- United States

- /

- Software

- /

- NYSE:NOW

Could ServiceNow's (NOW) Staffbase Integration Reveal Its Next Move in Enterprise Workflow Dominance?

Reviewed by Simply Wall St

- Earlier this month, Staffbase announced a product integration with ServiceNow to bring ServiceNow’s digital workflows and AI capabilities directly into Staffbase’s mobile-first communications platform, further improving accessibility and engagement for all employees, including frontline and non-desk workers.

- This collaboration not only bridges potential gaps between digital systems and workforce adoption but also supports greater ServiceNow workflow adoption, workflow resolution speed, and returns on digital investments.

- We'll explore how integrating ServiceNow’s AI-powered workflows into employee communications signals broader enterprise adoption and new growth opportunities.

Find companies with promising cash flow potential yet trading below their fair value.

ServiceNow Investment Narrative Recap

To be a shareholder in ServiceNow, you need to believe in the company’s central role in automating enterprise digital workflows, powered by AI integration across a wide range of industries. The recent Staffbase partnership reinforces ServiceNow's commitment to broader user adoption, but does not materially alter the most important short-term catalyst: strong subscription revenue growth from expanding AI-based capabilities. The biggest risk remains execution challenges in new workflows and CRM markets, as competition and integration demands could affect profitability.

Among the previous announcements, the July launch of Agentic Workforce Management stands out as highly relevant here. It complements the Staffbase integration by focusing on AI and employee collaboration, aimed at increasing operational efficiency. Both moves align with ServiceNow’s push into broader enterprise markets using AI, supporting the subscription momentum that underpins current growth expectations.

In contrast, investors should be aware that integration and adoption challenges could impact earnings visibility if customers...

Read the full narrative on ServiceNow (it's free!)

ServiceNow's narrative projects $20.3 billion in revenue and $3.3 billion in earnings by 2028. This requires 18.9% annual revenue growth and a $1.6 billion earnings increase from the current $1.7 billion level.

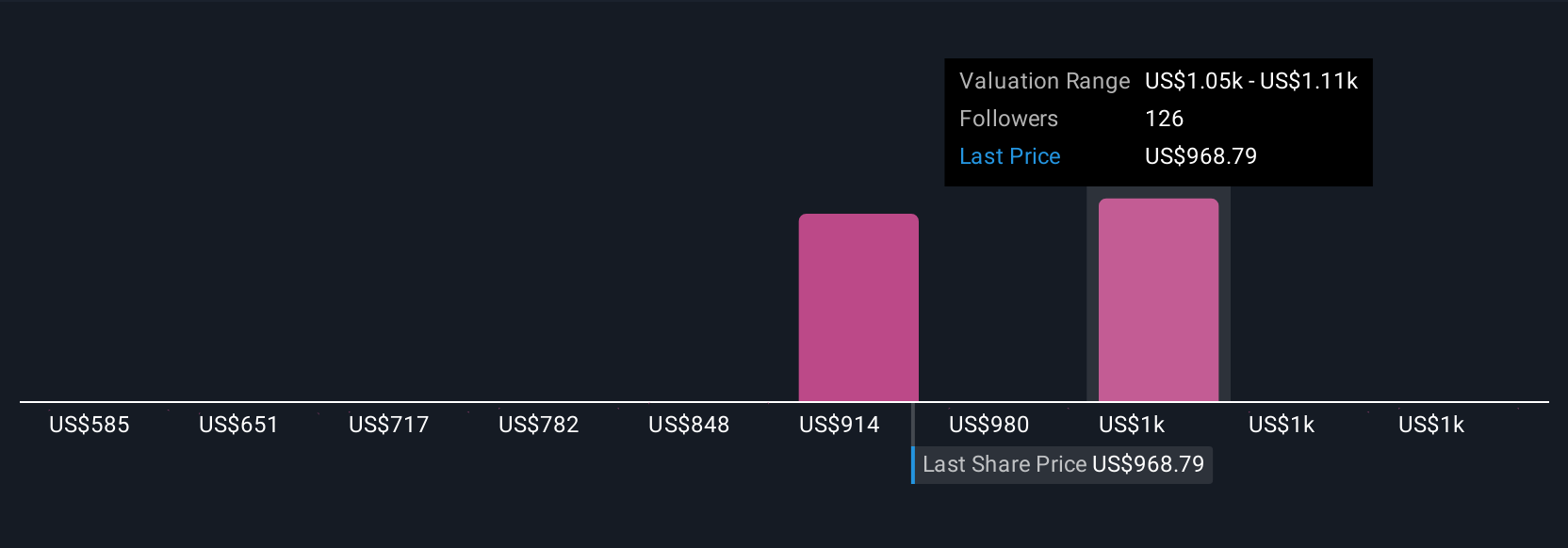

Uncover how ServiceNow's forecasts yield a $1149 fair value, a 33% upside to its current price.

Exploring Other Perspectives

Some analysts with the lowest estimates forecasted that ServiceNow’s annual revenue may reach only US$17.8 billion by 2028, with profit margins slightly shrinking. They see risks if hybrid pricing and AI adoption slow short-term growth. Your view may differ, so it’s useful to consider these more pessimistic perspectives as the latest news could shift expectations for both risks and opportunities.

Explore 15 other fair value estimates on ServiceNow - why the stock might be worth 36% less than the current price!

Build Your Own ServiceNow Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ServiceNow research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free ServiceNow research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ServiceNow's overall financial health at a glance.

No Opportunity In ServiceNow?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 27 companies in the world exploring or producing it. Find the list for free.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Outshine the giants: these 18 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NOW

ServiceNow

Provides cloud-based solution for digital workflows in the North America, Europe, the Middle East and Africa, Asia Pacific, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)