- United States

- /

- Diversified Financial

- /

- NasdaqGS:STNE

Here are the Growth Forecasts and Risks Influencing StoneCo's (NASDAQ:STNE) Valuation

StoneCo Ltd.'s ( NASDAQ:STNE ) is the second FinTech holding that is present in Warren Buffett's portfolio, which is pushing to grow in Latin American Markets. The US$3.8b company has lost more than 80% of its market cap since February 2021, but investors are wondering whether the stock has found a bottom and what are the future prospects of the business.

We also covered another FinTech company in Latin America - Nu Holdings. The companies are in a similar industry, and do not directly compete with each other, which can be good for investors looking for diverse picks.

The key takeaways of our analysis are:

- The company is offering essential financial services to merchants at a competitive price

- StoneCo is entering the high growth phase and institutions like Berkshire have added the stock to their portfolio

- The company is early in the growth cycle and trading at a relatively cheap EV to Sales valuation

- The cost of capital for doing business in that region may be hard to overcome because of the implied financial risks

Overview

StoneCo is similar to Block ( NYSE:SQ ) regarding the service palette it offers to clients. The company currently aims to be a one-stop shop for financial transactions for businesses. It serves businesses by offering a point of sale app, online payment processing and other merchant solutions. It also offers store and life insurance, loyalty programs and business accounts.

The company gained prominence, after Berkshire added it into its portfolio, and we can see in the chart below, which institutions hold a stake in StoneCo:

It seems that there are quite a few players that are keen to capture the business transactions share in the Latin Emerging markets.

They have about 1.8 million active clients, of which are 492k banking clients and some 200k subscribed software clients. The main revenue source - 73%, comes from their financial services , while the rest comes from their software platform.

To the extent that the service creates value for clients, it will ensure future returns as these clients grow their business - which is why it seems that StoneCo is engaged in a virtuous circle.

Fundamentals

Now we will dive into the financial performance of StoneCo, and see if the current valuation makes sense.

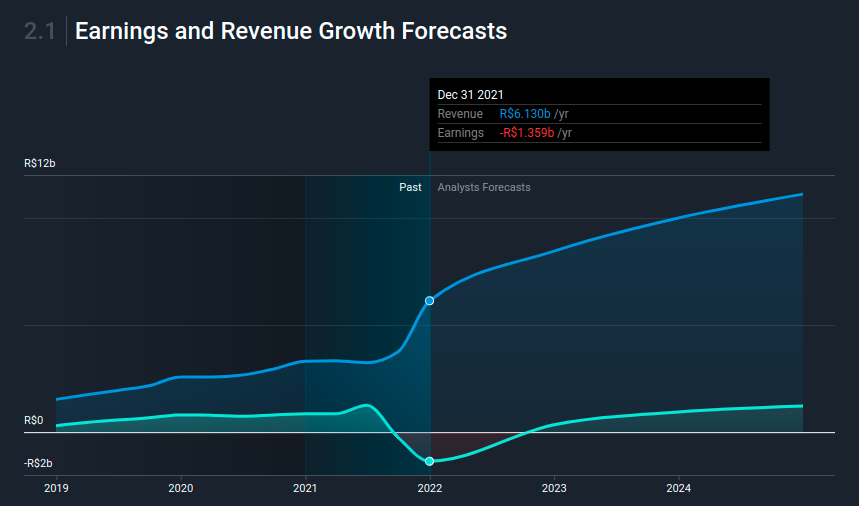

On 31 December 2021, the US$3.8b market-cap company posted a loss of R$1.4b for its most recent financial year. The company seems to be regaining traction, with their Q4 adjusted net income coming at R$33.7m, however investors should make sure that they find the adjustments reasonable.

See our latest analysis for StoneCo

Analysts' expectations reveal why the company is appealing to investors like Berkshire. The company is forecasted to reach revenues of R$11b (US$2.36m) by the end of 2024, as well are increase profits to R$1.2b (US$260m).

One thing we would like to bring into light with StoneCo is itsrelatively high level of debt.Typically, debt shouldn’t exceed 40% of your equity, which in StoneCo's case is 60%.Note that a higher debt obligationincreases the risk in investing in the loss-making company.

Valuation

The company is trading at a price to sales ratio of 2.9x, which means that there might be a mismatch between the expectations of investors and what analysts are predicting for growth. Considering that the company has a significant total debt balance, we need to add that on top in order to get a complete picture of the structure used to generate revenues.

For StoneCo, the enterprise value is calculated as: Market cap + Debt - Cash or US$3.8b + US$1.74 - US$1.79 = US$3.63b

This gives us a EV to Sales of: US$3.63 / US$1.32 = 2.75x

This indicates that the company is even cheaper when investors consider all the funds that finance revenues.

Note: we use EV to sales instead of price to sales, because revenue is high in the capital structure, comes before debt payments, and we can use debt to fund growth (sales).

Investors that believe in the growth story for StoneCo, may find these numbers very appealing, but they will likely also have to wait some time before the company completes its high-growth phase. Additionally, the company is still quite early in the lifecycle, so investors that believe in the future of the company may consider this an "early catch".

A Word On Risk

Keep in mind that StoneCo is targeting and headquartered in emerging markets. These territories have a lot of implied growth, but they also have increased risks, which means that their costs of capital are larger than those of developed markets.

The risk part comes from inflation and the risks associated with emerging markets, where small store owners have more difficulties doing business, there are frequent changes in legislation and the legal system may be slower than in Westernized countries. This creates risk factors that are outside the control of the company, but will nonetheless affect it.

In order for a company to create value, it needs to produce a return on capital higher than the costs. Over the last few years, the Returns on Capital Employed for StoneCo, have been between 9.3% and 7.1% .

The cost of capital for these markets is arguably around 19%, stemming from the Brazilian 10 Year T.Bond of 10.97% + the implied enterprise risk premium of 7.4%.

Having higher returns than the cost of capital may be a significant issue in this region of the world.

Conclusion

While it is true that the company is producing a great financial service at a relatively cheap valuation, the costs of risk may put downward pressure on the company's valuation.

There are too many aspects of StoneCo to cover in one brief article, but the key fundamentals for the company can all be found in one place – StoneCo's company page on Simply Wall St .

We've also put together a list ofpertinentaspectsyou should look at:

- Management Team : An experienced management team on the helm increases our confidence in the business – take a look at who sits on StoneCo’s board and the CEO’s background .

- Other High-Performing Stocks : Are there other stocks that provide better prospects with proven track records? Explore our free list of these great stocks here .

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Goran Damchevski

Goran is an Equity Analyst and Writer at Simply Wall St with over 5 years of experience in financial analysis and company research. Goran previously worked in a seed-stage startup as a capital markets research analyst and product lead and developed a financial data platform for equity investors.

About NasdaqGS:STNE

StoneCo

Provides financial technology and software solutions to merchants and integrated partners to conduct electronic commerce across in-store, online, and mobile channels in Brazil.

Very undervalued with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026