- United States

- /

- Software

- /

- NYSE:PATH

UiPath (PATH): Reassessing Valuation After a 36% Three-Month Share Price Rally

Reviewed by Simply Wall St

UiPath (PATH) has quietly outperformed many software peers over the past 3 months, with the stock up about 36%, even after a choppy week that saw a pullback from recent highs.

See our latest analysis for UiPath.

That recent wobble comes after a strong run, with UiPath’s share price now at $16.09 and a solid 90 day share price return helping to offset a more modest 1 year total shareholder return. This suggests momentum is still broadly constructive as investors reassess its growth and automation tailwinds.

If UiPath’s move has you thinking about what else could be gaining steam, this might be a good moment to scan other high growth tech and AI stocks that are starting to attract attention.

With shares now trading just below analyst targets but still showing a near 10 percent implied intrinsic discount, the question looms: is UiPath quietly undervalued, or is the market already pricing in its next growth leg?

Most Popular Narrative: Fairly Valued

With UiPath closing at $16.09 against a narrative fair value near $15.93, the story frames the stock as roughly aligned with embedded expectations.

The fair value estimate has risen moderately from approximately 13.86 dollars to 15.93 dollars, reflecting a higher implied intrinsic value per share. The future P/E multiple has increased significantly from approximately 96.9x to 139.9x, implying a higher valuation multiple on expected forward earnings.

Curious why a richer future profit multiple still clears the narrative’s hurdle rate, even as growth and margin assumptions turn more cautious? The full breakdown reveals the tension.

Result: Fair Value of $15.93 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing geopolitical uncertainty and FX headwinds could delay deals and pressure margins, quickly challenging the idea that UiPath’s current valuation is justified.

Find out about the key risks to this UiPath narrative.

Another Take On Valuation

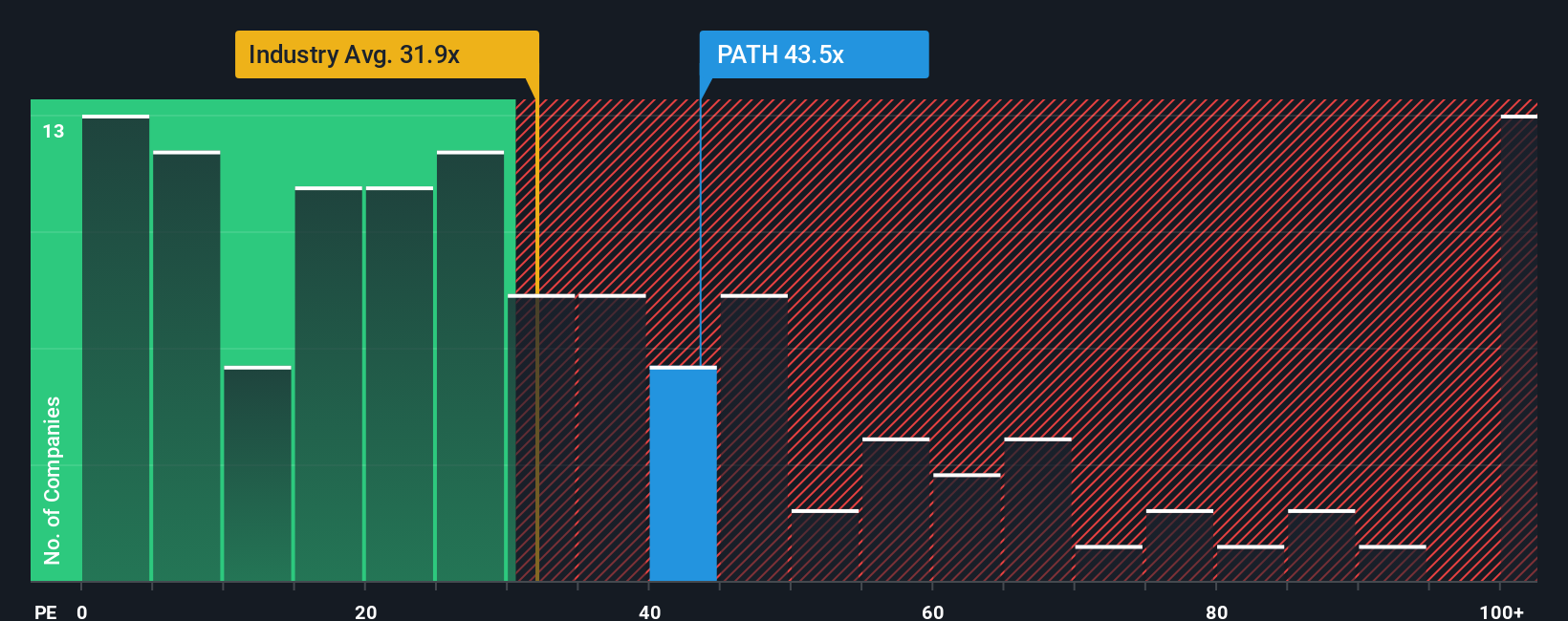

While UiPath screens as roughly fairly priced on narrative fair value, its 37.5x earnings multiple versus a 32.7x industry average and a 14.5x fair ratio suggests the market is paying a steep premium. Is this confidence in AI automation, or a margin of error waiting to close?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own UiPath Narrative

If this perspective does not quite align with your own, or you prefer to dive deeper into the numbers yourself, you can build a personalized view in just a few minutes, Do it your way.

A great starting point for your UiPath research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next investing move?

Do not leave your next opportunity to chance, use the Simply Wall Street Screener now to uncover stocks that match your strategy before the crowd catches on.

- Capture potential mispricings early by scanning these 915 undervalued stocks based on cash flows that the market may be overlooking right now.

- Ride structural themes in automation and data by targeting these 25 AI penny stocks poised to benefit from long term technology adoption.

- Strengthen your income stream by focusing on these 13 dividend stocks with yields > 3% that can support cash returns through different market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PATH

UiPath

Provides an end-to-end automation platform that offers a range of robotic process automation (RPA) solutions primarily in the United States, Romania, the United Kingdom, the Netherlands, and internationally.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Salesforce Stock: AI-Fueled Growth Is Real — But Can Margins Stay This Strong?

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)