- United States

- /

- Software

- /

- OTCPK:RBTC

Rubicon Technologies, Inc.'s (NYSE:RBT) Share Price Boosted 29% But Its Business Prospects Need A Lift Too

Rubicon Technologies, Inc. (NYSE:RBT) shareholders are no doubt pleased to see that the share price has bounced 29% in the last month, although it is still struggling to make up recently lost ground. But the last month did very little to improve the 87% share price decline over the last year.

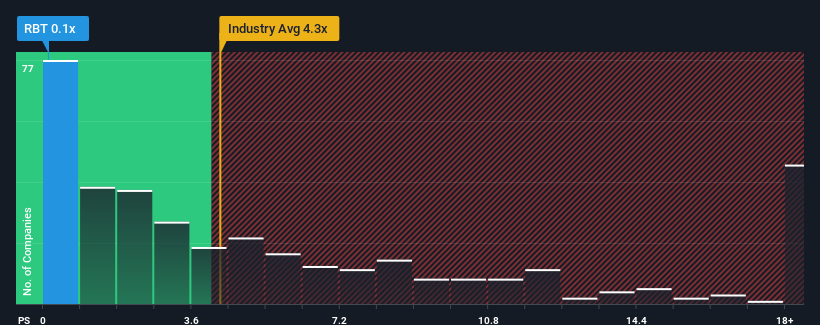

Even after such a large jump in price, Rubicon Technologies may still be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.1x, since almost half of all companies in the Software industry in the United States have P/S ratios greater than 4.3x and even P/S higher than 10x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

See our latest analysis for Rubicon Technologies

What Does Rubicon Technologies' P/S Mean For Shareholders?

Recent times haven't been great for Rubicon Technologies as its revenue has been rising slower than most other companies. The P/S ratio is probably low because investors think this lacklustre revenue performance isn't going to get any better. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

Keen to find out how analysts think Rubicon Technologies' future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The Low P/S Ratio?

In order to justify its P/S ratio, Rubicon Technologies would need to produce anemic growth that's substantially trailing the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 3.0% last year. The solid recent performance means it was also able to grow revenue by 28% in total over the last three years. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 9.5% each year as estimated by the three analysts watching the company. That's shaping up to be materially lower than the 16% per year growth forecast for the broader industry.

With this in consideration, its clear as to why Rubicon Technologies' P/S is falling short industry peers. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Key Takeaway

Shares in Rubicon Technologies have risen appreciably however, its P/S is still subdued. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As expected, our analysis of Rubicon Technologies' analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

You should always think about risks. Case in point, we've spotted 5 warning signs for Rubicon Technologies you should be aware of, and 3 of them are a bit unpleasant.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OTCPK:RBTC

Rubicon Technologies

A digital marketplace for waste and recycling services, provides cloud-based waste and recycling solutions to businesses and governments worldwide.

Slight risk and slightly overvalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.