- United States

- /

- IT

- /

- NYSE:TWLO

Twilio (NYSE:TWLO) Expands RCS Business Messaging To Singapore With Singtel Partnership

Reviewed by Simply Wall St

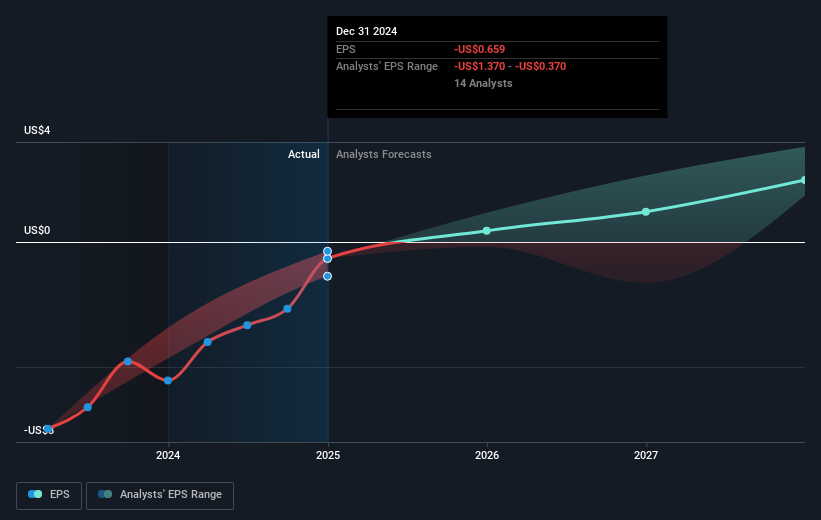

Twilio (NYSE:TWLO) experienced a notable quarter with a share price increase of nearly 12%, driven by key developments and market dynamics. The company's partnership with Singtel to enhance customer communications in Singapore likely sparked investor interest, especially as this expansion into the Asian RCS market underscores Twilio's commitment to global messaging solutions. Furthermore, the collaboration with Chelsea FC to boost fan engagement could have strengthened investor confidence in Twilio's growth trajectory. Despite broader market concerns, including economic uncertainty affecting indexes like the Nasdaq's February decline, Twilio's positive Q4 earnings report, showcasing improved sales and reduced net losses, reinforced its financial resilience. Additionally, Twilio's buyback activity, with a substantial share repurchase, signaled a focus on shareholder value, potentially bolstering investor sentiment. These elements combined to influence its stock performance, even amid a market showing a 1% decline over the same period.

Click here and access our complete analysis report to understand the dynamics of Twilio.

Over the past year, Twilio's shares impressively achieved a total return of 99.12%, significantly outperforming both the US market, which rose 15.3%, and the US IT industry's growth of 12.2%. This strong performance can be attributed to several key factors. Twilio's integration of OpenAI's Realtime API in October enhanced its conversational AI capabilities, improving customer engagement. Additionally, the introduction of the Unified Profiles and Agent Copilot within Twilio Flex in May aimed to boost personalization and productivity, adding value to its product offerings.

Alongside product enhancements, Twilio's substantial share repurchase efforts further contributed to shareholder value. Notably, between April and June, the company bought back 15.23 million shares for US $898.77 million. This was part of an ongoing initiative announced in January to repurchase up to US $2 billion of shares by the end of 2027. These strategic actions have helped solidify investor confidence and bolster Twilio's stock performance over the past year.

- Understand the fair market value of Twilio with insights from our valuation analysis—click here to learn more.

- Analyze the downside risks for Twilio and understand their potential impact—click to learn more.

- Is Twilio part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Twilio might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TWLO

Twilio

Offers customer engagement platform solutions in the United States and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives