- United States

- /

- Software

- /

- NYSE:U

Will Unity (U) and Globant’s Alliance Redefine Enterprise Reach or Reinforce Existing Challenges?

Reviewed by Simply Wall St

- On August 20, 2025, Globant announced a global partnership with Unity Software to deliver advanced interactive solutions to sectors including automotive, healthcare, life sciences, and manufacturing through the Unity Service Partner Program.

- An integral part of this agreement is Globant’s large-scale training and certification of its engineers on Unity’s platform, aiming to create one of the most extensive pools of Unity-proficient enterprise technologists worldwide.

- We'll examine how Globant's role in accelerating Unity's enterprise market entry could influence the company's longer-term investment narrative.

We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Unity Software Investment Narrative Recap

Unity’s long-term story hinges on accelerating adoption of real-time 3D solutions beyond gaming, particularly into complex enterprise sectors. The Globant partnership directly supports this vision, helping Unity expand into automotive, healthcare, and manufacturing segments. However, while this news reinforces Unity’s enterprise push, a current catalyst, it does not materially address the most important short-term challenge: the company’s high R&D investment and a persistent lack of sustained profitability. The risk remains that operating expenses may continue to outpace revenue growth, delaying margin improvements central to many investors’ thesis.

The recent announcement of Unity’s expanded partnership with BMW, where Unity Asset Manager will support 3D asset management, is especially relevant. Both deals signal Unity’s momentum in securing high-profile enterprise clients, which could further diversify revenue streams and drive recurring subscription growth, directly tied to the catalysts most frequently cited by analysts.

Yet, in contrast to these growth ambitions, investors should be aware that Unity’s ongoing investment requirements mean sustained profitability remains out of reach for now, especially as...

Read the full narrative on Unity Software (it's free!)

Unity Software's narrative projects $2.3 billion revenue and $313.8 million earnings by 2028. This requires 9.3% yearly revenue growth and a $747.7 million increase in earnings from -$433.9 million.

Uncover how Unity Software's forecasts yield a $33.98 fair value, a 6% downside to its current price.

Exploring Other Perspectives

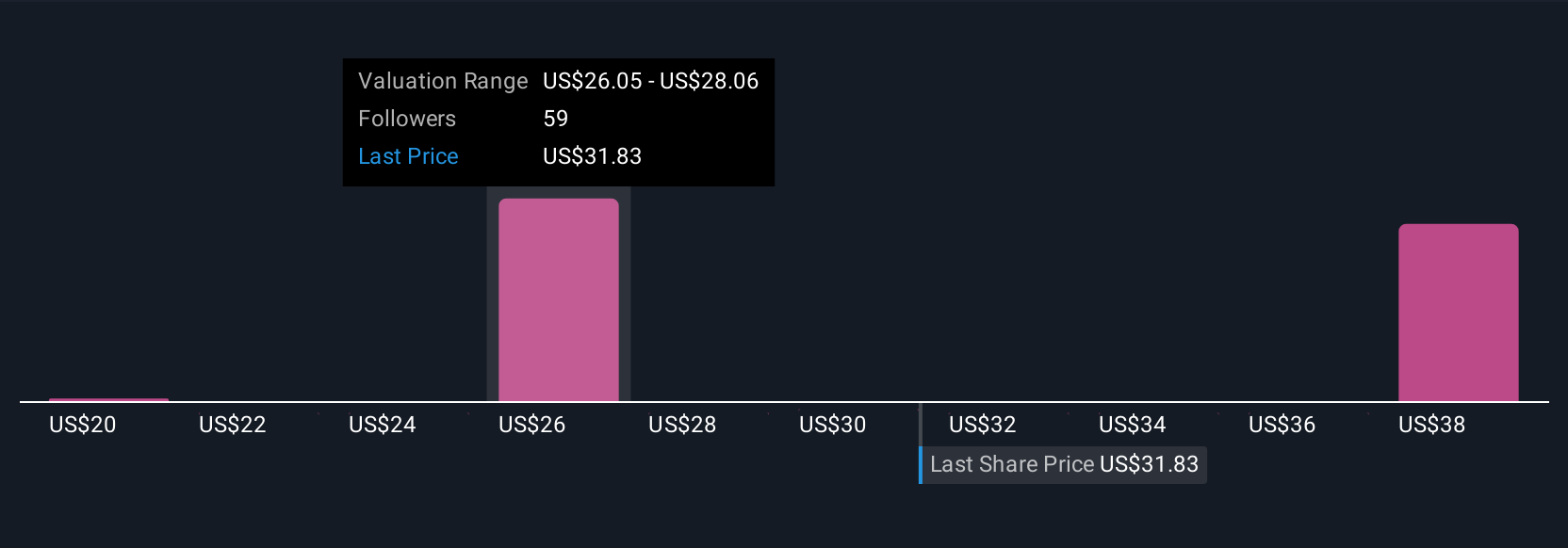

Six distinct fair value estimates from the Simply Wall St Community range from US$20.31 to US$39 per share. While many are drawn to Unity’s recent enterprise deals, opinions differ on whether new revenue streams will arrive quickly enough to balance continued heavy spending.

Explore 6 other fair value estimates on Unity Software - why the stock might be worth as much as 7% more than the current price!

Build Your Own Unity Software Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Unity Software research is our analysis highlighting 2 important warning signs that could impact your investment decision.

- Our free Unity Software research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Unity Software's overall financial health at a glance.

Interested In Other Possibilities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 27 companies in the world exploring or producing it. Find the list for free.

- This technology could replace computers: discover 24 stocks that are working to make quantum computing a reality.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:U

Unity Software

Operates a platform to create and grow games and interactive experiences for mobile phones, PCs, consoles, and extended reality devices in the United States, China, Hong Kong, Taiwan, Europe, the Middle East, Africa, the Asia Pacific, Canada, and Latin America.

Excellent balance sheet with very low risk.

Similar Companies

Market Insights

Community Narratives