- United States

- /

- Diversified Financial

- /

- NYSE:XYZ

Despite the Negative Revisions, Block, Inc. (NYSE:SQ) has Large Future Potential

Key takeaways:

- The latest Q1 performance and outlook was poorer than expected

- Analysts revised their projections downward for the company

- Block has certain risks but is likely to produce value for investors in the future

Block, Inc. (NYSE:SQ) is on the receiving end of market turbulence as the stock has declined some 12% from the day on the earnings announcement. We will review how the company performed, and what do analysts expect in the future.

The earnings day for stocks is used by investors to revisit their thesis, as well as to use the anticipated large liquidity in executing their strategy.

Here is a recap of the key highlights from the Q1 May 5th earnings:

- Q1 revenue was USD 3.96b compared to USD 5.06b a year ago.

- Net loss was USD 204.2 million, compared to net income of USD 39.01 million a year ago.

- Diluted loss per share was USD 0.38 vs. an EPS of USD 0.08 a year ago.

While earnings came in negative, the company still managed to produce positive free cash flows of US$965m in the last 12 months. This makes the FCF margin 5.8%, which essentially indicates that the company is making money but reinvesting profits into growth.

In the past, we discussed some key fundamental and competitive risk factors. Our takeaway was that SQ has enough balance sheet stability to develop their business. The business is also competing with Apple's (NASDAQ:AAPL) "Tap to Pay" feature, and StoneCo (NASDAQ:STNE) is limiting expansion to Latin America.

In combination with the mentioned risks, it may seem like Block will have a harder time ahead, however the company has an innovative business that reduces the costs of doing business for merchants and will likely develop - unfortunately, market pressures have brought the valuation estimate from what the company could be in the future to what it is today, which is why we see such a decline in this and similar young stocks.

We noted some negative short-term developments after the company reported earnings:

- Analysts decreased the price target from US$176 to US$160, which is still 91% above the last closing price of US$83.86

- On the 2nd of May, the CFO sold around 4k shares on-market at roughly US$98.47 per share, there was significant selling even before that. Review insider transactions in our Ownership section.

- 2022 EPS forecasts decreased from US$-0.38 per share to US$-1.22.

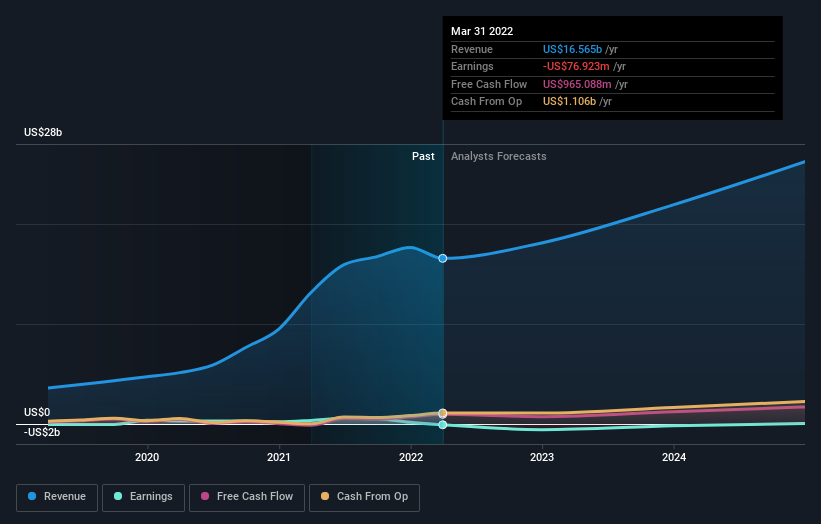

Finally, we will review how analysts envision the future performance of the stock and we start with the chart below:

Check out our latest analysis for Block

Taking into account the latest results, the current consensus from Block's 39 analysts is for revenue growth of about 9.3% in 2022, and US$26.2b revenue in 2024.

Yet prior to the latest earnings, the analysts had been forecasting revenues of US$18.8b and losses of US$0.38 per share in 2022. While this year's revenue estimates dropped there was also a regrettable increase in loss per share expectations, suggesting the consensus has a bit of a mixed view on the stock.

The good thing about Block is that the company is still expected to create cash and have enough financial stability in order to realize its business potential - the price may change based on market forces, but the company will keep developing.

Conclusion

Block has been hit with negative revisions after the latest earnings report, and insider transactions in the last 12 months are also dampening investor's confidence.

The company is still stable, cash flow positive and building up its business. The market price of risk may depress the price even more, but investors are likely engaged with a business that can produce future value.

Even so, be aware that Block is showing 3 warning signs in our investment analysis , you should know about.

Valuation is complex, but we're here to simplify it.

Discover if Block might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Goran Damchevski

Goran is an Equity Analyst and Writer at Simply Wall St with over 5 years of experience in financial analysis and company research. Goran previously worked in a seed-stage startup as a capital markets research analyst and product lead and developed a financial data platform for equity investors.

About NYSE:XYZ

Block

Block, Inc., together with its subsidiaries, builds ecosystems focused on commerce and financial products and services in the United States and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives