- United States

- /

- Software

- /

- NYSE:NOW

ServiceNow (NYSE:NOW) Partners With SAIC for Government Risk Reduction Initiative

Reviewed by Simply Wall St

ServiceNow (NYSE:NOW) has experienced significant portfolio-strengthening developments, highlighted by its recent collaboration with SAIC to enhance IT risk management for U.S. agencies. This partnership marks a pivotal move in ServiceNow's push for enhanced operational resilience through AI integration. Over the last quarter, the company saw its share price climb by an impressive 44%, a move highlighted by broader market gains. While the S&P 500 and Nasdaq closed at record highs during three of the past four sessions, ServiceNow's share price surge was also buoyed by solid Q1 results and product advancements, establishing a strong market position amidst a rising tech sector.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

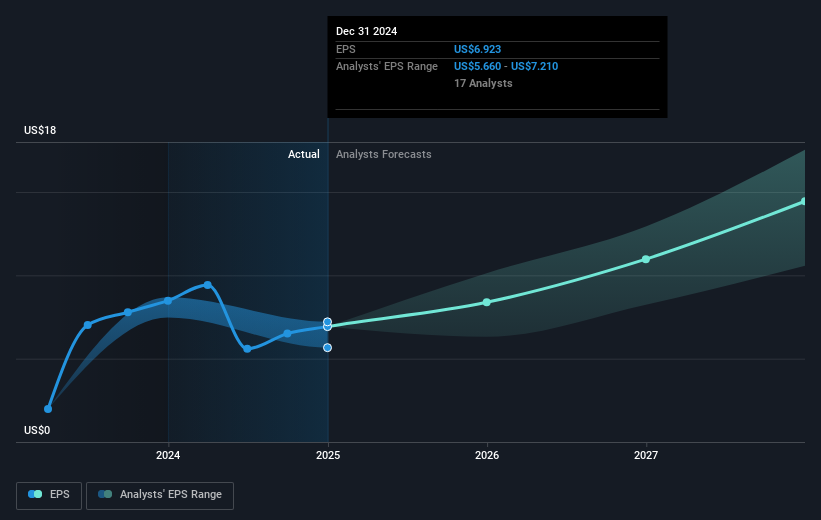

ServiceNow's recent partnership with SAIC could reinforce its competitive positioning, providing a medium for expanding its AI solutions. This move might positively influence its long-term revenue and earnings, despite a temporary slowdown due to the hybrid pricing model. While Q1 results and product advancements have supported its short-term share price, the company's total returns over five years, including dividends, stood at 159.96%. This reflects a strong longer-term performance, significantly exceeding typical market returns.

Over the past year, ServiceNow's stock performance outpaced the US Software industry, which returned 17.8%, indicating its robust market presence. However, as the focus shifts toward AI integration, ServiceNow faces challenges with net margin pressures and revenue headwinds from geopolitical and currency fluctuations. Analysts' price targets provide mixed insights, with the current share price of US$812.7 sitting at a 4.51% discount from the consensus target of approximately US$1,091.82. This represents a crucial juxtaposition, inviting stakeholders to weigh short-term fluctuations against potential long-term benefits.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NOW

ServiceNow

Provides cloud-based solution for digital workflows in the North America, Europe, the Middle East and Africa, Asia Pacific, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)