- United States

- /

- Software

- /

- NYSE:ONTF

Insiders who placed huge bets on ON24, Inc. (NYSE:ONTF) earlier this year would be disappointed with the 13% drop

The recent 13% drop in ON24, Inc.'s (NYSE:ONTF) stock could come as a blow to insiders who purchased US$1.8m worth of stock at an average buy price of US$20.29 over the past 12 months. Insiders purchase with the hope of seeing their investments increase in value over time. However, due to recent losses, their initial investment is now only worth US$1.0m, which is not great.

While we would never suggest that investors should base their decisions solely on what the directors of a company have been doing, we would consider it foolish to ignore insider transactions altogether.

View our latest analysis for ON24

ON24 Insider Transactions Over The Last Year

Over the last year, we can see that the biggest insider purchase was by Founder Sharat Sharan for US$520k worth of shares, at about US$22.12 per share. That means that an insider was happy to buy shares at above the current price of US$11.49. It's very possible they regret the purchase, but it's more likely they are bullish about the company. In our view, the price an insider pays for shares is very important. It is generally more encouraging if they paid above the current price, as it suggests they saw value, even at higher levels.

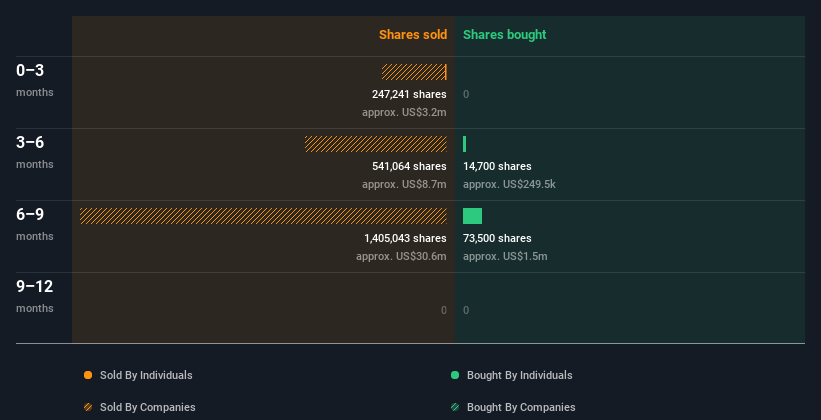

In the last twelve months insiders purchased 88.20k shares for US$1.8m. But insiders sold 5.70k shares worth US$76k. In total, ON24 insiders bought more than they sold over the last year. You can see the insider transactions (by companies and individuals) over the last year depicted in the chart below. If you want to know exactly who sold, for how much, and when, simply click on the graph below!

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Insiders at ON24 Have Sold Stock Recently

Over the last three months, we've seen significant insider selling at ON24. In total, insiders sold US$76k worth of shares in that time, and we didn't record any purchases whatsoever. Overall this makes us a bit cautious, but it's not the be all and end all.

Insider Ownership of ON24

Many investors like to check how much of a company is owned by insiders. We usually like to see fairly high levels of insider ownership. It appears that ON24 insiders own 8.5% of the company, worth about US$49m. While this is a strong but not outstanding level of insider ownership, it's enough to indicate some alignment between management and smaller shareholders.

What Might The Insider Transactions At ON24 Tell Us?

Insiders sold stock recently, but they haven't been buying. In contrast, they appear keener if you look at the last twelve months. We like that insiders own a fair amount of the company. So the recent selling doesn't worry us too much. In addition to knowing about insider transactions going on, it's beneficial to identify the risks facing ON24. For instance, we've identified 5 warning signs for ON24 (1 makes us a bit uncomfortable) you should be aware of.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:ONTF

ON24

Provides a cloud-based intelligent engagement platform that offers interactive and personalized digital experience products to create and capture data from professionals to provide businesses with buying signals and behavioral insights to convert prospects into customers worldwide.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Positioned to Win as the Streaming Wars Settle

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion