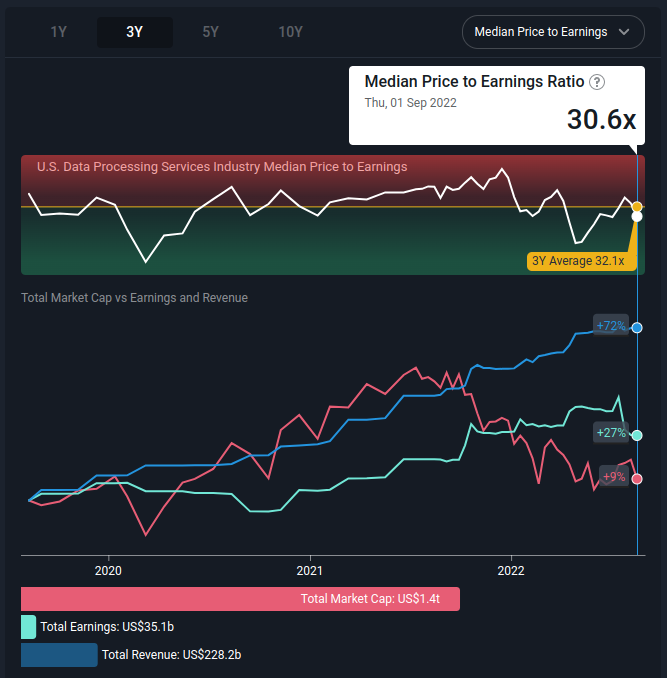

The two companies have a combined $728b market cap, and brought in $49.665b in revenue over the last year. The industry is quite large, with the top five companies having processed $6 trillion in 2021, while the 90% majority have processed $9 trillion. As part of payment processing infrastructure, both companies belong within the IT data processing services industry , which has an estimated annual earnings growth of 19% . This industry is currently experiencing a downturn from the highs of 2021 and as a whole has seen only a 9% gain in the last three years.

The chart below shows how this industry has grown over the last three years:

The key attraction for investors is the assumption that the payment industry will expand as more countries adopt new technologies and people shift their payments away from cash. The payment market revenue is valued ( 1 , 2 ) at $90b in 2022, and estimated to grow another 63% (or 12.6% per year) to $147.4b by 2027.

Looking at Visa and Mastercard, the fundamentals indicate that the companies have growth potential and may increase their returns for investors.

Comparing Visa and Mastercard

Both companies are mainly involved in payment processing services and issue debit and credit cards to customers for cashless payments. The companies are direct competitors and have managed to build a sizeable and global market share over the years. Here is our point by point fundamental comparison:

| 1-year total returns | TTM Revenue | Net profit margin | Net income | Market cap | 5-year earnings growth | PE | |

| Visa | -10.1% | $28b | 50.8% | $14.3 | $414b | 10.8% | 29x |

| Mastercard | -4.2% | $20.78 | 46.5% | $9.7 | $314.3b | 14.8% | 32.4x |

The fundamentals paint a strong picture for both companies, with neither having an obvious advantage. This gives us an opportunity to better compare the companies on a relative basis.

Forward Price to Earnings Ratio Comparison

We can use the forward price to earnings ratio to get a better picture of how many times over are investors paying for every future EPS. The forward PE is a good metric to use on companies that are stable and have predictable earnings, since we need to have a good estimate of the future net income in order to use this ratio. Generally, we want to see a declining forward PE vs the current PE, implying that the company is moving in the right direction, i.e. growing earnings.

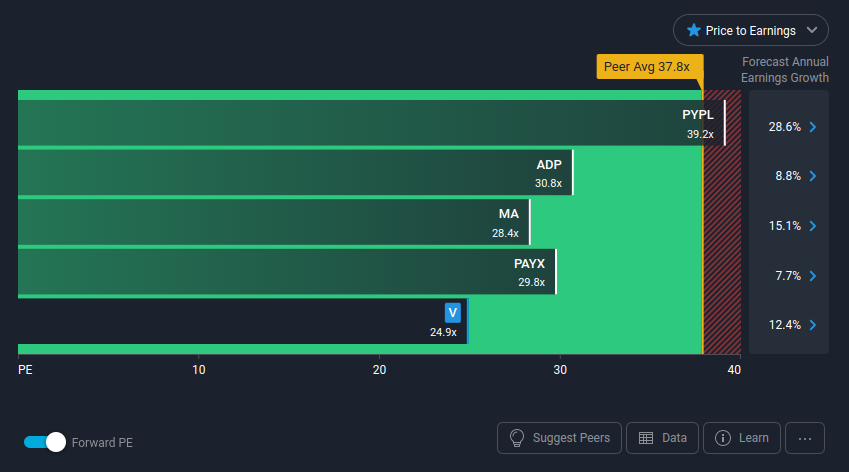

The chart below shows how Visa, Mastercard and a set of other peers compare on the forward PE:

It seems that both Visa and Mastercard have similar expected earnings growth rates at 12.% and 15.1% respectively. However, the forward PE ratio is lower for Visa, at 24.9x. On the face of it, given the similar expected growth rates, Visa appears to be the more attractive stock. However, Visa has a good $100b+ higher market cap than Mastercard, which opens up the question "How much more can the large cap grow?". Which is why investors may be cautious when paying a premium for the company.

A Notable Risk Factor

An important factor to consider for these two companies is that they are high margin businesses. Which is great for investors on one hand, but a target for additional competition at the same time. So it is no wonder as we see innovative young companies specifically targeting this industry. Some of the trends for payments include mobile wallets, which aim to substitute plastic cards with using a mobile device for contactless payments, this may lead to the mobile device substituting a significant portion of plastic cards.

While it is likely that both companies will retain their positions as market leaders in this space, investors may need to consider a future where the profit margins are slowly shrinking due to the availability of cheaper technology.

Conclusion

One possible approach for investors is to consider both companies in a package. This would spread the risk and investors wouldn't have to worry too much as to who comes out ahead, as long as the two companies are in the lead.

If we go strictly by the fundamentals, it seems that Visa is coming off slightly better, but this should be considered together with a deep dive and an analysis of the risk factors.

Investors may also look to combine their portfolio with some of the other peers who are seeking a share in the industry:

- Adyen ( ENXTAM:ADYEN )

- Apple ( NASDAQ:AAPL )

- Block ( NYSE:SQ )

- Discover Financial Services ( NYSE:DFS )

With that in mind, we wouldn't be too quick to come to a conclusion on Visa. Long-term earnings power is much more important than next year's profits. We have forecasts for Visa going out to 2024, and you can see them free on our platform here.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Goran Damchevski

Goran is an Equity Analyst and Writer at Simply Wall St with over 5 years of experience in financial analysis and company research. Goran previously worked in a seed-stage startup as a capital markets research analyst and product lead and developed a financial data platform for equity investors.

About NYSE:V

Visa

Operates as a payment technology company in the United States and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)