- United States

- /

- Software

- /

- NYSE:U

Unity Software (U) Sees 71% Jump In Last Quarter

Reviewed by Simply Wall St

Unity Software (U) reported a 71% price increase over the last quarter, largely driven by advancements and partnerships that align with market trends. Despite a slight decline in sales, the improvement in net loss and reduced impairments highlighted better financial management, potentially supporting investor confidence. The company's collaboration with BMW Group and its partnership with Genies provided avenues for future expansion in AI and asset management, complementing its overall strategy. These moves likely added momentum to the stock's rise, against a backdrop where major indexes reached record highs, signaling a generally optimistic investment climate across tech sectors.

The recent advancements and partnerships, such as Unity Software's collaboration with BMW Group and Genies, underscore the company's focus on expansion into AI and asset management. These align with the broader narrative of Unity's aggressive investment strategy, which anticipates sustained revenue growth and improved profit margins despite current losses. The strategic shifts also address the risks identified in the company's move into non-gaming sectors, potentially diversifying its revenue streams and supporting future market positioning.

Unity's shares saw a very large total return, 127.33%, over the past year, reflecting strong investor confidence despite the wider market return of 16.1% and a 28% rise in the US Software industry. The performance can be contextualized against broader market optimism and Unity's innovative moves. The current share price stands at US$38.01, compared to the consensus price target of US$33.98, indicating a 10.61% premium to analyst expectations. This suggests that investors might be factoring in future growth prospects more favorably, driven by the continued expansion in AI and new product offerings.

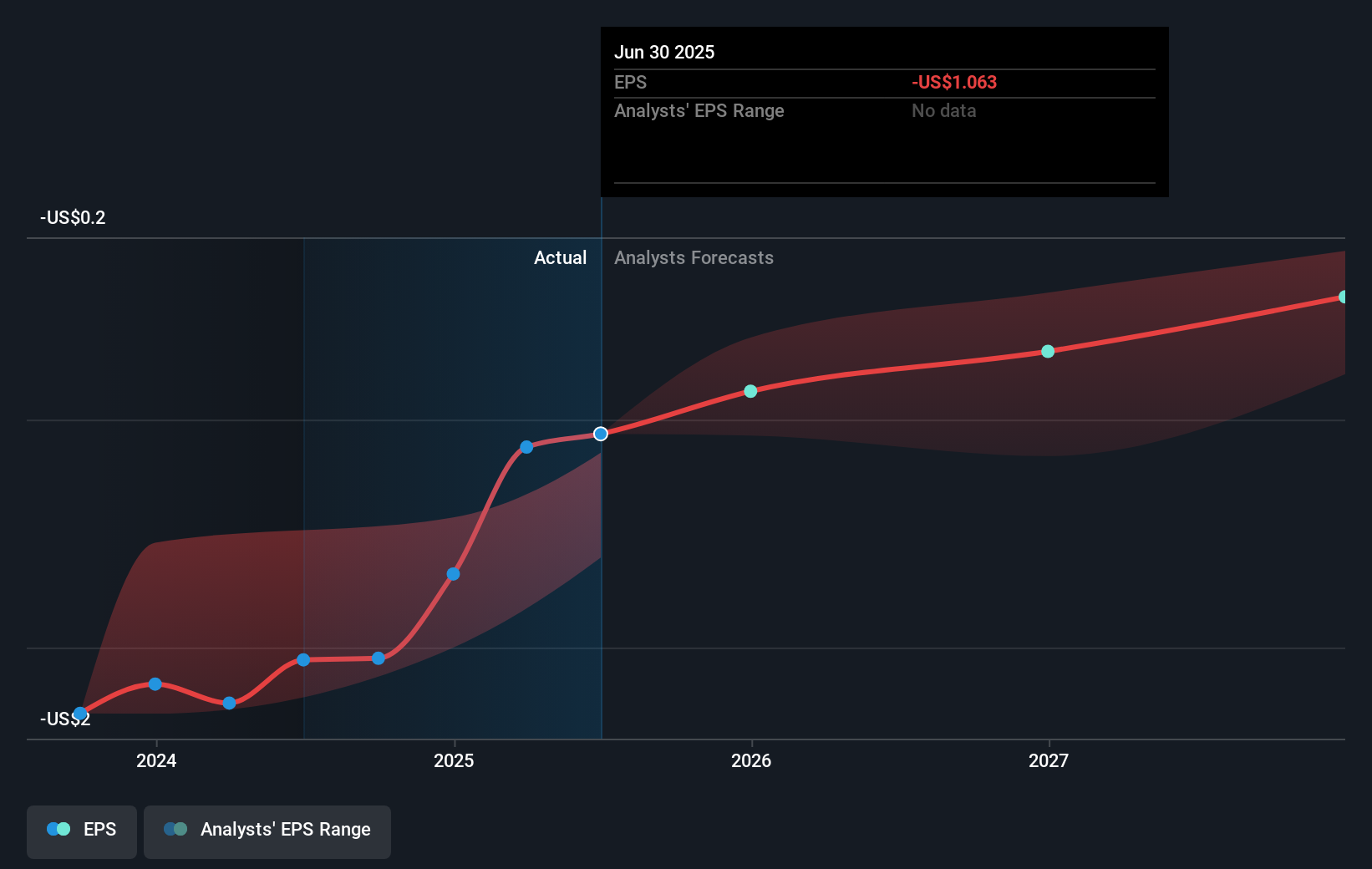

Revenue and earnings forecasts could witness potential upward adjustments as Unity's AI-driven products and industry collaboration bear fruit, particularly if new offerings like Unity Vector and Unity 6 achieve high market adoption. However, the company's efforts to meet profitability challenges persist, underscored by an anticipated increase from a current loss of US$433.91 million and assumed future earnings of around US$313.8 million by 2028. Analysts continue to view these financials with caution, highlighting the premium P/E ratio necessary to justify current price levels amidst a complex competitive landscape.

Click to explore a detailed breakdown of our findings in Unity Software's financial health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:U

Unity Software

Operates a platform to create and grow games and interactive experiences for mobile phones, PCs, consoles, and extended reality devices in the United States, China, Hong Kong, Taiwan, Europe, the Middle East, Africa, the Asia Pacific, Canada, and Latin America.

Excellent balance sheet with very low risk.

Similar Companies

Market Insights

Community Narratives