- United States

- /

- IT

- /

- NYSE:TWLO

Twilio (TWLO): A Fresh Look at Valuation After Bullish Analyst Coverage and Global RCS Product Launch

Reviewed by Simply Wall St

Twilio (TWLO) is back in the spotlight and making waves with investors after Rosenblatt Securities initiated coverage and called out the company as a “key inflection point” for profitable growth and a leader in AI-powered communications. This bullish endorsement lands just as Twilio is rolling out Rich Communication Services (RCS) messaging globally, which the company describes as its biggest product leap since SMS. For many investors, today’s events put a fresh focus on whether Twilio’s growth story has entered a new phase or if this is just another swing in the tech narrative.

Zooming out, Twilio’s shares jumped 1.8% on the news, snapping a stretch of volatility that included a dip earlier this quarter but recent signs of momentum. While the past three months showed a modest pullback, Twilio has still seen its stock almost double over the past year, reflecting bursts of confidence in its ability to monetize product innovations like RCS. Compared to longer timeframes, the stock is climbing out of a multiyear hole, but the new product momentum could be shifting sentiment.

After this year’s surge, the big question is whether Twilio is trading at a bargain relative to its future potential, or if the market is already baking in the next wave of growth. What do you think—is there still upside ahead?

Most Popular Narrative: 60% Overvalued

According to the most widely discussed narrative, Twilio is considered substantially overvalued relative to its fair value estimate and current fundamentals.

Lack of consistent profitability and predictable earnings.

A tech-heavy business model with competitive risks and a less durable moat.

Curious what makes Twilio’s valuation so hotly debated? The answer lies in the narrative’s underlying growth expectations and the type of future performance the company will need to justify its premium price tag. Discover what is behind this dramatic disconnect and which financial trend could shift the story in a completely new direction.

Result: Fair Value of $68.00 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, a breakthrough in consistent profitability or a fortified competitive moat could quickly challenge the prevailing view that the stock is overvalued.

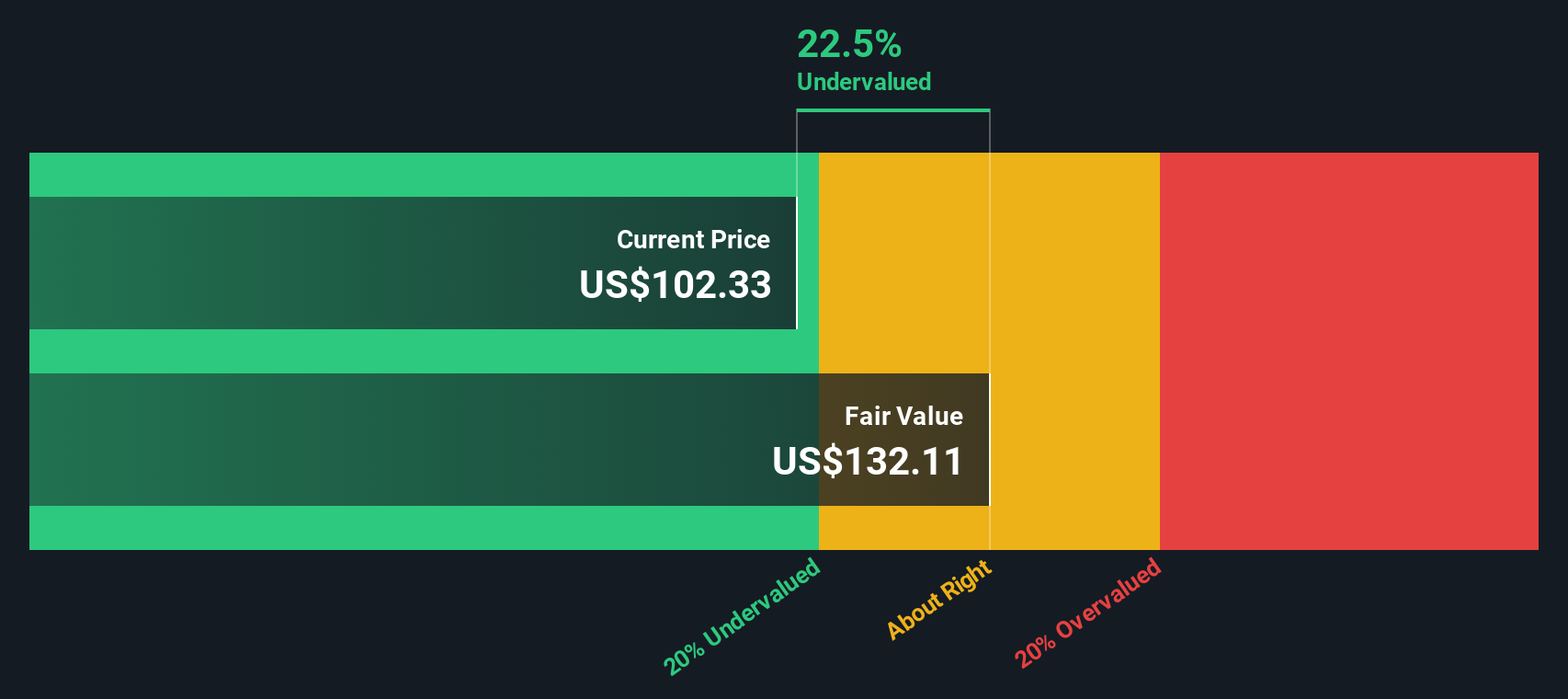

Find out about the key risks to this Twilio narrative.Another View: SWS DCF Model

Looking from a different angle, our DCF model suggests Twilio may actually be undervalued, even considering the high price tag implied by other methods. Could the market be underestimating Twilio’s future cash flows? Alternatively, are risks not fully reflected yet?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Twilio Narrative

If you see the story unfolding differently or want to dive into your own analysis, it takes just a few minutes to build your own view. Do it your way.

A great starting point for your Twilio research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Level up your portfolio by tapping into top trends and smart opportunities with these specially curated stock picks you do not want to miss out on.

- Unlock high-potential bargains by targeting undervalued shares using our undervalued stocks based on cash flows.

- Capture tomorrow’s medical breakthroughs by investing in companies at the forefront of artificial intelligence in healthcare with healthcare AI stocks.

- Turbocharge your returns with reliable income streams from companies offering impressive yields through our dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Twilio might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NYSE:TWLO

Twilio

Offers customer engagement platform solutions in the United States and internationally.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

Thanks for sharing these. They really help when I pick what dividend stocks to invest in