- United States

- /

- Software

- /

- NYSE:ORCL

Exploring 3 High Growth Tech Stocks In The US Market

Reviewed by Simply Wall St

The United States market has shown a positive trajectory, climbing 2.9% in the last week and up 14% over the past year, with earnings anticipated to grow by 15% annually in the coming years. In this context of robust market performance, identifying high growth tech stocks involves looking for companies that demonstrate strong potential for revenue expansion and innovation within this dynamic sector.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 24.99% | 39.09% | ★★★★★★ |

| Circle Internet Group | 32.27% | 61.44% | ★★★★★★ |

| Mereo BioPharma Group | 50.84% | 58.22% | ★★★★★★ |

| Ardelyx | 21.02% | 61.29% | ★★★★★★ |

| TG Therapeutics | 26.46% | 38.75% | ★★★★★★ |

| AVITA Medical | 27.42% | 61.04% | ★★★★★★ |

| Alnylam Pharmaceuticals | 23.72% | 59.95% | ★★★★★★ |

| Alkami Technology | 20.53% | 76.67% | ★★★★★★ |

| Ascendis Pharma | 35.07% | 59.92% | ★★★★★★ |

| Lumentum Holdings | 23.02% | 103.97% | ★★★★★★ |

Click here to see the full list of 225 stocks from our US High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Seagate Technology Holdings (STX)

Simply Wall St Growth Rating: ★★★★☆☆

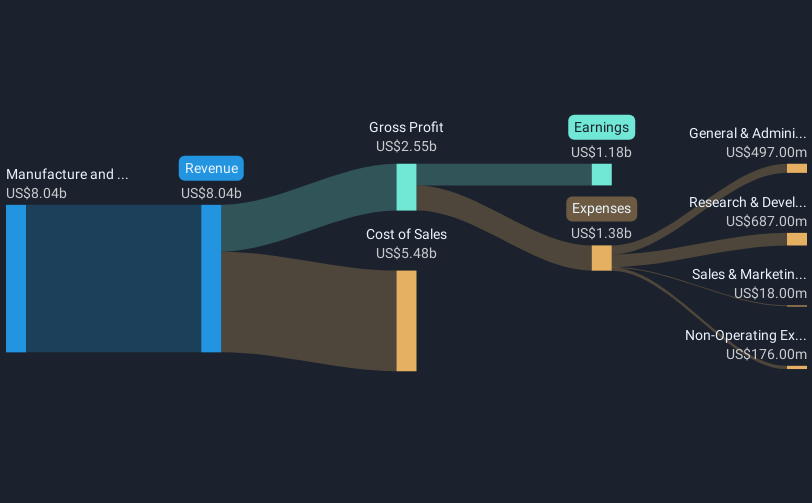

Overview: Seagate Technology Holdings plc is a global company that provides data storage technology and infrastructure solutions, operating in Singapore, the United States, the Netherlands, and other international markets with a market cap of approximately $30.78 billion.

Operations: Seagate Technology Holdings focuses on manufacturing and distributing storage solutions, generating revenue of $8.54 billion. The company's operations span multiple international markets, emphasizing its role in the global data storage industry.

Seagate Technology Holdings has demonstrated a robust financial performance with a significant uptick in quarterly sales from $1.65 billion to $2.16 billion and a surge in net income from $25 million to $340 million year-over-year. This growth is complemented by an ambitious expansion of its share repurchase program, now totaling $12.3 billion, underscoring strong confidence in its financial health and future prospects. Moreover, the company's recent strategic debt restructuring initiatives further streamline operations, potentially enhancing future earnings capabilities which are projected to outpace the broader U.S market with an annual growth rate of 15%. These maneuvers not only reflect Seagate’s proactive approach in fortifying its balance sheet but also highlight its adaptability in a dynamic tech landscape, promising continued relevance and competitive edge.

AbbVie (ABBV)

