- United States

- /

- Software

- /

- NYSE:RAMP

How Investors Are Reacting To LiveRamp (RAMP) Unveiling AI Agentic Orchestration for Marketing Transformation

Reviewed by Sasha Jovanovic

- Earlier this month, LiveRamp unveiled new AI-powered tools, including agentic orchestration capabilities and industry-first segmentation and search features that harness its data collaboration network to enhance marketing workflows.

- This advancement positions LiveRamp as the first to enable autonomous AI agents to securely collaborate across identity, segmentation, and measurement, potentially transforming how marketers activate and measure campaigns at scale.

- We'll assess how LiveRamp's launch of agentic AI orchestration may influence its investment narrative and outlook for AI-driven marketing technologies.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

LiveRamp Holdings Investment Narrative Recap

To be a shareholder in LiveRamp Holdings, one must believe in the secular trend toward AI-driven marketing and the company’s ability to act as a trusted, neutral enabler for secure data collaboration. The launch of LiveRamp’s agentic AI orchestration may support the company’s position in unlocking new marketing workflows, though it likely doesn't fully address short-term revenue concentration risk tied to large enterprise clients, or significantly shift the pacing of revenue growth guidance at this stage.

The recent announcement of LiveRamp’s industry-first AI-Powered Segmentation stands out, as it enables marketers to quickly generate high-precision audience segments using natural language, simplifying activation and campaign planning. This tool directly supports the ongoing shift towards automated, smarter marketing decisions, a key catalyst for growth as first-party data use becomes increasingly important.

However, even with enhanced AI tools, investors need to keep a close eye on the risk that comes from heavy reliance on a handful of major enterprise clients, because if just one of these...

Read the full narrative on LiveRamp Holdings (it's free!)

LiveRamp Holdings is projected to reach $969.7 million in revenue and $154.0 million in earnings by 2028. This scenario requires annual revenue growth of 8.3% and an approximate $141 million increase in earnings from the current level of $12.7 million.

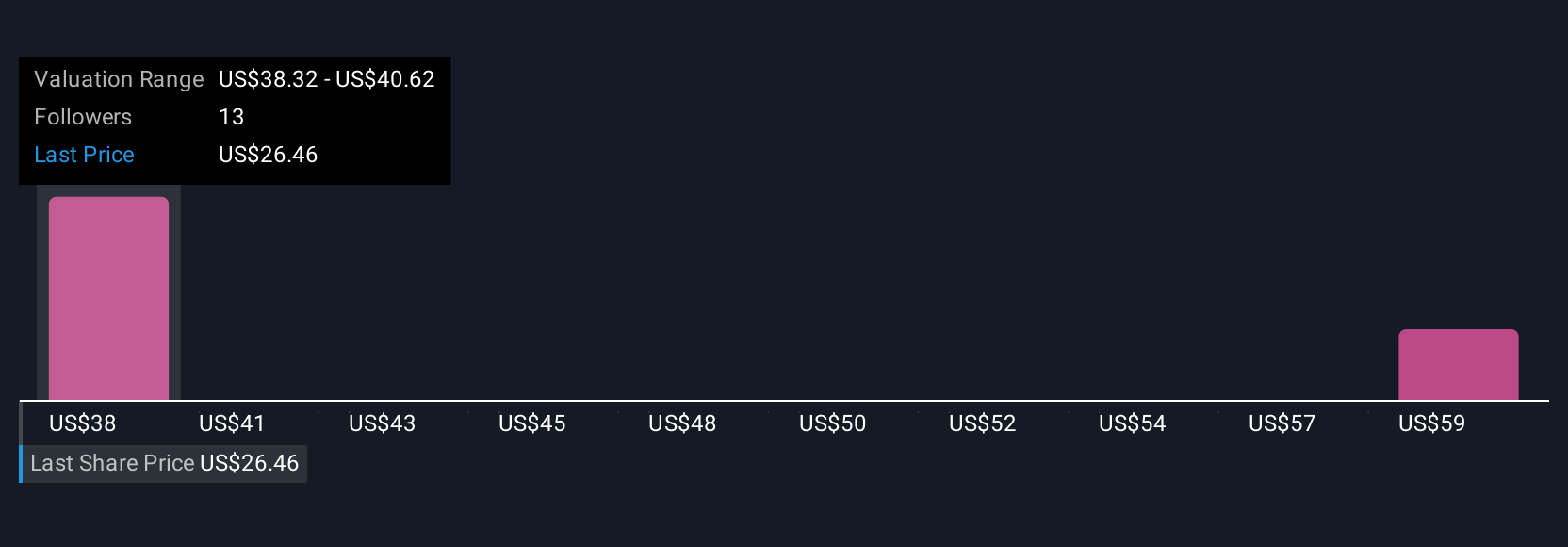

Uncover how LiveRamp Holdings' forecasts yield a $39.62 fair value, a 45% upside to its current price.

Exploring Other Perspectives

Four individual fair value estimates from the Simply Wall St Community range from US$28 to US$52, highlighting the wide spread of investor expectations. Competition from major technology providers integrating similar features may further influence LiveRamp’s potential to maintain market share and deliver long-term growth, so consider multiple viewpoints before making your decision.

Explore 4 other fair value estimates on LiveRamp Holdings - why the stock might be worth just $28.00!

Build Your Own LiveRamp Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your LiveRamp Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free LiveRamp Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate LiveRamp Holdings' overall financial health at a glance.

Curious About Other Options?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 32 best rare earth metal stocks of the very few that mine this essential strategic resource.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RAMP

LiveRamp Holdings

A technology company, operates a data collaboration platform in the United States, Europe, the Asia-Pacific, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives