- United States

- /

- Software

- /

- NYSE:RBRK

How Rubrik’s (RBRK) AI-Powered Agent Rewind Launch and IDC Leader Recognition Have Changed Its Investment Story

Reviewed by Sasha Jovanovic

- Rubrik (NYSE:RBRK) was recently recognized as a Leader in the IDC MarketScape: Worldwide Cyber-Recovery 2025 Vendor Assessment for its strong threat detection, identity resilience, and ransomware response capabilities, while also launching its Agent Rewind product powered by Predibase AI infrastructure.

- This dual milestone highlights Rubrik's continued emphasis on AI-driven cyber recovery solutions and growing influence within the enterprise data security ecosystem.

- We'll explore how Rubrik's AI-powered Agent Rewind launch could further support its innovation-led investment narrative and industry differentiation.

Find companies with promising cash flow potential yet trading below their fair value.

Rubrik Investment Narrative Recap

Rubrik’s investment story pivots on whether you see a durable path for AI-driven cyber resilience solutions to capture more market share in an increasingly competitive field. The recent recognition as a Leader by IDC MarketScape and the launch of Agent Rewind underscore Rubrik’s commitment to product innovation, but these milestones do not materially alter the most urgent short-term catalyst, delivering on accelerated, profitable revenue growth, or its biggest risk, which is sustaining differentiation amid intensifying competition.

Of the latest announcements, the August introduction of Agent Rewind directly reinforces Rubrik’s position at the intersection of AI and security, an area that remains crucial for driving future growth. This product’s ability to safely reverse unwanted AI-driven actions aligns closely with the company's aim to enhance operational control for enterprise customers, supporting Rubrik’s competitive strengths and long-term innovation potential.

Yet, it is important to note that, in contrast to headline innovations, investors should also be aware of how aggressive competition from legacy and new-generation players may still...

Read the full narrative on Rubrik (it's free!)

Rubrik's narrative projects $2.0 billion revenue and $257.3 million earnings by 2028. This requires 26.2% yearly revenue growth and a $782.1 million increase in earnings from -$524.8 million.

Uncover how Rubrik's forecasts yield a $115.20 fair value, a 40% upside to its current price.

Exploring Other Perspectives

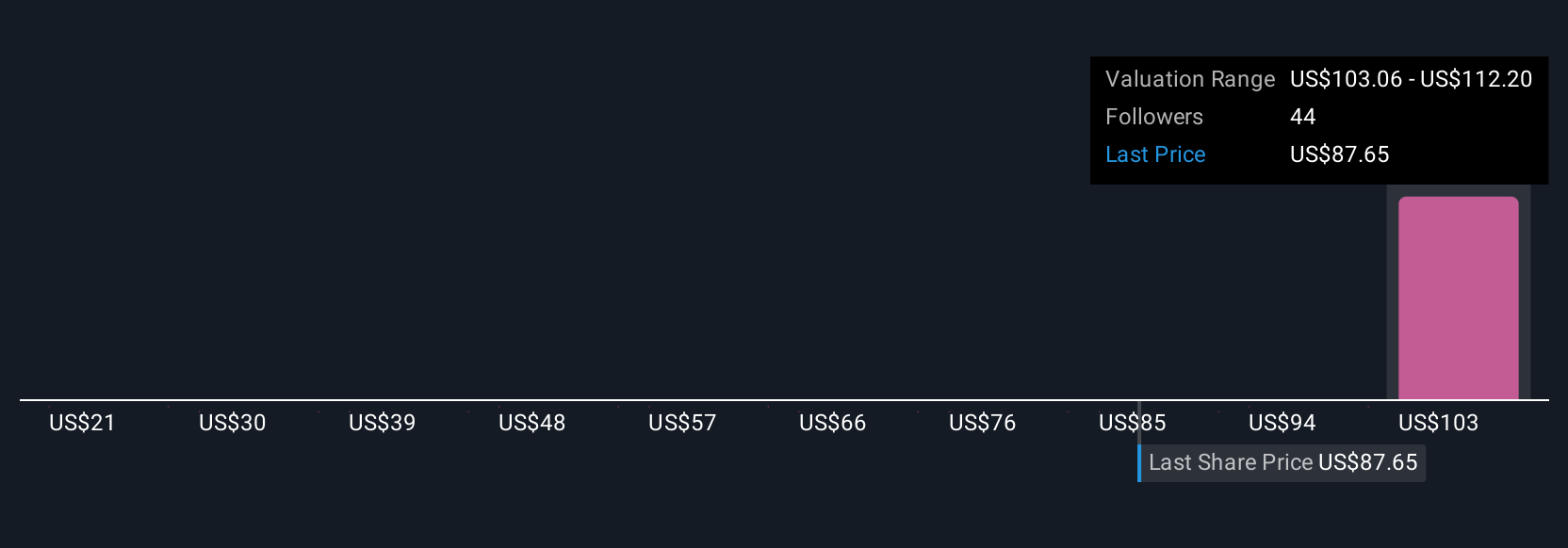

Twelve fair value estimates from the Simply Wall St Community span from US$20.21 to US$115.85 per share, reflecting a wide spectrum of retail forecasts. In light of this diversity, the ongoing challenge from established and emerging cyber resilience rivals remains a key point for considering how Rubrik’s performance could evolve.

Explore 12 other fair value estimates on Rubrik - why the stock might be worth as much as 41% more than the current price!

Build Your Own Rubrik Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Rubrik research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Rubrik research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Rubrik's overall financial health at a glance.

Looking For Alternative Opportunities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RBRK

Rubrik

Provides data security solutions to individuals and businesses worldwide.

Slightly overvalued with imperfect balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026