Simply Wall St Growth Rating: ★★★★☆☆

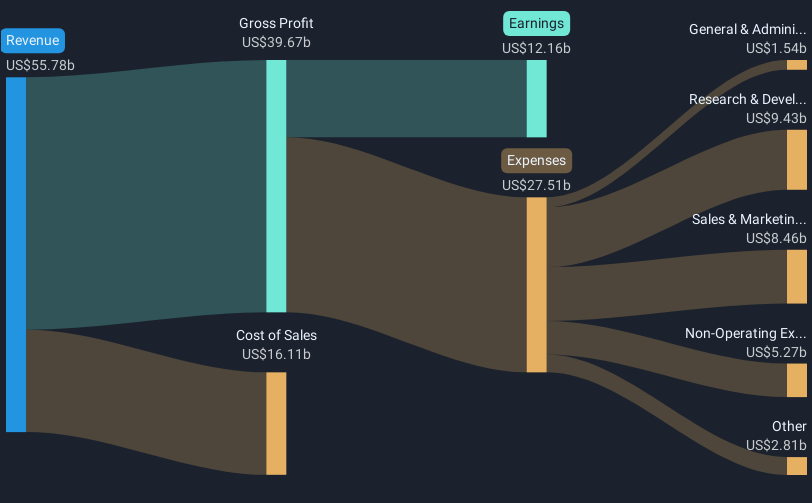

Overview: AbbVie Inc. is a research-based biopharmaceutical company involved in the global research, development, manufacture, commercialization, and sale of medicines and therapies with a market cap of $327.88 billion.

Operations: AbbVie focuses on the global research, development, and sale of innovative medicines and therapies, generating $57.37 billion in revenue from this segment.

Despite recent setbacks, including its removal from multiple Russell indexes, AbbVie remains a formidable player in the biopharmaceutical sector. The company's commitment to innovation is underscored by significant R&D investments, which have led to promising developments such as atogepant for migraine prevention. This focus on high-value therapeutic areas is complemented by a robust dividend payout, evidenced by the recent affirmation of a $1.64 per share quarterly dividend. Moreover, AbbVie's strategic alliances and continuous product pipeline advancements reflect its proactive approach in addressing complex medical needs and sustaining growth amidst industry challenges.

Oracle (ORCL)

Simply Wall St Growth Rating: ★★★★☆☆

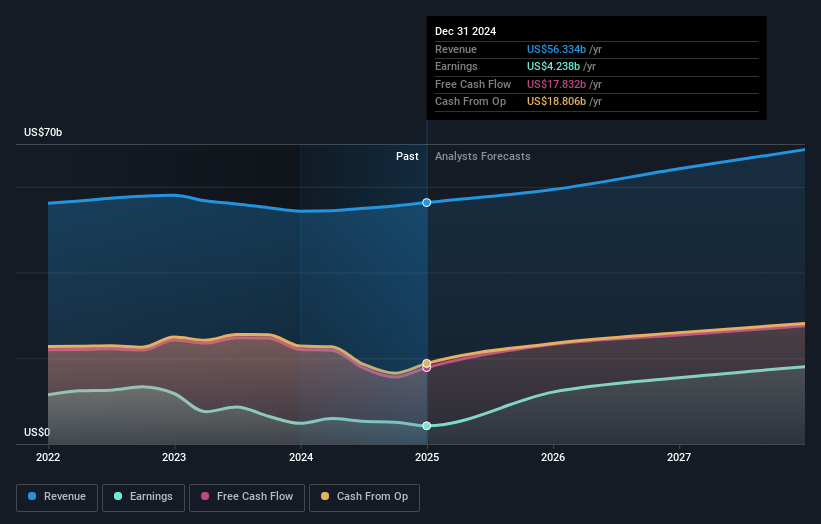

Overview: Oracle Corporation provides a range of products and services designed for enterprise information technology environments globally, with a market capitalization of $614.10 billion.

Operations: The company generates revenue primarily from its Cloud and License segment, which accounts for $49.23 billion, followed by Services at $5.23 billion and Hardware at $2.94 billion. The focus on cloud solutions is a significant contributor to its financial performance within the enterprise IT sector.

Oracle's recent strategic moves underscore its commitment to expanding its cloud and AI capabilities, crucial for sustaining growth in the high-tech sector. With a 14% annual revenue increase and a 16.6% rise in earnings, Oracle is leveraging these gains to enhance its product offerings significantly. The launch of new cloud services for trade finance and supply chain management illustrates Oracle's focus on automating and streamlining banking operations globally, addressing a $2.5 trillion finance gap as reported by the Asian Development Bank. These innovations not only boost operational efficiency for banks but also improve customer experiences through digital transformations that enable faster transaction processing and enhanced regulatory compliance. This strategy reflects Oracle's adept adaptation to market needs, driving forward its financial technology segment amidst evolving global trade dynamics.

- Dive into the specifics of Oracle here with our thorough health report.

Examine Oracle's past performance report to understand how it has performed in the past.

Make It Happen

- Click this link to deep-dive into the 225 companies within our US High Growth Tech and AI Stocks screener.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ORCL

Oracle

Offers products and services that address enterprise information technology environments worldwide.

Solid track record with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives