- United States

- /

- Software

- /

- NYSE:U

Unity's (NYSE:U) Set Q2 Revenue Outlook 20% Below Expectations - Recent Insider Transactions are not Helpful with Investor Sentiment

Key takeaways:

- Unity posted a revenue outlook for Q2 some 20% below expectations

- Revenue jumped to US320m in Q1 but is expected to drop again in to around US$292.5m Q2

- The continuous sale of stock by insiders in the last 12 months makes it harder for investors to believe in the future of the company

As investors are wondering why the stock is dropping after the earnings call, Unity's (NYSE:U) management will have a harder time convincing them to stay on-board. Today we will review the earnings results, and take a look at the history of insider transactions.

Unity shareholders are down about 30% at market open, while prior to today, they were down 43% in the last 12 months. It is clear that investors have a pessimistic outlook on the stock.

Earnings Review

While it is hard to separate the impact of a tighter economic environment from that of earnings, we can assume that unprofitable companies will have a harder time managing downside risk.

For the Q1 2022, Unity's earnings highlights are:

- Revenue jumped to $320 million vs. $234.8 million last year, a 36.3% increase

- Net loss of $177.6 million

- EPS down to $-0.6 vs. $-0.34 last year

- Management set a Q2 revenue outlook to around $292.5m - 19% below the expectations of $360m

Given that analysts are still looking at the top line while evaluating Unity, the latest result comes as a big surprise.

Unity has the added risk factor of being unprofitable (and is expected to stay unprofitable for some time), which means that the company may need additional financing before it gets on the right side of 0. In order to assess this, we can see Unity's balance sheet.

Looking at the latest balance sheet snapshot, we see that unity maintains a US$1.7b convertible debt, but the company actually increased current assets by 3.4% to US$2.224b from US$2.151b in 2021, indicating that it is generating some cash.

View our latest analysis for Unity Software

In the Q1 press release, management stated:

“We believe we are in the early stages of one of the largest transformations in tech: the move to real-time 3D. We will continue to invest to capture the opportunity while quickly driving to sustainable and growing profitability.”

While the story is great, and technologies will indeed develop, it is harder to believe the grand narrative in-light of the continuous selling of shares by Unity's insiders.

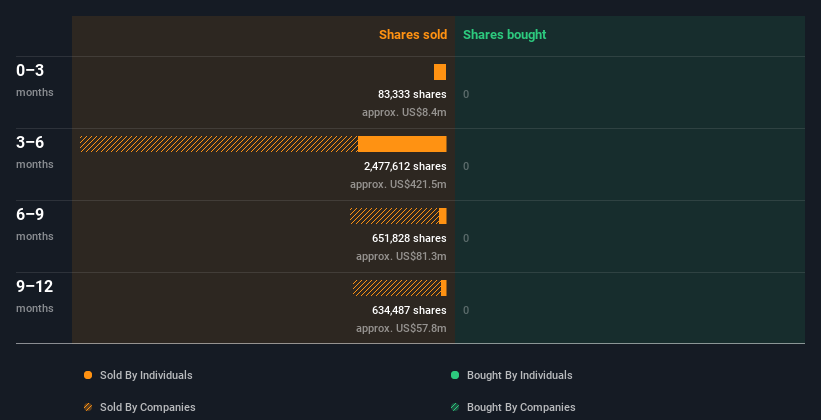

The chart below shows insider transactions (by companies and individuals) over the last year. By clicking on the graph below, you can see the precise details of each insider transaction.

The Last 12 Months Of Insider Transactions At Unity Software

Over the last year, we can see that the biggest insider sale was by the Co-Founder & Director, David Helgason, for US$30m worth of shares, at about US$185 per share.

The last quarter also saw substantial insider selling of Unity Software shares. In total, Co-Founder & Director David Helgason sold US$8.4m worth of shares in that time.

His current stake in the company is about 3%, which is actually significantly better than some other key managers. The CFO cashed out in 2021, but keeps receiving a large cash compensation of about US$41 million yearly.

In total, Unity Software insiders own about US$1.7b worth of shares (which is 12% of the company).

If you like to buy stocks that insiders are buying, rather than selling, then you might just love this free list of companies. (Hint: insiders have been buying them).

Conclusion

Today's drop in the stock price of Unity is likely derived by both the outlook and the tightening of the economic landscape.

While management is painting an optimistic story for Unity's future, it would be better if they backed it with some insider buying - after all, if they believe in their company, the price should be considered a bargain after today.

We've spotted 4 warning signs for Unity Software you should be aware of.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Goran Damchevski

Goran is an Equity Analyst and Writer at Simply Wall St with over 5 years of experience in financial analysis and company research. Goran previously worked in a seed-stage startup as a capital markets research analyst and product lead and developed a financial data platform for equity investors.

About NYSE:U

Unity Software

Operates a platform to create and grow games and interactive experiences for mobile phones, PCs, consoles, and extended reality devices in the United States, China, Hong Kong, Taiwan, Europe, the Middle East, Africa, the Asia Pacific, Canada, and Latin America.

Excellent balance sheet with very low risk.

Similar Companies

Market Insights

Community Narratives