- United States

- /

- IT

- /

- NYSE:TWLO

Twilio (TWLO): Evaluating Valuation After AI-Fueled Tech Rally and New S&P MidCap 400 Milestone

Reviewed by Kshitija Bhandaru

Twilio (TWLO) caught some attention this week as tech stocks recovered due to revived optimism in artificial intelligence, combined with upbeat news about Twilio’s business fundamentals and market position.

See our latest analysis for Twilio.

This upward move for Twilio comes after a flurry of bullish AI news and notable company milestones, including the launch of RCS messaging and its upcoming addition to the S&P MidCap 400 index. While Twilio’s share price faced a 6% dip in the latest session, momentum has generally been positive, as reflected in a 1-year total shareholder return of 52%. Despite some ups and downs in the short term, recent events point to strengthening investor confidence in Twilio’s longer-term growth potential.

If rising tech optimism and Twilio’s momentum have you curious about other opportunities, now is a good moment to expand your search and discover See the full list for free.

Yet with analyst price targets still well above current levels and Twilio’s valuation reflecting both recent momentum and future earnings growth, the question remains: Is Twilio an undervalued AI communications leader, or has the market already priced in its next chapter?

Most Popular Narrative: 58% Overvalued

Twilio’s current share price of $107.12 sits far above the $68 fair value estimated in the most widely followed narrative. This hints at sharp disconnects around profitability, competitive risk, and growth sustainability.

Warren Buffett would likely not invest in Twilio Inc. at its current stage. While Twilio has a promising growth trajectory, a moderate competitive moat, and improving management, it falls short of Buffett’s criteria in several key areas:

• Lack of consistent profitability and predictable earnings.

• A tech-heavy business model with competitive risks and a less durable moat.

• A valuation that does not offer a clear margin of safety.

• A fast-evolving industry that may feel too speculative for Buffett’s long-term, value-driven approach.

How is this bearish view justified despite recent profitability wins and strong growth? The narrative’s formula leans heavily on uncertain future earnings, industry disruption, and a valuation multiple that is much steeper than iconic value investors would accept. The biggest wild card is the narrative’s assumptions around cash flow strength and how quickly management can build a lasting moat. Find out what is really driving this deep discount behind the headline numbers.

Result: Fair Value of $68 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, stronger-than-expected profitability or a significant expansion of Twilio’s competitive moat could challenge the current overvalued narrative.

Find out about the key risks to this Twilio narrative.

Another View: Discounted Cash Flow Tells a Different Story

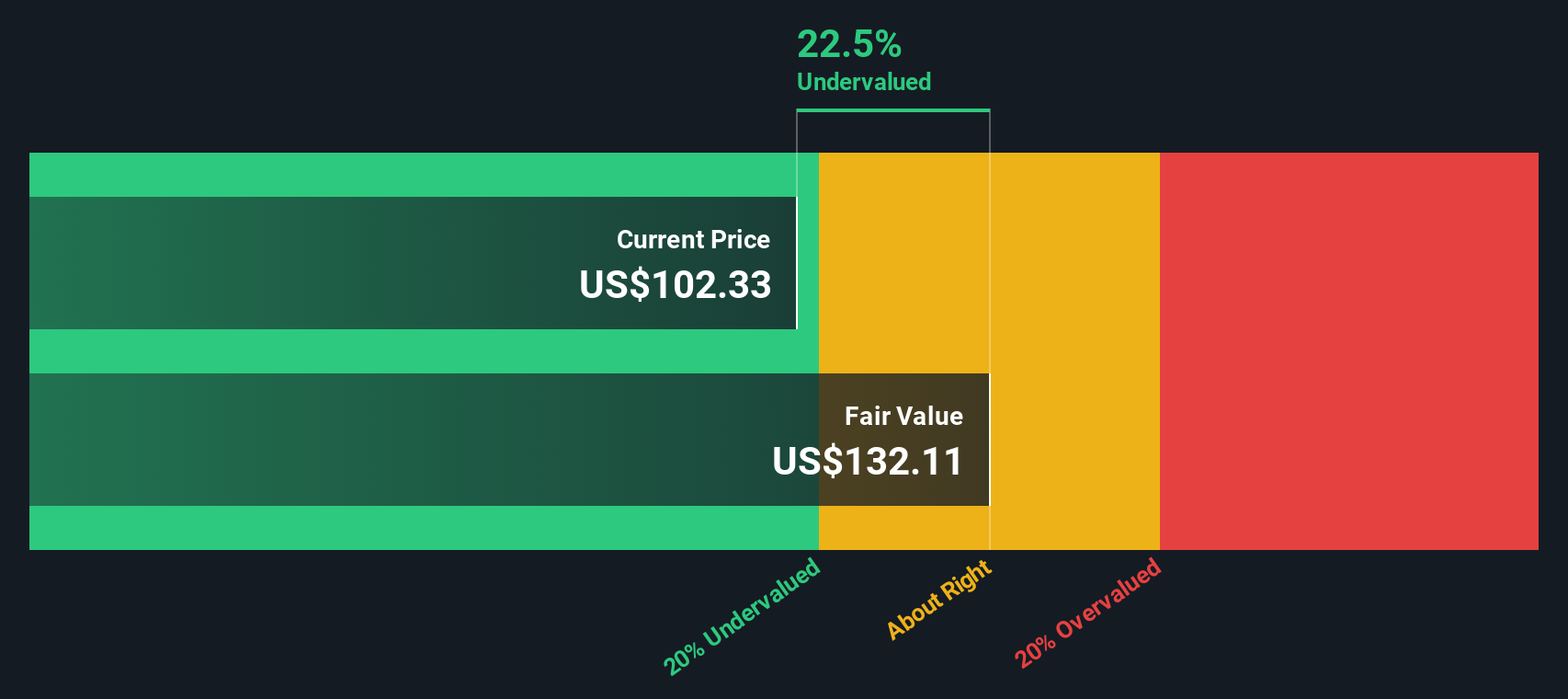

While the most popular narrative says Twilio is overvalued, a different method paints a contrasting picture. Our DCF model estimates Twilio’s fair value at $132.33, about 19% above today’s price. This suggests shares may actually be undervalued by this measure. Which number better reflects reality?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Twilio Narrative

If you see the outlook differently or want to dive deeper into Twilio's numbers yourself, you can build your own narrative and insights in just a few minutes. Do it your way

A great starting point for your Twilio research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors act quickly, and nothing beats getting ahead of the curve with ideas that can change your portfolio’s trajectory. Ignoring these could mean missing tomorrow's top performers.

- Capture reliable income streams by checking out these 19 dividend stocks with yields > 3% offering yields above 3%. This is ideal if stability is your top priority.

- Seize emerging trends and pinpoint opportunities with these 24 AI penny stocks selected for their forward-looking AI innovation.

- Capitalize on overlooked potential in the market by reviewing these 898 undervalued stocks based on cash flows based on strong cash flows and favorable pricing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Twilio might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TWLO

Twilio

Offers customer engagement platform solutions in the United States and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives