- United States

- /

- Software

- /

- NYSE:ORCL

How the $381B AI Cloud Deal Is Shaping Oracle’s 2025 Valuation

Reviewed by Bailey Pemberton

If you have Oracle stock on your watchlist, you are definitely not alone. The stock’s recent moves have given investors plenty to talk about, with an eye-popping year-to-date run of 85.5% and a three-year return of 377%. In just the past week, Oracle shares climbed another 5.6%, reflecting not just broad tech momentum, but also shifting optimism around AI and cloud infrastructure.

A big part of the excitement stems from Oracle’s push into renting out powerful cloud servers for artificial intelligence work, including deals with OpenAI and other high-demand clients. It is no surprise the company has become this year’s best-performing megacap stock. However, Oracle faces some challenges too, from cybersecurity events like the E-Business Suite extortion campaign to the competitive landscape around cloud and AI hardware, especially as U.S. tech supply chains respond to policy changes such as the recent approval for Nvidia chip exports to the UAE.

With all these headlines, what’s the real story behind Oracle’s valuation? According to a standard checklist, the company scores 1 out of 6 on undervaluation signals, hardly a slam dunk for bargain hunters. But there is more nuance than those numbers might suggest. Let’s dig into the most common valuation methods investors use, and at the end, I will share an even sharper lens for understanding what Oracle might really be worth today.

Oracle scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Oracle Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates what a business is worth based on its projected future cash flows, which are then discounted back to their present value. In Oracle’s case, analysts start with the company’s current Free Cash Flow, which sits at $5.8 Billion, and build forward using growth forecasts.

For Oracle, the FCF projections show sharp variability over the next decade. The outlook moves from negative FCF in the mid-2020s, with figures like -$9.8 Billion in 2026 and -$10.5 Billion in 2027. The projections then rebound to positive cash flow, peaking at $24.99 Billion by 2030. Only five years of estimates come directly from analysts, with the rest extrapolated to offer a longer-term perspective. All these cash flows are discounted back to provide the intrinsic value.

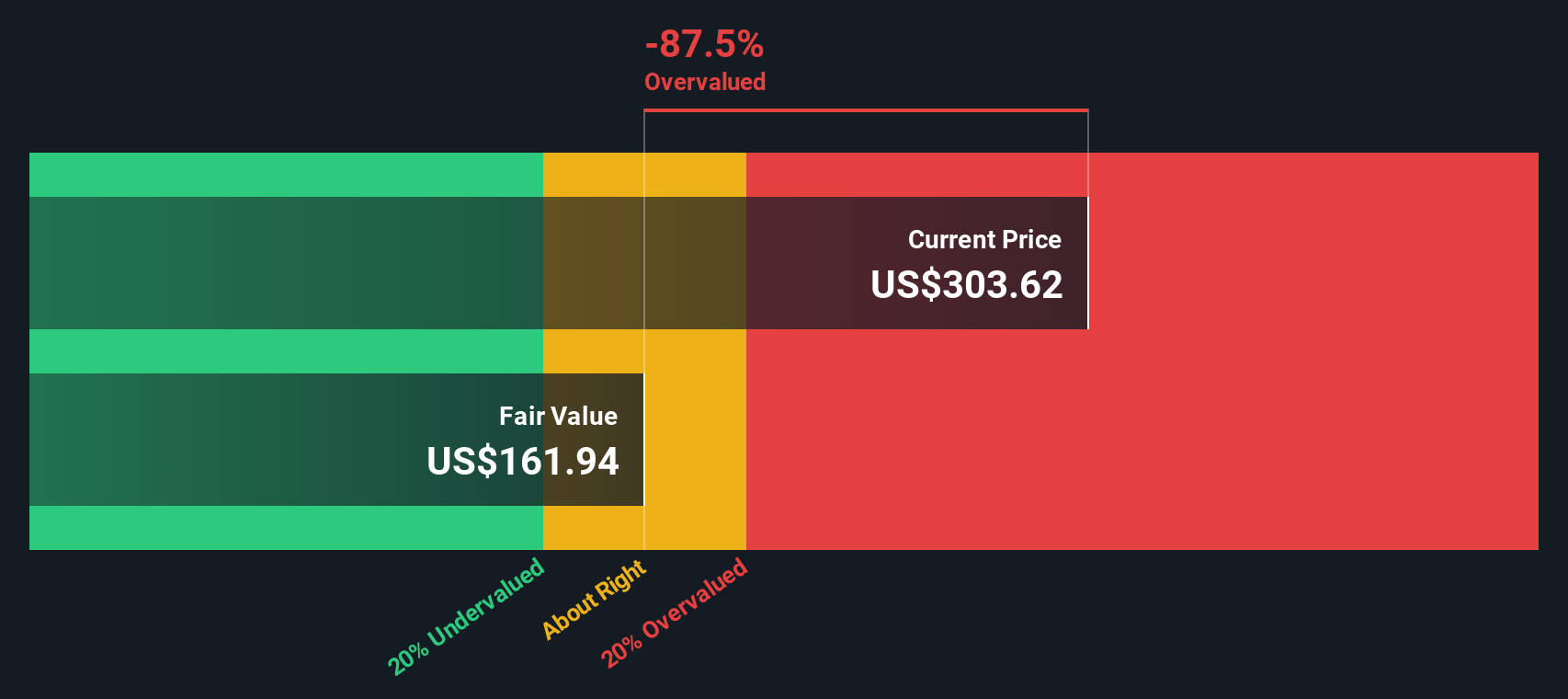

By this DCF approach, Oracle’s estimated fair value is $161.86 per share. However, the model shows the stock is trading at a premium, with a negative discount of -90.3%. This indicates it is overvalued by a wide margin compared to this model’s estimate.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Oracle may be overvalued by 90.3%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Oracle Price vs Earnings (PE Ratio)

