- United States

- /

- Software

- /

- NYSE:U

Party Time: Brokers Just Made Major Increases To Their Unity Software Inc. (NYSE:U) Earnings Forecasts

Celebrations may be in order for Unity Software Inc. (NYSE:U) shareholders, with the analysts delivering a significant upgrade to their statutory estimates for the company. Consensus estimates suggest investors could expect greatly increased statutory revenues and earnings per share, with the analysts modelling a real improvement in business performance. Unity Software has also found favour with investors, with the stock up an impressive 29% to US$32.52 over the past week. Could this upgrade be enough to drive the stock even higher?

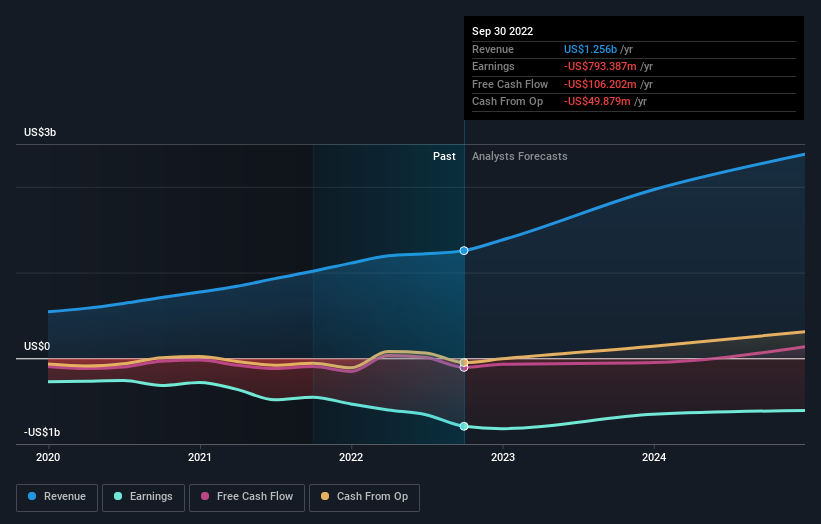

Following the upgrade, the latest consensus from Unity Software's 22 analysts is for revenues of US$2.0b in 2023, which would reflect a substantial 60% improvement in sales compared to the last 12 months. The loss per share is anticipated to greatly reduce in the near future, narrowing 37% to US$1.67. However, before this estimates update, the consensus had been expecting revenues of US$1.7b and US$1.89 per share in losses. So there's been quite a change-up of views after the recent consensus updates, with the analysts making a sizeable increase to their revenue forecasts while also reducing the estimated loss as the business grows towards breakeven.

View our latest analysis for Unity Software

Yet despite these upgrades, the analysts cut their price target 26% to US$39.64, implicitly signalling that the ongoing losses are likely to weigh negatively on Unity Software's valuation. There's another way to think about price targets though, and that's to look at the range of price targets put forward by analysts, because a wide range of estimates could suggest a diverse view on possible outcomes for the business. Currently, the most bullish analyst values Unity Software at US$71.00 per share, while the most bearish prices it at US$16.00. With such a wide range in price targets, the analysts are almost certainly betting on widely diverse outcomes for the underlying business. With this in mind, we wouldn't rely too heavily on the consensus price target, as it is just an average and analysts clearly have some deeply divergent views on the business.

One way to get more context on these forecasts is to look at how they compare to both past performance, and how other companies in the same industry are performing. It's clear from the latest estimates that Unity Software's rate of growth is expected to accelerate meaningfully, with the forecast 45% annualised revenue growth to the end of 2023 noticeably faster than its historical growth of 32% p.a. over the past three years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to grow their revenue at 13% per year. Factoring in the forecast acceleration in revenue, it's pretty clear that Unity Software is expected to grow much faster than its industry.

The Bottom Line

The most important thing here is that analysts reduced their loss per share estimates for next year, reflecting increased optimism around Unity Software's prospects. Fortunately, analysts also upgraded their revenue estimates, and our data indicates sales are expected to perform better than the wider market. The declining price target is a puzzle, but still - with a serious upgrade to next year's expectations, it might be time to take another look at Unity Software.

Even so, the longer term trajectory of the business is much more important for the value creation of shareholders. At Simply Wall St, we have a full range of analyst estimates for Unity Software going out to 2024, and you can see them free on our platform here..

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are upgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:U

Unity Software

Operates a platform to create and grow games and interactive experiences for mobile phones, PCs, consoles, and extended reality devices in the United States, China, Hong Kong, Taiwan, Europe, the Middle East, Africa, the Asia Pacific, Canada, and Latin America.

Excellent balance sheet with very low risk.

Similar Companies

Market Insights

Community Narratives