- United States

- /

- IT

- /

- NYSE:TWLO

Twilio (TWLO): Revisiting Valuation After Profitability Return, Strong Growth Beat, and New LA Kings Partnership

Reviewed by Simply Wall St

Twilio (TWLO) is back in the spotlight after a profitable quarter and a new LA Kings helmet partnership put the stock on investors radar again, raising fresh questions about how much upside is already priced in.

See our latest analysis for Twilio.

The strong quarter and LA Kings deal have helped extend an already powerful run, with a 90 day share price return of 32.81 percent and a three year total shareholder return of 192.8 percent signaling that momentum is clearly rebuilding around the story.

If this kind of renewed enthusiasm has your attention, it is also a good time to explore other high growth tech names and emerging platforms via high growth tech and AI stocks.

But with Twilio now hovering just below Wall Street price targets and trading at a premium to its own fundamentals, investors face a pivotal question: Is this still an overlooked turnaround story, or is the market already baking in the next leg of growth?

Most Popular Narrative Narrative: 0.4% Undervalued

With Twilio last closing at $137.50 against a narrative fair value of $138.04, the story leans toward modest upside built on improving profitability.

Twilio's strategic focus on product innovation and platform integration (such as the merging of Segment's customer data with core communications offerings) is increasing customer stickiness and opening new cross-sell opportunities, directly impacting both revenue growth and gross margin improvements.

Curious how steady top line growth, rising margins, and a richer earnings profile can still justify a punchy future profit multiple? Unpack the full narrative math.

Result: Fair Value of $138.04 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent pricing pressure in core messaging and intensifying AI competition could quickly undermine the margin expansion and premium multiple that this narrative leans on.

Find out about the key risks to this Twilio narrative.

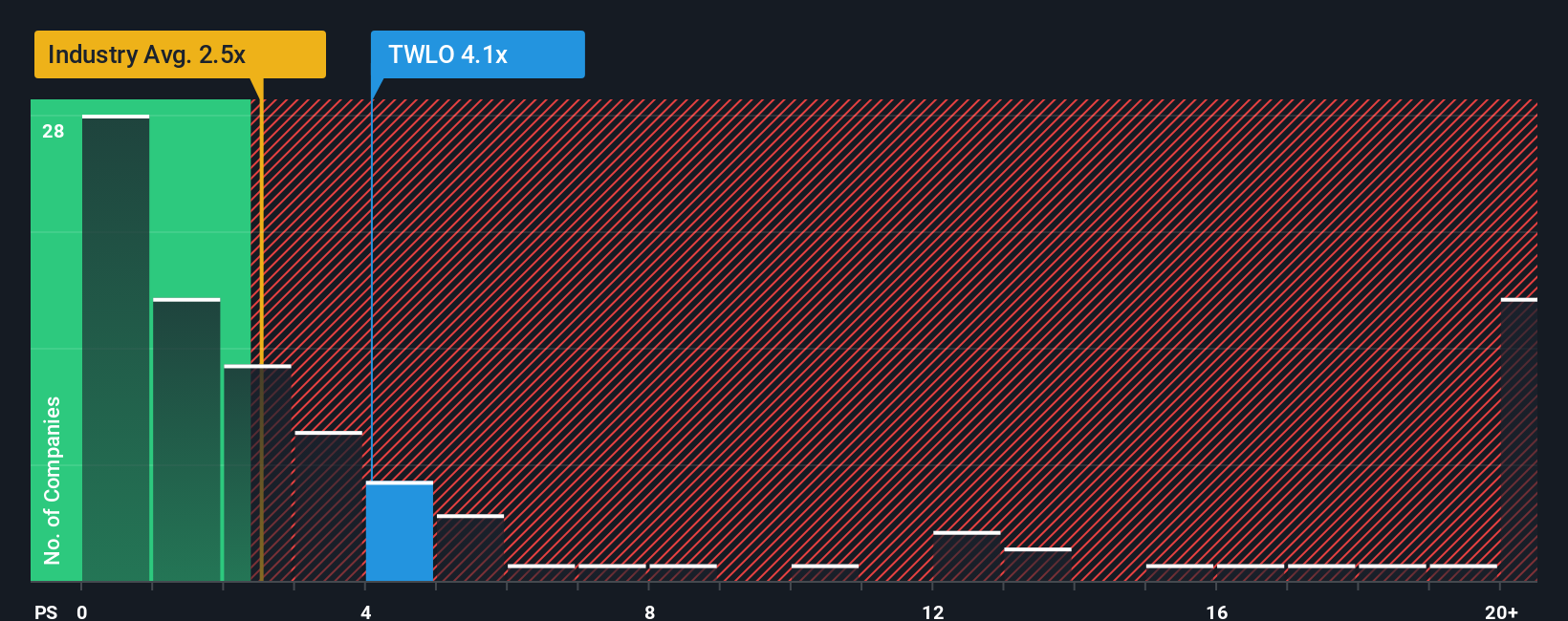

Another Lens on Value: Sales Multiple Risks

Our SWS DCF model suggests Twilio is trading above fair value at $119.59, but the price to sales ratio paints a more nuanced picture. At 4.3x sales, the stock looks inexpensive versus peers at 6.5x and close to its fair ratio of 4.7x, yet still elevated compared with the broader US IT sector at 2.3x. This leaves investors weighing potential upside against the risk of multiple compression.

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Twilio for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 915 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Twilio Narrative

If you see the numbers differently or want to stress test your own assumptions, you can build a personalized Twilio thesis in minutes: Do it your way.

A great starting point for your Twilio research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next investing move?

Do not stop at Twilio; use the Simply Wall Street Screener now to uncover focused opportunities other investors will only notice after the biggest gains are gone.

- Capture potential multi-baggers early by targeting these 3626 penny stocks with strong financials that already back their tiny market caps with real financial strength.

- Position yourself at the forefront of automation by screening these 25 AI penny stocks shaping how software, data, and intelligent systems create value.

- Strengthen your portfolio core by selecting from these 13 dividend stocks with yields > 3% that aim to deliver both income and resilience through market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Twilio might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TWLO

Twilio

Offers customer engagement platform solutions in the United States and internationally.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)