The Price-to-Earnings (PE) ratio is a widely used valuation tool for established, profitable companies like Oracle because it connects a company’s market price directly to its earnings power. For investors, a “normal” or “fair” PE ratio depends on not just current profit, but also forward-looking factors such as how quickly the company is expected to grow and the risks it faces. Higher growth potential can justify a higher PE, while elevated risks might result in a lower PE ratio.

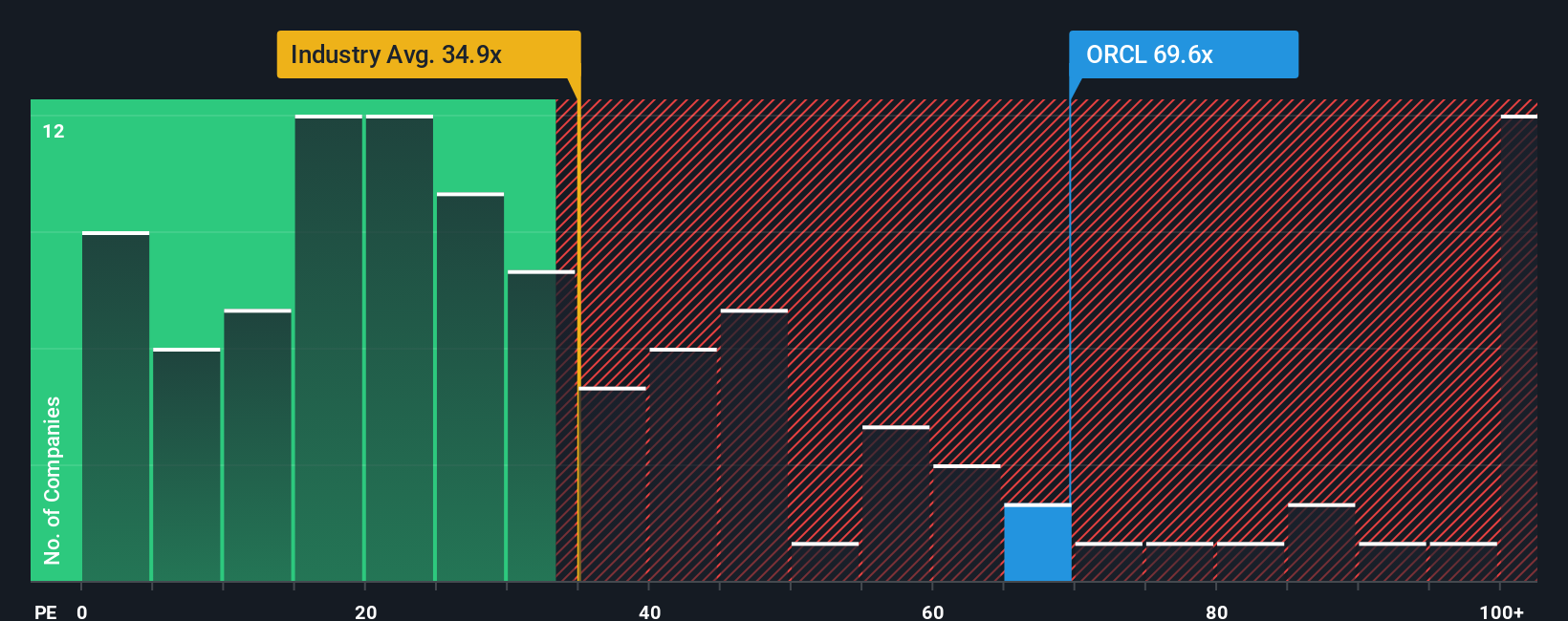

Currently, Oracle trades at a PE ratio of 70.58x, which is notably higher than the Software industry average of 34.85x and its peer group’s average of 78.38x. The Simply Wall St “Fair Ratio” for Oracle is calculated at 62.67x, taking into account the company’s specific growth outlook, business risks, margins, and its considerable scale in the market. This Fair Ratio offers a more tailored assessment than a basic comparison with the industry or peers, providing a relevant perspective on Oracle’s unique position.

Comparing the current PE ratio of 70.58x to the tailored Fair Ratio of 62.67x, Oracle’s shares appear to be trading at a premium, though the gap is not substantial. The stock is slightly overvalued by this metric, but not to an extreme degree.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Oracle Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is an investment tool that helps you bring together your view of a company’s story, such as how you think Oracle will win in the market, with a simple set of assumptions about future revenue, profit margins, risk, and ultimately fair value.

