- United States

- /

- Software

- /

- NYSE:RNG

RingCentral (RNG): Rethinking Valuation After High-Profile Chicago Cubs Partnership Announcement

Reviewed by Simply Wall St

Most Popular Narrative: 3.9% Undervalued

According to the most widely followed narrative, RingCentral shares are trading at nearly a 4% discount to their fair value. Analysts believe the stock could be modestly undervalued, with expectations of improved profitability and revenue growth ahead.

“Deepening strategic partnerships with industry leaders like AT&T and the renewal of the NiCE partnership provide improved distribution and cross-sell opportunities. This expands RingCentral's addressable market and customer base across both SMB and enterprise segments, bolstering top-line revenue and lowering customer acquisition costs over time.”

What is underpinning this near double-digit upside? Analysts point to ambitious future profit margins, a return to positive earnings, and robust expansion plans. Want to see which forecasted growth rates and margin jumps are fueling this valuation, and the one figure that could redefine investor expectations? The answer might surprise even experienced tech stock watchers.

Result: Fair Value of $33.24 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, increased competition from bundled productivity suites or a shift in key partner strategies could quickly dampen RingCentral's optimistic growth outlook.

Find out about the key risks to this RingCentral narrative.Another View: SWS DCF Model Weighs In

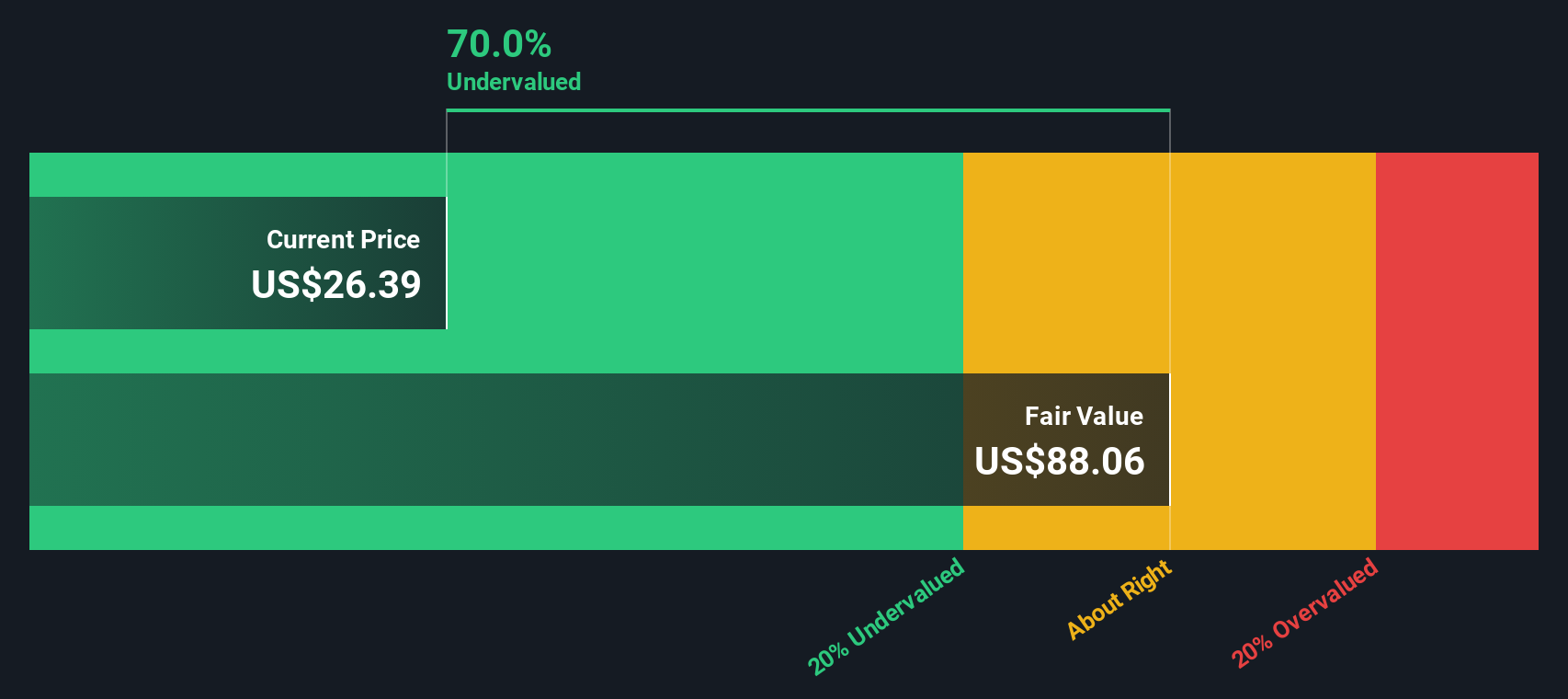

Looking at the numbers from a different angle, our discounted cash flow (DCF) model suggests a far wider gap between RingCentral’s share price and its long-term intrinsic value. This result reinforces the idea that the market may be overlooking hidden upside. However, is this outlook too optimistic given the headwinds ahead?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out RingCentral for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own RingCentral Narrative

If you see things differently or want to dive into the data on your own terms, it's easy to craft your perspective in just a few minutes. Do it your way

A great starting point for your RingCentral research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Level up your research by tapping into sectors and trends that could shape tomorrow’s winners. Here are three smart pathways you should check out right now:

- Capitalize on the cutting edge of artificial intelligence by scanning the market’s most promising opportunities with our list of AI penny stocks.

- Catch hidden value before the crowd by browsing companies assessed as underpriced, thanks to in-depth analysis in our undervalued stocks based on cash flows.

- Power up your income strategy by finding businesses with robust, above-average yields using our collection of dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NYSE:RNG

RingCentral

Provides cloud business communications, contact center, video, and hybrid event solutions in North America and internationally.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)