- United States

- /

- Diversified Financial

- /

- NYSE:XYZ

Here is why Block (NYSE:SQ) is Fundamentally Strong, and has Enough Resources to Handle Competition

Block, Inc. (NYSE:SQ) shareholders may be concerned to see the share price fall 55% over the last three months. While the long term performance of the stock was great (609% return over the last 5 years) this is prompting investors to ask whether this is a short term issue, or a lasting situation. In addition, the company has raised its debt level to US$5.4b. This further increases the concerns of investors that things might not be all that great.

Today, we will take a look at the fundamentals of the business, with a deeper emphasis on debt, and see if the company is having difficulties or is actually aggressively developing.

See our latest analysis for Block

Fundamentals

Square has a gross profit margin of 24.2%, while other tech companies boast a 40%+ gross profit margin, the lower GP from Square also means that competitors will have higher required investments that they need to make in order to enter the landscape.

The Net Profit margin is 3.2%, which is great to see that the company is already profitable at this early stage. A profitable company assures investors that they can create excess value with their business.

While Net Income is a standard measure of profitability, investors have a claim to the residual cash flows of the firm, which makes the free cash flows a more appropriate measure of profit for equity (and debt) investors. The free cash flow margin is 3.5% which means that statutory profits are slightly underrepresented in relation to how much cash the company is putting in at the end of the quarter.

Fundamental growth has been quite high for the company, with revenues growing 76% in the last 12 months. The high growth is party attributable to the shift in consumer habits in 2020 and 2021. Analysts are still expecting high growth in the future, but this growth is estimated to dampen to some 12% annually.

Looking a bit beyond the quantitative fundamentals, there is at least one notable external risk factor.

Apple Inc., (NASDAQ:AAPL) is planning to release the tap to pay feature which would offer merchants an alternative to Square's payment service without the need to buy additional hardware. The service would allow merchants to process cards using their iPhones and ApplePay - this process uses near field communication (NFC). While this has strong potential to lower the costs for businesses that use the technology, there is a possibility that Square can also find ways tor retain market share and improve the quality of service.

Now that we looked at income and a key risk factor, we will move on to the balance sheet and address the US$5.4b total debt of Square.

Debt Analysis

Companies generally take on debt for two main reasons. One is if they are in financial trouble - which does not look good in the eyes of investors.

The second is that the law is tilted in favor of debt, and interest expenses are tax-deductible, which gives a company a tax benefit if they take on some debt.

While the benefits are enticing, taking on too much debt or taking it too early in a company's development can cause problems.

Fortunately for Square, they have a positive EBIT of US$568m in the last 12 months.

Their US$5468b total debt has interest expenses of US$38.1m, which means that the company is borrowing at an average rate of 0.7%. This is quite a "cheap" rate in order to move money from the future to the present.

Because of this, we can calculate the tax savings as: Debt * Interest % * Marginal tax rate

for Square, that comes out to $5.468b *0.07*0.27 = US$10.3m in tax saving per year

How well can Square cover its Debt?

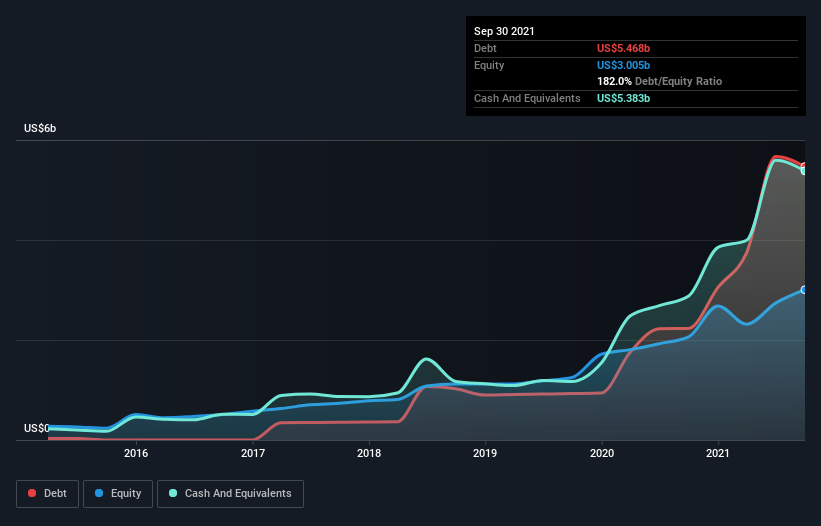

As you can see below, at the end of September 2021, Block had US$5.47b of debt, up from US$2.23b a year ago. However, because it has a cash reserve of US$5.38b, its net debt is less, at about US$84.7m.

For companies, debt can be held as cash (which makes less sense in an inflationary period), as a reserve before engaging in projects or acquisitions, or in order to recapitalize the business and cut costs.

The image below shows how Square changed its debt balance.

How Healthy Is Block's Balance Sheet?

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). Thus, we consider debt relative to earnings both with and without depreciation and amortization expenses.

Block has net debt of just 20% of EBITDA, indicating that it is certainly not a reckless borrower. And this view is supported by the solid interest coverage, with EBIT coming in at 8.7 times the interest expense over the last year. It was also good to see that despite losing money on the EBIT line last year, Block turned things around in the last 12 months, delivering EBIT of US$332m.

As we mentioned before, cash is king when it comes to investors, and Square produced more cash than EBIT in the last 12 months.

Key Takeaways

When evaluating a troubled stock, a key question to ask is whether the downtrend is temporary.

Looking at the past along with analyst forecasts, we can see that Square has solid fundamentals. However, the main risk factor for the company is qualitative and demands that they increase innovation in order to maximize their competitiveness.

While looking at the risk of debt on the balance sheet, one can be taken a back on first sight. However, our analysis reveals that the company is benefiting from debt, and can easily manage the liabilities.

In summary, Square is a great FinTech company, which has enough resources to innovate and grow even faced with competition.

If you want to make a deeper dive, take a loot at these 4 warning signs for Block.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Block might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Goran Damchevski

Goran is an Equity Analyst and Writer at Simply Wall St with over 5 years of experience in financial analysis and company research. Goran previously worked in a seed-stage startup as a capital markets research analyst and product lead and developed a financial data platform for equity investors.

About NYSE:XYZ

Block

Block, Inc., together with its subsidiaries, builds ecosystems focused on commerce and financial products and services in the United States and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)