Narratives bridge the gap between financial models and real-world company drivers by linking your perspective. For example, you might believe "Oracle will lead in AI-powered cloud for global enterprises" or “competitive pressure and high spending will cap growth,” and these perspectives can be connected directly to an up-to-date valuation and forecast. On Simply Wall St’s Community page, millions of investors use Narratives to make sense of fast-changing companies, update their outlooks with new information, and see in real time whether their story suggests “Buy,” “Hold,” or “Sell” as prices move.

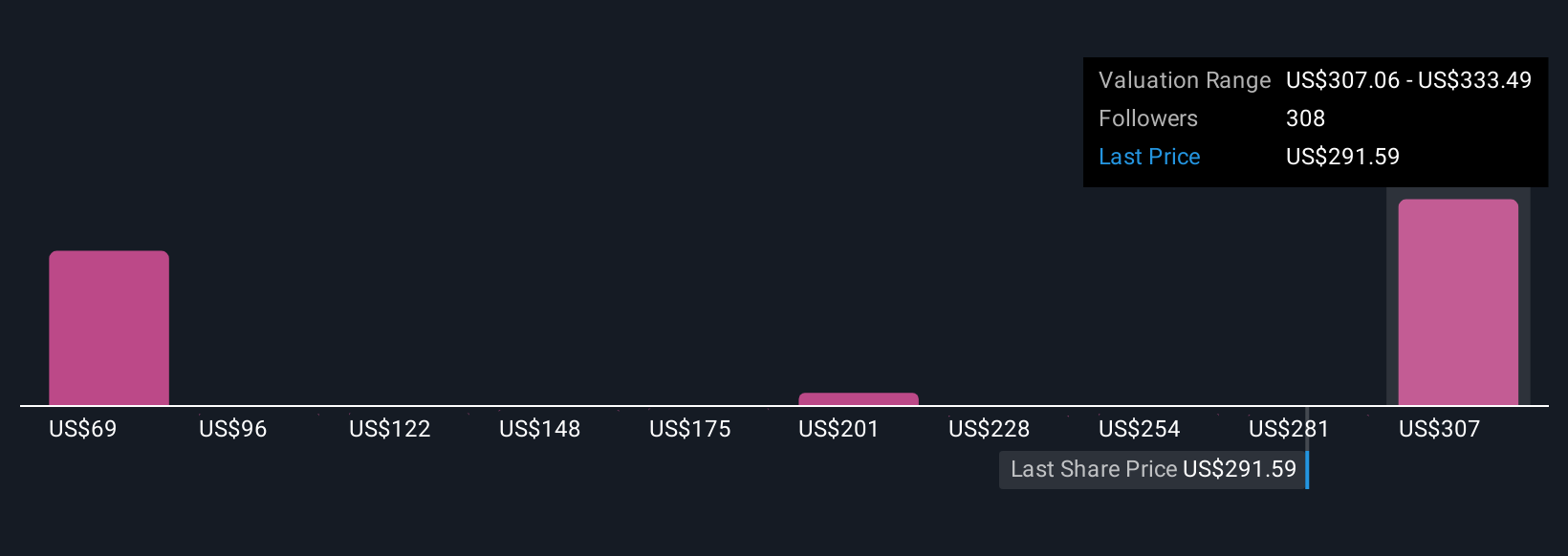

For example, some investors currently see Oracle’s fair value as high as $333 per share, driven by record-breaking AI contracts and rapid cloud expansion. Others forecast a much more conservative $183 per share if growth stalls or margins shrink. This demonstrates how a Narrative helps you translate your beliefs into actionable investment decisions, instantly updated as new facts emerge.

For Oracle, however, we will make it really easy for you with previews of two leading Oracle Narratives:

🐂 Oracle Bull CaseFair Value: $333.49

Current Price Difference: -7.6% (undervalued)

Revenue Growth Rate: 29.9%

- Oracle’s unique cloud and AI offerings are fueling accelerated enterprise adoption, with rapid revenue growth and margin expansion supported by high-value contracts like OpenAI.

- Analysts forecast ongoing double-digit revenue and earnings growth, with profit margins climbing and Oracle maintaining strong market positioning through differentiated AI products.

- Risks include heavy dependence on continued AI demand, elevated CapEx, and potential margin pressure if competitor investments outpace Oracle’s innovation or efficiency.

Fair Value: $212.00

Current Price Difference: 45.2% (overvalued)

Revenue Growth Rate: 14.4%

- Oracle is transforming into a cloud-first, AI-driven enterprise IT leader, but faces intense competition from AWS, Microsoft Azure, and Google Cloud.

- The company’s leveraged balance sheet and scaling challenges could limit its ability to maintain recent growth rates, especially if economic conditions soften or execution falters.

- Investment appeal hinges on Oracle’s ability to boost cloud revenue, successfully integrate AI, and improve margins. Otherwise, current valuation may be hard to justify.

Do you think there's more to the story for Oracle? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ORCL

Oracle

Offers products and services that address enterprise information technology environments worldwide.

Exceptional growth potential with proven track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion