- United States

- /

- Software

- /

- NYSE:QBTS

D-Wave Quantum (QBTS) Is Up 20.0% After Rethink Conference Presentation Announcement Has The Bull Case Changed?

Reviewed by Simply Wall St

- D-Wave Quantum Inc. is set to present at the 2025 Rethink Conference in Florida on July 18, featuring technical leaders Ken Robbins and Sean McNunn discussing quantum optimization solutions.

- This upcoming presentation offers a platform for D-Wave to potentially highlight new advancements, which often draws heightened interest from both industry peers and investors.

- We’ll explore how anticipation around D-Wave’s planned updates in quantum optimization could influence its broader investment narrative.

What Is D-Wave Quantum's Investment Narrative?

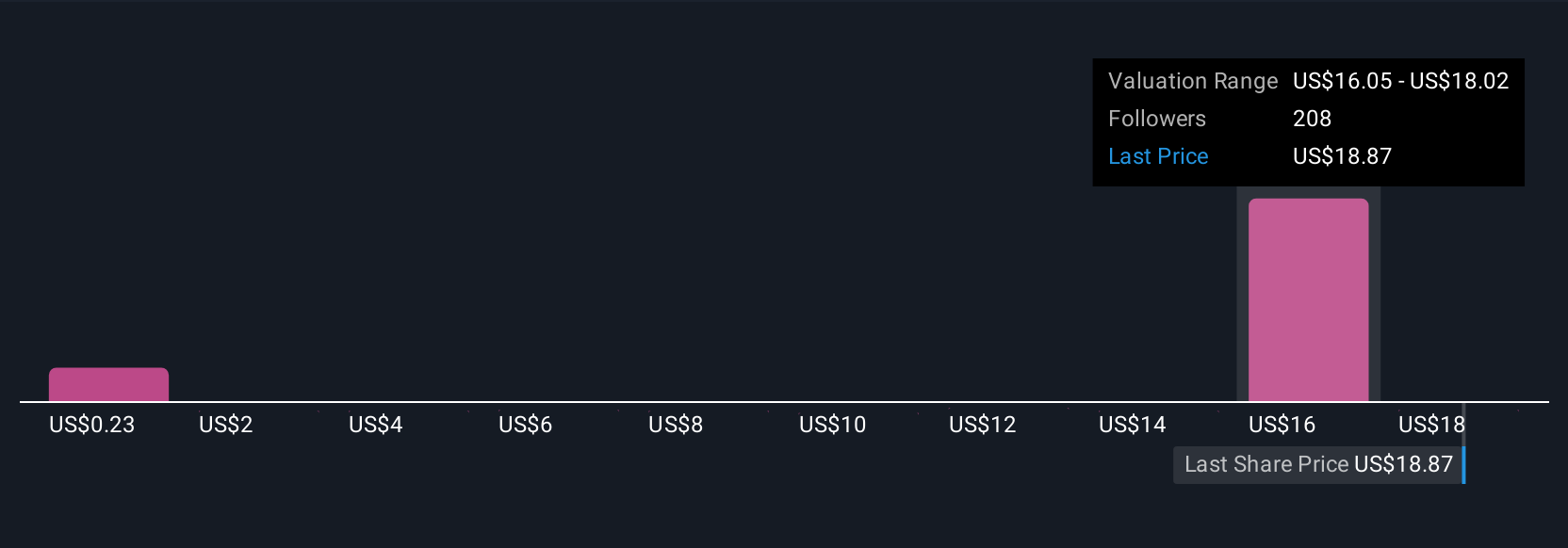

To be a D-Wave Quantum shareholder, you need to buy into a vision where quantum optimization is a backbone for future industries, a belief that large-scale adoption is more about “when” than “if.” The Rethink Conference airing, along with yesterday’s sharp share price rise, suggests investors are closely watching for signals that D-Wave’s solutions can translate excitement into contracts and lasting revenue. Previously, the central short-term catalysts focused on customer wins, adoption of the Advantage2 system, and visibility from strategic alliances like those with Yonsei University or Ford Otosan. This event, however, might amplify near-term interest, especially if any technical updates hint at deeper commercial traction or new partnerships. Yet, risks haven’t gone away: D-Wave remains unprofitable, has diluted shareholders, faced high volatility, and was recently dropped from several major indices despite rapid sales growth and healthy capital raises. For now, the upcoming presentation may fuel speculation but likely doesn’t materially shift the toughest challenges, delivering profit, stabilizing the share base, and sustaining momentum.

But set against the excitement, dilution risk looms for all new shareholders.

Exploring Other Perspectives

Build Your Own D-Wave Quantum Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your D-Wave Quantum research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free D-Wave Quantum research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate D-Wave Quantum's overall financial health at a glance.

Contemplating Other Strategies?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:QBTS

D-Wave Quantum

Develops and delivers quantum computing systems, software, and services worldwide.

Excellent balance sheet slight.

Similar Companies

Market Insights

Community Narratives