- United States

- /

- Software

- /

- NYSE:PATH

UiPath (PATH): Valuation Perspective Following Gartner Leadership and Strong Earnings Momentum

Reviewed by Simply Wall St

UiPath (NYSE:PATH) just landed a significant spot in the Gartner Magic Quadrant, being placed as a Leader in Intelligent Document Processing for the first time. For investors watching the automation space, this is more than another industry accolade. Being recognized alongside top technology players highlights UiPath’s edge in unlocking value from complex, unstructured data, which is a big deal for enterprises navigating AI adoption. This development has arrived as the company also reported higher quarterly revenue and a swing to net profit, giving fresh energy to the conversation around UiPath’s future trajectory.

Looking at the broader picture, the stock has seen some volatility this year, dropping nearly 3% over the past 12 months but bouncing back by over 10% in the past month as positive sentiment has started to build. The dual boost of new product leadership and improving financials has certainly helped, especially given UiPath’s noticeable earnings progress and a more optimistic market outlook. These recent movements mark a shift from a weak first half of the year, with momentum gathering pace amid ongoing enthusiasm for automation and AI.

With the stock’s recent uptick and increasing attention on whether UiPath’s technology can stay ahead, the big question is whether today’s price reflects genuine upside or if Wall Street is already factoring in the next phase of growth.

Most Popular Narrative: 11.3% Undervalued

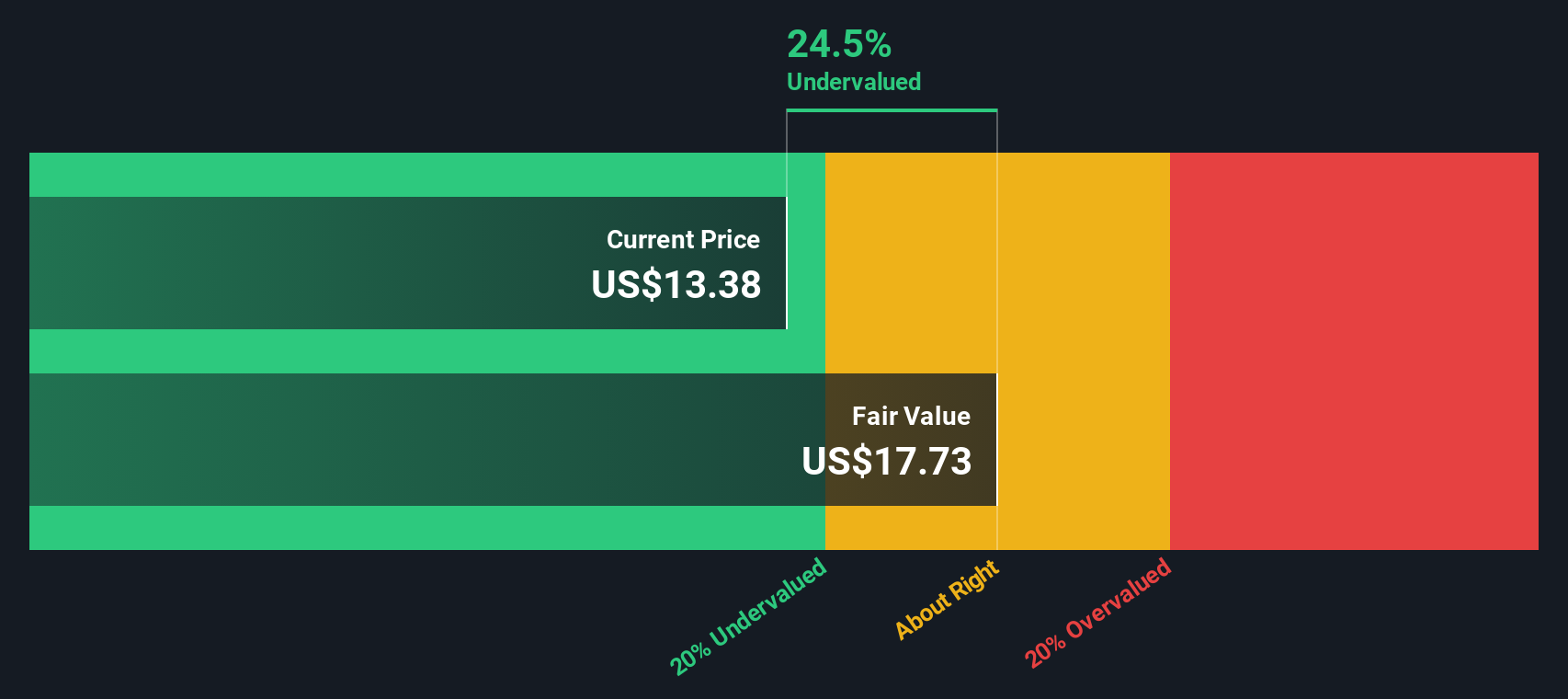

UiPath is widely considered undervalued right now based on prevailing analyst expectations, with the most popular narrative pointing to significant upside potential versus its current share price.

*New product launches such as Agent Builder and Agentic Orchestration, along with strategic partnerships like those with Microsoft and Deloitte, are positioned to expand market opportunities. This could potentially increase earnings through higher-value deals.*

Want to discover what’s behind this bullish outlook? The narrative leans on bold projections for future revenue and profit margins, influenced by major shifts in UiPath’s business model. Curious how much growth the analysts are really factoring in, and what kind of future valuation multiple they expect? There is a surprising set of assumptions behind this fair value estimate.

Result: Fair Value of $13.30 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, shifting market conditions and delayed contract decisions could quickly dampen this outlook. This makes short-term revenue projections less certain.

Find out about the key risks to this UiPath narrative.Another View: SWS DCF Model

While most analysts rely on future earnings projections and market sentiment, our DCF model offers a different angle. It also points to undervaluation, but from a cash flow perspective. Could the true value lie somewhere in between?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out UiPath for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own UiPath Narrative

If you think there’s more to this story or want to dive into the numbers yourself, you can easily craft your own narrative in just minutes. Do it your way

A great starting point for your UiPath research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let promising opportunities slip by when there’s a world of innovative companies out there. Use the Simply Wall Street Screener and find your next smart move today.

- Spot the innovators transforming healthcare with artificial intelligence by checking out healthcare AI stocks.

- Maximize your income potential and secure steady returns through dividend stocks with yields > 3%.

- Catch the undervalued gems others might miss by taking a look at undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NYSE:PATH

UiPath

Provides an end-to-end automation platform that offers a range of robotic process automation (RPA) solutions primarily in the United States, Romania, the United Kingdom, the Netherlands, and internationally.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

<html><head></head><body><div dir="auto">This is true here, but always true in the case of Alpha leaders. Often is takes a turn or two to get it right, like Gates to Nardella,  or Anton to Pinchar. This is when succession planning has failed or never happened. </div><div><br></div> </body></html>