- United States

- /

- Software

- /

- NYSE:U

Will Unity (U) Leverage Its New AI Council to Strengthen Its Long-Term Competitive Edge?

Reviewed by Sasha Jovanovic

- Unity Software recently announced the formation of the Unity AI Council, adding renowned AI experts to accelerate its innovation across interactive content, and has expanded its AI-powered advertising business, demonstrating a growing emphasis on artificial intelligence applications.

- This focus on AI initiatives has attracted heightened analyst optimism, reflecting expectations for strong year-over-year earnings growth and increased investor confidence in the company’s future prospects.

- We'll examine how the formation of Unity's AI Council could influence the company's long-term investment narrative and competitive positioning.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Unity Software Investment Narrative Recap

To own Unity Software shares, investors need to believe the company can successfully monetize its AI and interactive content platforms before rising operating expenses or competitive challenges limit its path to profitability. The recent formation of the Unity AI Council highlights an intensified focus on AI innovation, which could enhance near-term earnings optimism, but does not materially diminish the immediate risk of high R&D costs that continue to weigh on net margins.

Among Unity’s latest initiatives, the launch of its AI-powered advertising business is especially relevant. This move reflects Unity’s bid to grow digital marketing revenue streams, which many see as a key catalyst supporting the company's shift from reliance on gaming to broader commercial opportunities.

By contrast, investors should be aware that persistent losses and delayed margin expansion could become amplified if new AI-driven products take longer than expected to show material results...

Read the full narrative on Unity Software (it's free!)

Unity Software's narrative projects $2.3 billion revenue and $313.8 million earnings by 2028. This requires 9.3% yearly revenue growth and a $747.7 million increase in earnings from -$433.9 million.

Uncover how Unity Software's forecasts yield a $34.75 fair value, a 19% downside to its current price.

Exploring Other Perspectives

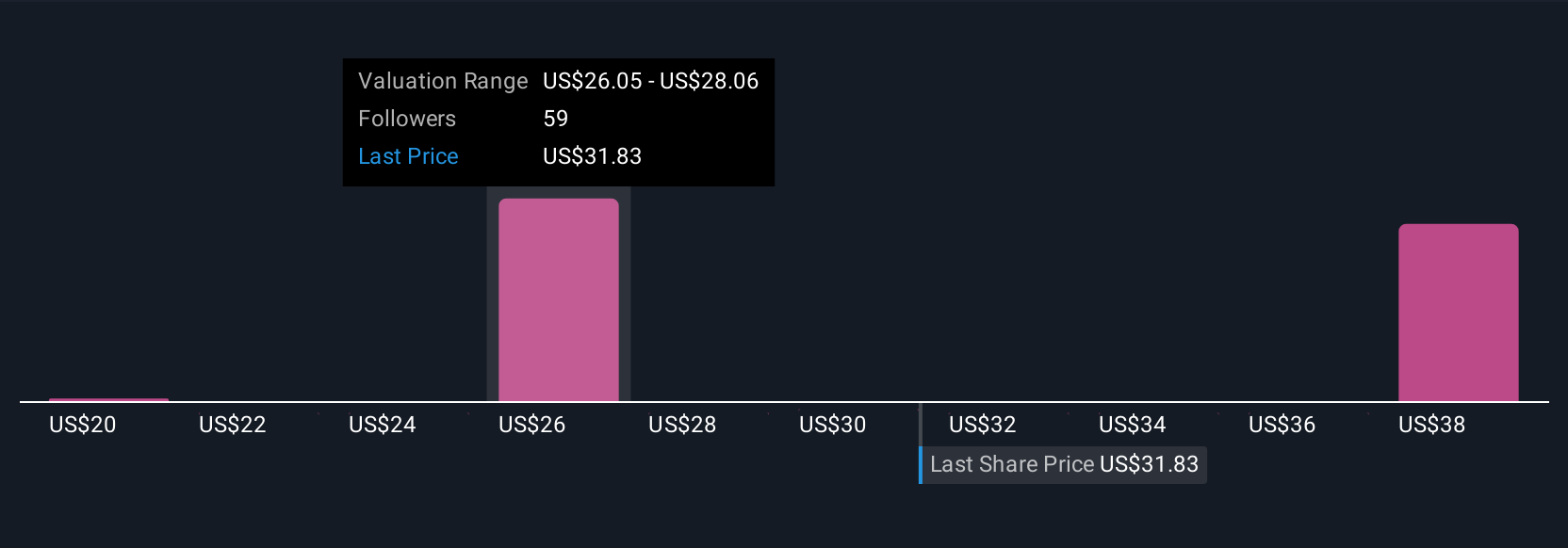

Nine members of the Simply Wall St Community estimate Unity’s fair value anywhere from US$20.31 to US$44. Opinions remain mixed, while persistent high R&D spending continues to raise questions about the timing of future profitability.

Explore 9 other fair value estimates on Unity Software - why the stock might be worth as much as $44.00!

Build Your Own Unity Software Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Unity Software research is our analysis highlighting 2 important warning signs that could impact your investment decision.

- Our free Unity Software research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Unity Software's overall financial health at a glance.

Ready For A Different Approach?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Rare earth metals are the new gold rush. Find out which 31 stocks are leading the charge.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:U

Unity Software

Operates a platform to create and grow games and interactive experiences for mobile phones, PCs, consoles, and extended reality devices in the United States, China, Hong Kong, Taiwan, Europe, the Middle East, Africa, the Asia Pacific, Canada, and Latin America.

Excellent balance sheet with very low risk.

Similar Companies

Market Insights

Community Narratives