- United States

- /

- Software

- /

- NYSE:TDC

These 4 Measures Indicate That Teradata (NYSE:TDC) Is Using Debt Safely

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. As with many other companies Teradata Corporation (NYSE:TDC) makes use of debt. But the more important question is: how much risk is that debt creating?

Why Does Debt Bring Risk?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. If things get really bad, the lenders can take control of the business. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we examine debt levels, we first consider both cash and debt levels, together.

See our latest analysis for Teradata

What Is Teradata's Net Debt?

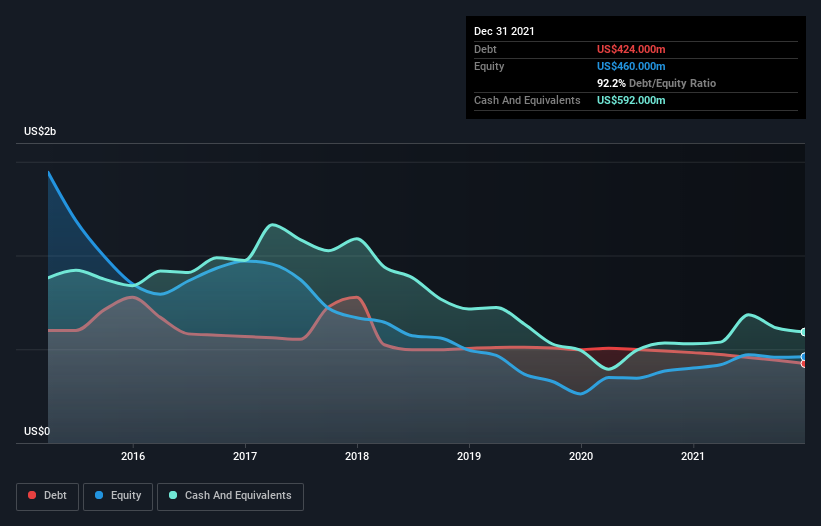

The image below, which you can click on for greater detail, shows that Teradata had debt of US$424.0m at the end of December 2021, a reduction from US$482.0m over a year. But on the other hand it also has US$592.0m in cash, leading to a US$168.0m net cash position.

How Strong Is Teradata's Balance Sheet?

We can see from the most recent balance sheet that Teradata had liabilities of US$1.03b falling due within a year, and liabilities of US$676.0m due beyond that. On the other hand, it had cash of US$592.0m and US$431.0m worth of receivables due within a year. So it has liabilities totalling US$686.0m more than its cash and near-term receivables, combined.

Given Teradata has a market capitalization of US$5.21b, it's hard to believe these liabilities pose much threat. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward. While it does have liabilities worth noting, Teradata also has more cash than debt, so we're pretty confident it can manage its debt safely.

Better yet, Teradata grew its EBIT by 353% last year, which is an impressive improvement. If maintained that growth will make the debt even more manageable in the years ahead. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if Teradata can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. Teradata may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. Over the last three years, Teradata actually produced more free cash flow than EBIT. There's nothing better than incoming cash when it comes to staying in your lenders' good graces.

Summing up

Although Teradata's balance sheet isn't particularly strong, due to the total liabilities, it is clearly positive to see that it has net cash of US$168.0m. The cherry on top was that in converted 230% of that EBIT to free cash flow, bringing in US$432m. So we don't think Teradata's use of debt is risky. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. Be aware that Teradata is showing 2 warning signs in our investment analysis , and 1 of those makes us a bit uncomfortable...

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

Valuation is complex, but we're here to simplify it.

Discover if Teradata might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:TDC

Teradata

Provides a connected hybrid cloud analytics and data platform in the United States and internationally.

Undervalued with proven track record.

Similar Companies

Market Insights

Weekly Picks

Ferrari's Intrinsic and Historical Valuation

Investment Thesis: Costco Wholesale (COST)

Undervalued Key Player in Magnets/Rare Earth

Recently Updated Narratives

SIrios Resources (SOI) is significantly undervalued on a risk-adjusted basis.

BSX after Penumbra ?

Procter & Gamble - A Fundamental and Historical Valuation

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

I'm exiting the positions at great return! WRLG got great competent management. But, 100k oz gold too small in today environment. They might looking for M/A opportunity in the future, or they might get take over by Aris Mining, I don't know. But, Frank Giustra stated he's believed in multi-assets, so that's my speculation. Anyhow, I want to be aggressive in today's gold price. I'm buying Lahontan Gold LG with this as exchange. Higher upside, more leverage. WRLG CEO is BOD's of LG, that's something. This will be my last update on WRLG, good luck!