- United States

- /

- Software

- /

- NYSE:ORCL

39% Growth for Infrastructure Cloud in the Latest Report - Why Oracle (NYSE:ORCL) Investors are Turning Bullish

Summary:

- Revenue grew by 5% while EPS declined 47% to $2.41 for the full FY 2022.

- Analysts are placing some hope on the new MySQL HeatWave service as a growth catalyst.

- Our intrinsic value model estimates that the stock may be 40% undervalued.

Oracle Corporation (NYSE:ORCL) released the latest Q4 earnings yesterday, and we will evaluate the implications for the intrinsic value of the company. The market has become increasingly cautious after the recent drop, and investors are prioritizing companies with current rather than future earnings.

Investors that have Oracle in their portfolio are bullish on the future of database and enterprise cloud technologies. While oracle is not a new player, the technology is constantly improving and has a tangible cost-cutting and efficacy implications for companies.

View our latest analysis for Oracle

Oracle is not the only one in this arena, and competitors are constantly looking for ways to improve their services and make clients stick. Some of the most notable peers in the Enterprise Resource Planning (ERP) cloud segment are:

- Microsoft (NASDAQ:MSFT) with MS Dynamics. The company's pitch is that Dynamics easily integrates with Office and Azure, giving clients a smooth execution across multiple systems.

- SAP (XTRA:SAP) is a feature-rich ERP software, focused on large and mature companies.

- Salesforce (NYSE:CRM) is centered around growing businesses, and their system is meant to support the sales process, by making it easier for a company's salesforce to manage relationships with leads and clients. It does not have all the features of a full ERP system, but is constantly expanding their service palette.

- Notable mentions: Snowflake (NYSE:SNOW), Intuit (NASDAQ:INTU), Palantir (NYSE:PLTR), Sage Group (LSE:SGE)

Investors that are unsure about which company will emerge as a market leader and as a company with a dedication to shareholders, can always diversify some risk by looking at multiple peers in this space.

Next, we will review the earnings report of the company.

Earnings Performance

The key highlights in the latest quarterly earnings were:

- Revenue at $11.8b, up 5% from a year ago, with the Cloud license and on-premise license accounting for most of the rise.

- Operating margin, slightly lower at 38%, vs 40% a year ago. The company's increase in R&D and Sales expenses accounts for some of the drop.

- The net quarterly margin came at 27% vs the 36% a year ago - Oracle booked a larger ($435m) tax expense and a non-operating expense of $175m, which accounts for most of the change in the bottom line.

- GAAP diluted EPS came at $1.16 vs 1.37 a year ago. The company beat analyst's expectation by 12.4% on a basic basis (not diluted).

For the full 2022 fiscal year, Oracle made $42.4b in revenue, up 5% YoY. Net income of $6.7b with an EPS of $2.41. Management emphasized that they experienced an increased demand in Q4 for their infrastructure cloud business—which grew 39% in constant currency.

While management didn't provide explicit guidance, they remarket that Oracle is entering a hyper revenue growth phase, and that we can expect multiple quarters of growth. Analysts are setting their sights on the new MySQL HeatWave service that is claimed to be faster and cheaper than peers such as Snowflake, Amazon Redshift with AQUA, and Amazon Aurora. If the Oracle team do manage to surpass expectations, they may enter the scene as the fourth major cloud service provider.

Now let's see what this means for the stock's valuation.

Valuation

Finally, after this week's market volatility, it is important to make sure that we are not overpaying for a stock. One way to estimate if the price justifies the expected performance of a company is to use an intrinsic valuation (DCF model). We use a general model, but it's good enough to get a rough estimate for the company's cash generating capacity.

Our DCF model utilizes a combination of analysts' estimates and some assumptions to derive the intrinsic value of Oracle.

We start off by forecasting the cash flows for the next 10 years:

10-year free cash flow (FCF) forecast

| 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | |

| Levered FCF ($, Millions) | US$7.12b | US$18.0b | US$18.1b | US$17.9b | US$17.8b | US$17.8b | US$18.0b | US$18.2b | US$18.4b | US$18.7b |

| Growth Rate Estimate Source | Analyst x16 | Analyst x1 | Analyst x1 | Analyst x1 | Analyst x1 | Est @ 0.26% | Est @ 0.76% | Est @ 1.11% | Est @ 1.35% | Est @ 1.52% |

| Present Value ($, Millions) Discounted @ 7.2% | US$6.6k | US$15.7k | US$14.7k | US$13.5k | US$12.6k | US$11.7k | US$11.0k | US$10.4k | US$9.8k | US$9.3k |

("Est" = FCF growth rate estimated by Simply Wall St)

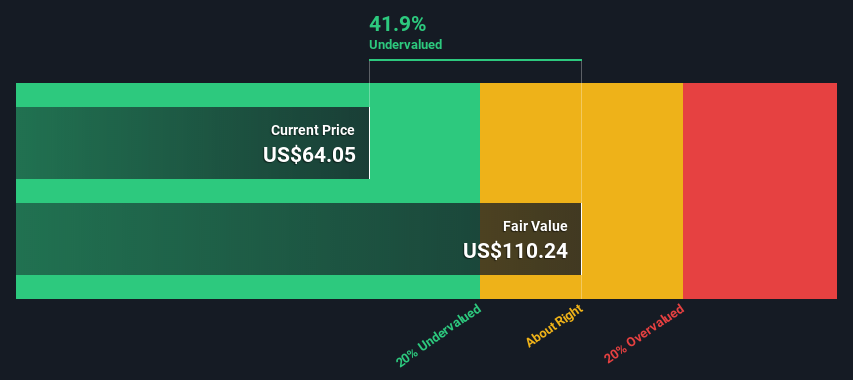

This results in a present value of 10-year Cash Flow (PVCF) = $115b and a present terminal value at $179b. In total, the company intrinsic value comes up to $294b, or $110 per share. Which is some 40% undervalued compared to the latest close.

Conclusion

Oracle experienced a drop in the net margin, but analysts are optimistic on the innovation and growth provided by their new MySQL HeatWave service. The value also reflected the optimism for future growth, and our DCF yielded an intrinsic value of $110 per share.

Investors that are optimistic on the future of ERP and cloud services can build a mix of multiple companies, rather than relying on one stock, which carries more risk by itself.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Goran Damchevski

Goran is an Equity Analyst and Writer at Simply Wall St with over 5 years of experience in financial analysis and company research. Goran previously worked in a seed-stage startup as a capital markets research analyst and product lead and developed a financial data platform for equity investors.

About NYSE:ORCL

Oracle

Offers products and services that address enterprise information technology environments worldwide.

Exceptional growth potential with proven track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion