- United States

- /

- Software

- /

- NYSE:U

The Bull Case For Unity Software (U) Could Change Following Rare Cross-Engine Alliance With Epic Games

- Epic Games announced a partnership with Unity at Unite 2025, enabling developers to integrate Unity games into Fortnite and bring Unreal Engine support to Unity's cross-platform commerce platform for enhanced catalog and payment management.

- This collaboration marks a rare cross-engine alliance, potentially expanding both companies' developer ecosystems and creating new opportunities for monetization and audience growth among creators.

- We'll explore how this expanded developer reach and cross-platform integration could reshape Unity's investment narrative in the months ahead.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Unity Software Investment Narrative Recap

Owning shares in Unity Software demands conviction in the company's ability to monetize its developer ecosystem and maintain technology leadership, particularly as the gaming industry grows more interconnected. The recent partnership with Epic Games, while headline-grabbing, does not immediately resolve Unity's most pressing short-term catalyst, accelerating profitability and margin improvement, nor does it substantially alter the highest risk of execution challenges as Unity expands into non-gaming markets and manages rising costs. Investors should view the news as a meaningful step, but not a game-changer for near-term financial fundamentals. Among Unity’s recent announcements, the October engine enhancement, allowing developers to manage commerce and catalogs from a unified dashboard, directly aligns with the mission behind the Epic Games collaboration. Both developments emphasize Unity’s push to offer more robust, platform-agnostic tools, potentially making its ecosystem stickier for developers and partners and supporting recurring revenue expansion as a catalyst for future growth. However, in contrast, it’s important for investors to recognize the ongoing risk that Unity’s high R&D spend and uncertain non-gaming revenue bets could...

Read the full narrative on Unity Software (it's free!)

Unity Software's narrative projects $2.3 billion revenue and $313.8 million earnings by 2028. This requires 9.3% yearly revenue growth and a $747.7 million earnings increase from the current earnings of -$433.9 million.

Uncover how Unity Software's forecasts yield a $42.31 fair value, a 8% upside to its current price.

Exploring Other Perspectives

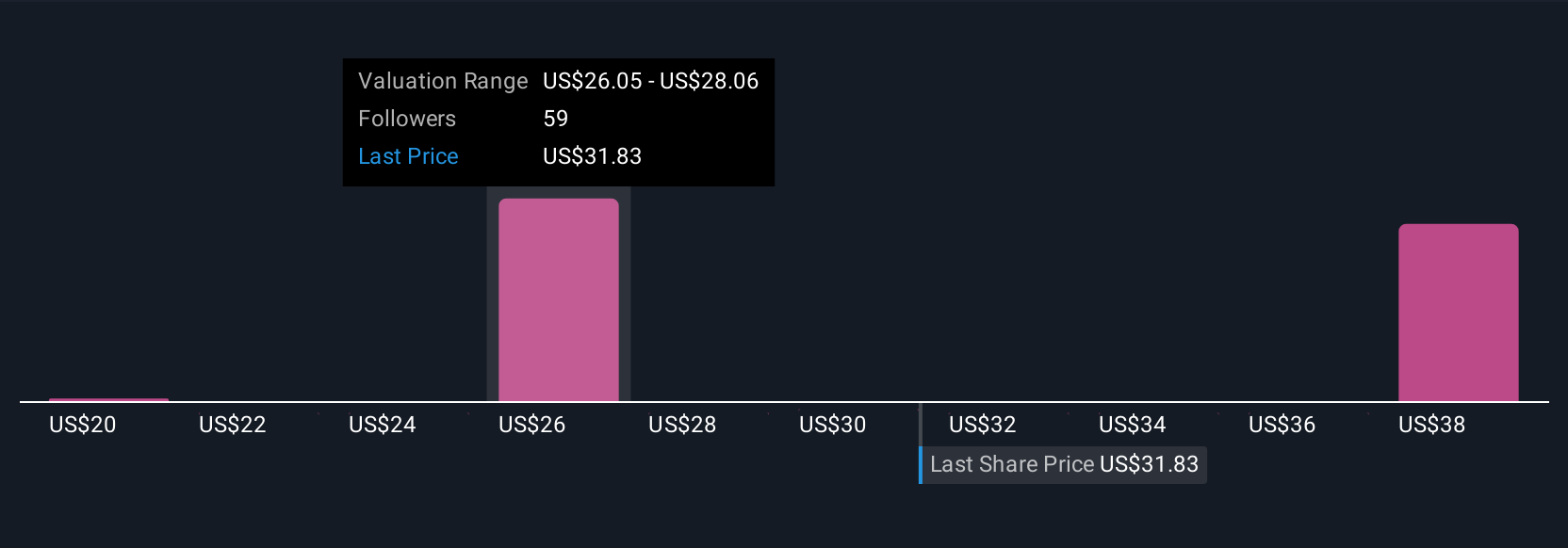

Eight Simply Wall St Community members estimate Unity’s fair value between US$20.31 and US$44 per share. With some estimates below current prices, investors are weighing future profitability hurdles and whether ecosystem partnerships will offset expense-driven risks.

Explore 8 other fair value estimates on Unity Software - why the stock might be worth as much as 12% more than the current price!

Build Your Own Unity Software Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Unity Software research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Unity Software research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Unity Software's overall financial health at a glance.

Curious About Other Options?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:U

Unity Software

Operates a platform to create and grow games and interactive experiences for mobile phones, PCs, consoles, and extended reality devices in the United States, China, Hong Kong, Taiwan, Europe, the Middle East, Africa, the Asia Pacific, Canada, and Latin America.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

The Future of Social Sharing Is Private and People Are Ready

EU#3 - From Philips Management Buyout to Europe’s Biggest Company

Booking Holdings: Why Ground-Level Travel Trends Still Favor the Platform Giants

A fully integrated LNG business seems to be ignored by the market.

Recently Updated Narratives

Sunny Returns with On the Beach

High Quality Business and a true compounding machine

Roche Holding AG To Benefit From Strong Drug Pipeline In 2027 And Beyond

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

AMZN: Acceleration In Cloud And AI Will Drive Margin Expansion Ahead

Trending Discussion

AGAG still in exploration, in bull market, such company will be the last to participate. It's high risk but can results in 20-30 baggers potential. The best play with current bull are with producers or near-producer miners, you can get 5-10 baggers with much lower risk. See my analysis on santacruz silver, andean silver.