- United States

- /

- Software

- /

- NYSE:ORCL

Could Oracle’s (ORCL) Supercomputer Ambitions Redefine Its Competitive Edge in AI and Fintech?

- Oracle, alongside NVIDIA and Argonne National Laboratory, announced a collaboration with the U.S. Department of Energy to deliver the nation’s largest AI supercomputer, while Oracle also unveiled its upcoming Digital Assets Data Nexus platform for digital asset management in banking and finance.

- These initiatives highlight Oracle’s rapid advancement in AI infrastructure and blockchain, underscoring its expanding influence across both scientific research and financial technology ecosystems.

- We'll explore how Oracle's leadership in the U.S. Department of Energy AI supercomputer project could impact its investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Oracle Investment Narrative Recap

To be a shareholder in Oracle today, you need conviction that the surge in AI infrastructure demand, driving huge long-term contracts and cloud revenue acceleration, will remain strong enough to sustain Oracle's rapid growth ambitions and justify ongoing high capital spending. The recent U.S. Department of Energy AI supercomputer partnership highlights Oracle's relevance in major scientific and enterprise AI projects, but as the company relies increasingly on a handful of massive AI clients, any slowdown or shift in spending could materially affect the current growth narrative; for now, the announcement mainly strengthens the AI demand catalyst and does not sharply alter the most important risk, which remains customer concentration and CapEx exposure.

Among recent developments, Oracle’s launch of the Digital Assets Data Nexus platform stands out as it broadens Oracle’s appeal to financial institutions navigating digital transformation. While this product expansion could help diversify Oracle’s sources of cloud revenue, the key catalysts continue to revolve around converting its AI infrastructure commitments and backlog into profitable growth.

Yet, in stark contrast to Oracle’s optimism, investors should be mindful of the risks associated with...

Read the full narrative on Oracle (it's free!)

Oracle's outlook anticipates revenues reaching $99.5 billion and earnings rising to $25.3 billion by 2028. This scenario implies a 20.1% annual revenue growth rate and a $12.9 billion increase in earnings from the current $12.4 billion.

Uncover how Oracle's forecasts yield a $344.07 fair value, a 34% upside to its current price.

Exploring Other Perspectives

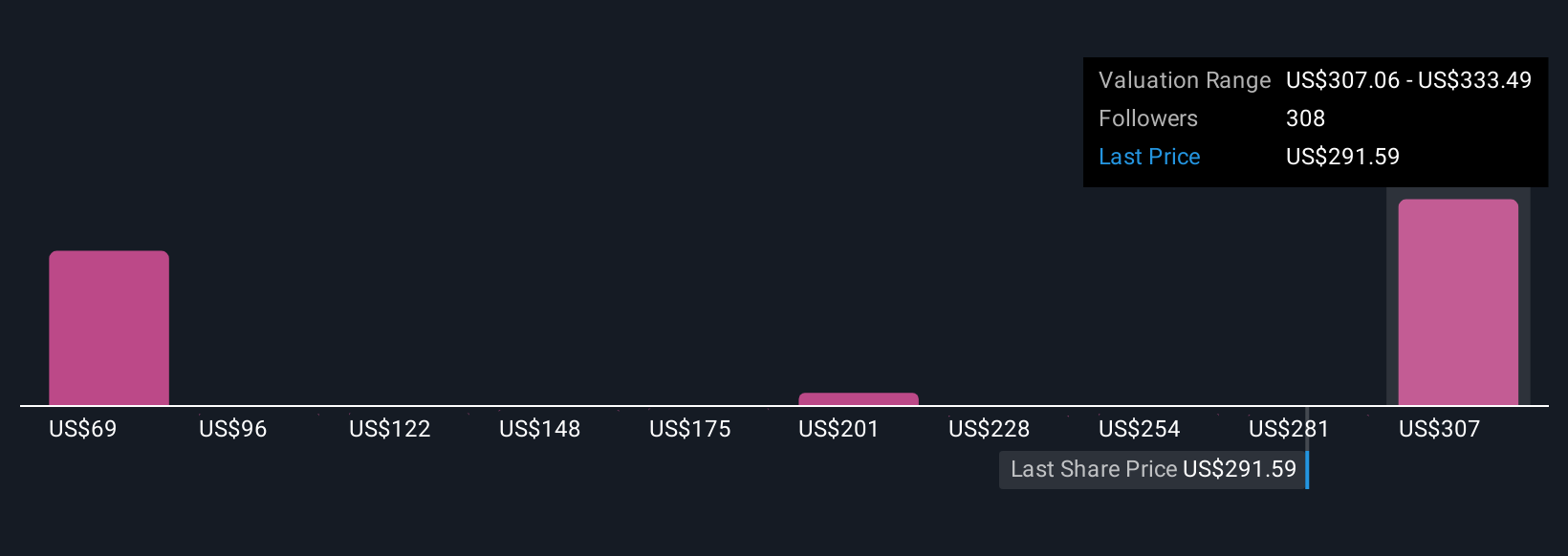

Across 25 fair value estimates from the Simply Wall St Community, opinions range from US$170.68 to US$344.07 per share. With investor sentiment split, the discussion sharpens around Oracle’s reliance on concentrated AI infrastructure contracts and whether such exposure could impact future financial resilience.

Explore 25 other fair value estimates on Oracle - why the stock might be worth as much as 34% more than the current price!

Build Your Own Oracle Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Oracle research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Oracle research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Oracle's overall financial health at a glance.

Curious About Other Options?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ORCL

Oracle

Offers products and services that address enterprise information technology environments worldwide.

Exceptional growth potential with proven track record.

Similar Companies

Market Insights

Weekly Picks

The Future of Social Sharing Is Private and People Are Ready

EU#3 - From Philips Management Buyout to Europe’s Biggest Company

Booking Holdings: Why Ground-Level Travel Trends Still Favor the Platform Giants

A fully integrated LNG business seems to be ignored by the market.

Recently Updated Narratives

Sunny Returns with On the Beach

High Quality Business and a true compounding machine

Roche Holding AG To Benefit From Strong Drug Pipeline In 2027 And Beyond

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

AGAG still in exploration, in bull market, such company will be the last to participate. It's high risk but can results in 20-30 baggers potential. The best play with current bull are with producers or near-producer miners, you can get 5-10 baggers with much lower risk. See my analysis on santacruz silver, andean silver.