- United States

- /

- Software

- /

- NYSE:U

Investors one-year losses grow to 59% as the stock sheds US$844m this past week

Investing in stocks comes with the risk that the share price will fall. And unfortunately for Unity Software Inc. (NYSE:U) shareholders, the stock is a lot lower today than it was a year ago. In that relatively short period, the share price has plunged 59%. Because Unity Software hasn't been listed for many years, the market is still learning about how the business performs. The falls have accelerated recently, with the share price down 48% in the last three months.

After losing 6.5% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

See our latest analysis for Unity Software

Because Unity Software made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In the last year Unity Software saw its revenue grow by 42%. We think that is pretty nice growth. Meanwhile, the share price tanked 59%, suggesting the market had much higher expectations. It may well be that the business remains approximately on track, but its revenue growth has simply been delayed. To our minds it isn't enough to just look at revenue, anyway. Always consider when profits will flow.

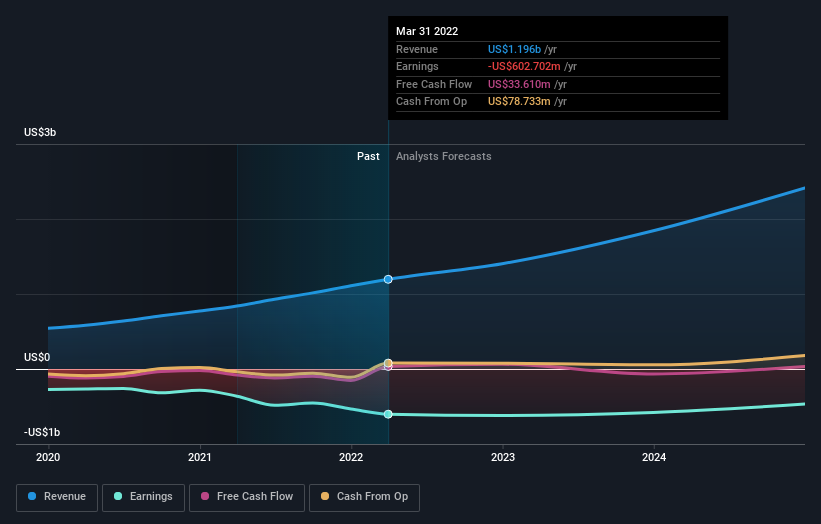

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Unity Software is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. You can see what analysts are predicting for Unity Software in this interactive graph of future profit estimates.

A Different Perspective

We doubt Unity Software shareholders are happy with the loss of 59% over twelve months. That falls short of the market, which lost 14%. There's no doubt that's a disappointment, but the stock may well have fared better in a stronger market. With the stock down 48% over the last three months, the market doesn't seem to believe that the company has solved all its problems. Given the relatively short history of this stock, we'd remain pretty wary until we see some strong business performance. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 4 warning signs for Unity Software that you should be aware of.

Of course Unity Software may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:U

Unity Software

Operates a platform to create and grow games and interactive experiences for mobile phones, PCs, consoles, and extended reality devices in the United States, China, Hong Kong, Taiwan, Europe, the Middle East, Africa, the Asia Pacific, Canada, and Latin America.

Excellent balance sheet with very low risk.

Similar Companies

Market Insights

Community Narratives