- United States

- /

- Software

- /

- NYSE:PATH

Could a Veteran Marketer’s Arrival Shape UiPath’s (PATH) Role in the Future of Automation?

Reviewed by Simply Wall St

- UiPath recently appointed Michael Atalla as its new Chief Marketing Officer, entrusting him with leadership over global marketing, brand, and communications initiatives aimed at advancing the company’s presence in agentic AI and automation.

- Atalla’s extensive experience at F5 and Microsoft, particularly in cloud transformation and enterprise technology marketing, signals UiPath’s intent to amplify its influence in transforming business automation and shaping market perception.

- We’ll examine how Atalla’s expertise in cloud marketing and agentic automation could influence UiPath’s broader growth strategy and investment narrative.

This technology could replace computers: discover 23 stocks that are working to make quantum computing a reality.

UiPath Investment Narrative Recap

For shareholders, confidence in UiPath’s ability to solidify its leadership in AI-powered automation is key. The appointment of Michael Atalla as Chief Marketing Officer is a forward-looking move, yet it does not immediately alter the most important short-term catalyst, successful customer adoption of its next-generation agentic automation platform. The key risk remains the caution in customer budgets and deal delays driven by macroeconomic uncertainty, which is not fundamentally changed by this executive transition.

Of recent announcements, the next-generation UiPath Platform launch on April 30 stands out. This release aligns closely with the short-term catalyst of deepening customer engagement and furthering adoption, providing the foundation for Atalla’s marketing team to amplify platform messaging and performance as demand generation becomes increasingly critical.

However, investors should not overlook the persistent risk of deal delays and cautious customer spending, as these may...

Read the full narrative on UiPath (it's free!)

UiPath's narrative projects $1.9 billion revenue and $242.3 million earnings by 2028. This requires 8.6% yearly revenue growth and a $309.8 million increase in earnings from -$67.5 million today.

Uncover how UiPath's forecasts yield a $14.15 fair value, a 30% upside to its current price.

Exploring Other Perspectives

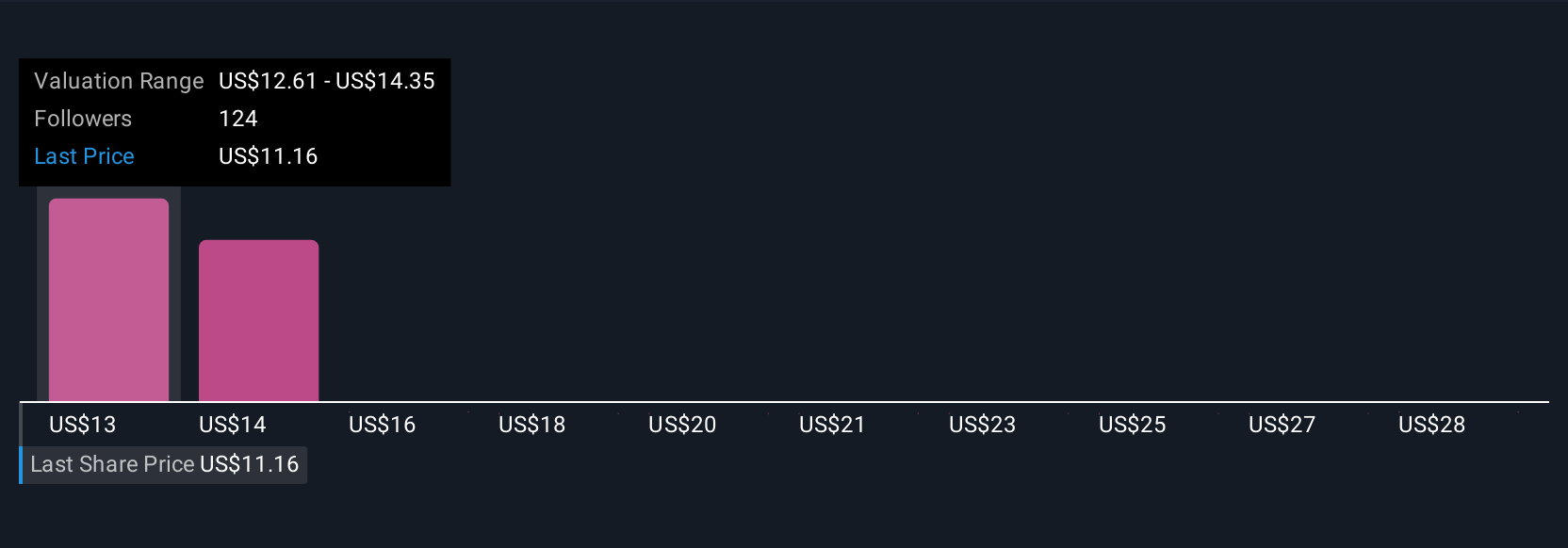

Fair value estimates from nine Simply Wall St Community members range from US$12.61 to US$30 per share. Your outlook on customer adoption and macro volatility could lead you to a very different conclusion than consensus, explore several perspectives to inform your view.

Explore 9 other fair value estimates on UiPath - why the stock might be worth over 2x more than the current price!

Build Your Own UiPath Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your UiPath research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free UiPath research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate UiPath's overall financial health at a glance.

Want Some Alternatives?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PATH

UiPath

Provides an end-to-end automation platform that offers a range of robotic process automation (RPA) solutions primarily in the United States, Romania, the United Kingdom, the Netherlands, and internationally.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives