- United States

- /

- IT

- /

- NYSE:NET

High Growth Tech Stocks To Watch In US March 2025

Reviewed by Simply Wall St

The United States market has experienced a positive trend, rising 2.8% in the last week and climbing 7.6% over the past year, with all sectors showing gains and earnings projected to grow by 14% annually. In this favorable environment, identifying high growth tech stocks involves looking for companies that demonstrate strong potential for innovation and expansion within this dynamic sector.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| TG Therapeutics | 26.18% | 37.61% | ★★★★★★ |

| Alkami Technology | 20.45% | 85.16% | ★★★★★★ |

| Travere Therapeutics | 28.43% | 65.01% | ★★★★★★ |

| Clene | 61.16% | 59.11% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.82% | 58.64% | ★★★★★★ |

| AVITA Medical | 27.75% | 55.36% | ★★★★★★ |

| Alvotech | 31.17% | 100.18% | ★★★★★★ |

| TKO Group Holdings | 22.54% | 25.17% | ★★★★★★ |

| Lumentum Holdings | 21.55% | 119.67% | ★★★★★★ |

| Ascendis Pharma | 32.36% | 59.79% | ★★★★★★ |

Click here to see the full list of 240 stocks from our US High Growth Tech and AI Stocks screener.

Here's a peek at a few of the choices from the screener.

Jabil (NYSE:JBL)

Simply Wall St Growth Rating: ★★★★☆☆

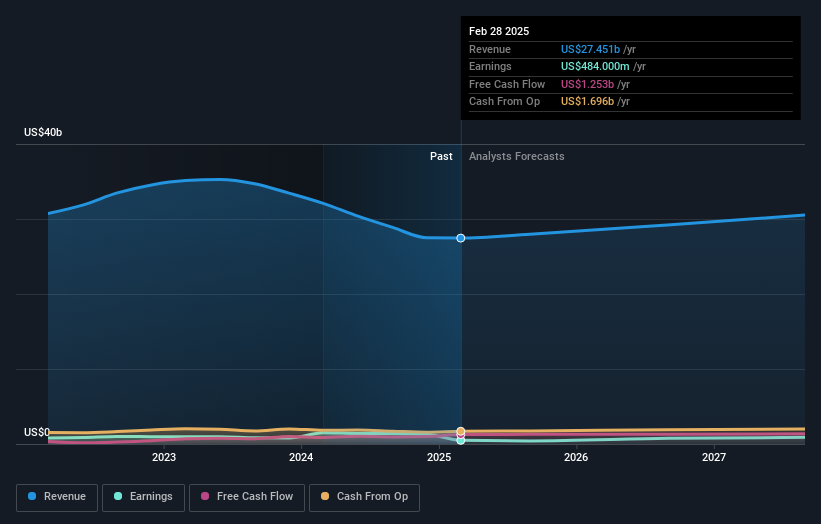

Overview: Jabil Inc. is a global provider of manufacturing services and solutions, with a market cap of approximately $15.28 billion.

Operations: Jabil operates in the manufacturing services and solutions sector globally. The company generates revenue through its diverse range of services, focusing on electronics manufacturing, supply chain management, and engineering solutions.

Jabil, navigating through a challenging landscape, reported a significant drop in net income to $117 million from $927 million year-over-year for Q2 2025, with sales slightly down at $6.7 billion. Despite these figures, the company is making strategic moves into high-growth sectors such as advanced robotics and automation by partnering with Apptronik to build Apollo humanoid robots. This collaboration not only enhances Jabil's manufacturing capabilities but also positions it well for future growth in AI-driven manufacturing solutions. Additionally, Jabil's commitment to expanding its global footprint is evident from its recent announcement of a new factory in Gujarat under a strategic MoU aimed at boosting local production capabilities and exploring cutting-edge technologies like silicon photonics.

- Click here to discover the nuances of Jabil with our detailed analytical health report.

Understand Jabil's track record by examining our Past report.

Cloudflare (NYSE:NET)

Simply Wall St Growth Rating: ★★★★★☆

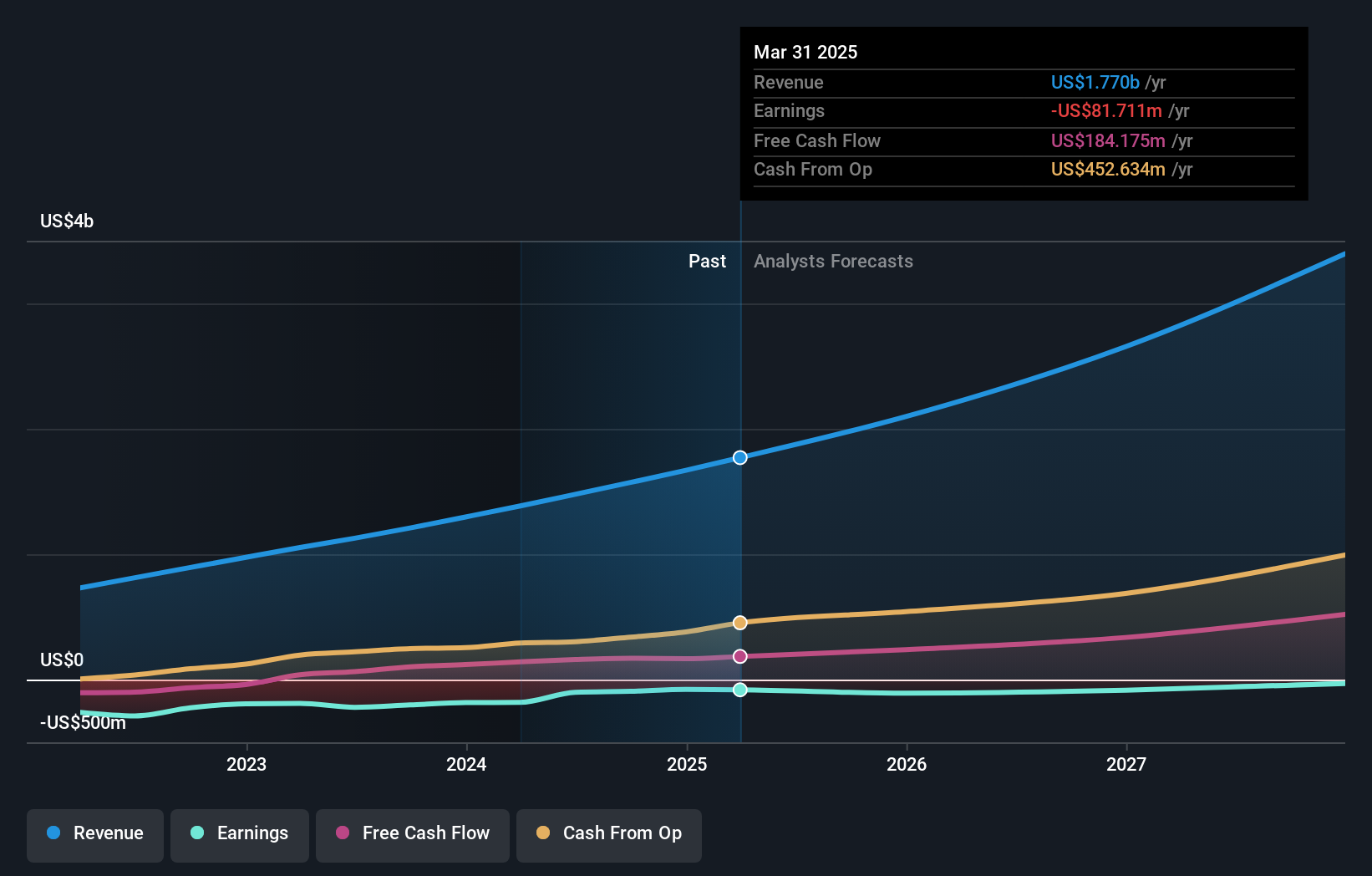

Overview: Cloudflare, Inc. operates as a cloud services provider offering various services to businesses globally and has a market capitalization of $40.55 billion.

Operations: The company generates revenue primarily from its Internet Telephone segment, which amounts to $1.67 billion.

Cloudflare is shaping the landscape of cybersecurity with its recent innovations aimed at enhancing organizational security across various platforms. The company's introduction of integrated Security Posture Management and the Cloudforce One threat events platform underscores its commitment to providing comprehensive security solutions that simplify complex IT infrastructures. These tools not only help businesses identify and mitigate risks swiftly but also adapt to an evolving cyber threat environment, leveraging Cloudflare's extensive network data. Moreover, the expansion of post-quantum cryptography within its services anticipates future security challenges, positioning Cloudflare as a forward-thinking leader in internet safety and data protection.

- Unlock comprehensive insights into our analysis of Cloudflare stock in this health report.

Review our historical performance report to gain insights into Cloudflare's's past performance.

Snap (NYSE:SNAP)

Simply Wall St Growth Rating: ★★★★☆☆

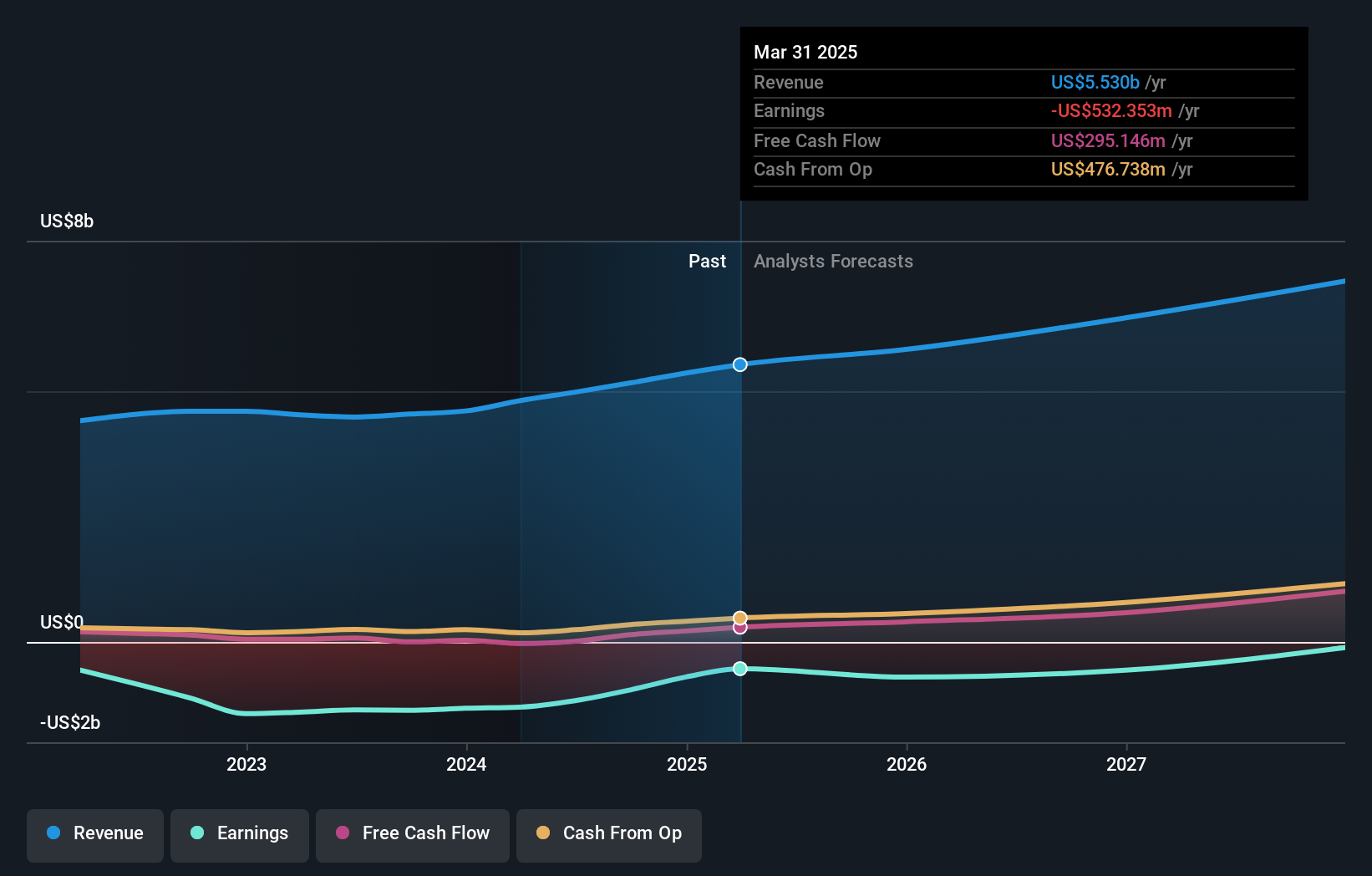

Overview: Snap Inc. is a technology company that provides social media services primarily through its Snapchat application, with a market capitalization of approximately $15.34 billion.

Operations: Snap generates revenue primarily from its Software & Programming segment, totaling $5.36 billion.

Snap Inc. is navigating the high-growth tech landscape with strategic partnerships and financial maneuvers aimed at enhancing its market position and financial stability. Recently, Snap announced a significant partnership with Later, integrating Snapchat's APIs to enhance content discovery and scheduling, which underscores its commitment to expanding digital marketing tools and creator monetization opportunities. Financially, Snap has been active in managing its debt portfolio, evidenced by a $1.5 billion senior notes offering aimed at repurchasing existing convertible notes. This move not only optimizes its capital structure but also potentially supports the stock price through reduced future dilution risks. With an annual revenue growth of 10.8% and projected earnings growth of 55.83%, coupled with strategic initiatives like these, Snap appears poised to strengthen its presence in the dynamic tech sector.

- Take a closer look at Snap's potential here in our health report.

Explore historical data to track Snap's performance over time in our Past section.

Taking Advantage

- Investigate our full lineup of 240 US High Growth Tech and AI Stocks right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NET

Cloudflare

Operates as a cloud services provider that delivers a range of services to businesses worldwide.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives