- United States

- /

- IT

- /

- NYSE:NET

Cloudflare (NYSE:NET) Stock Falls 15% Last Quarter Despite New AI-Focused Security Tools Launch

Reviewed by Simply Wall St

Recent changes at Cloudflare (NYSE:NET) include the appointment of new board members with expertise in AI, governance, and financial markets, as well as the launch of several AI-focused security tools. Despite these initiatives, the company's stock fell by 15% last quarter. This decline aligns with broader market trends, as the Nasdaq endured a 10% drop following tariff announcements, entering bear market territory. These external factors likely weighed heavily on Cloudflare's share price, despite its strategic expansions. Similar pressures affected tech sectors widely, with companies like Nvidia and Apple also experiencing significant falls amid trade tensions and stock market turbulence.

Buy, Hold or Sell Cloudflare? View our complete analysis and fair value estimate and you decide.

Find companies with promising cash flow potential yet trading below their fair value.

Over the past five years, Cloudflare's total shareholder return was a very large 358.36%. During this time, the company underwent several changes that may have influenced its performance. Notably, it launched "Cloudflare for AI" in March 2025, enhancing capabilities in AI applications, and introduced the "Cloudforce One" platform for real-time intelligence on cyberattacks, reflecting its commitment to innovation. The executive team was also revamped, with new board members joining in March 2025, including leaders with expertise in AI and open-source software, which likely shaped the company’s strategic direction. Furthermore, significant expansions occurred, such as the opening of a headquarters in Lisbon in October 2024, strengthening its EMEA operations.

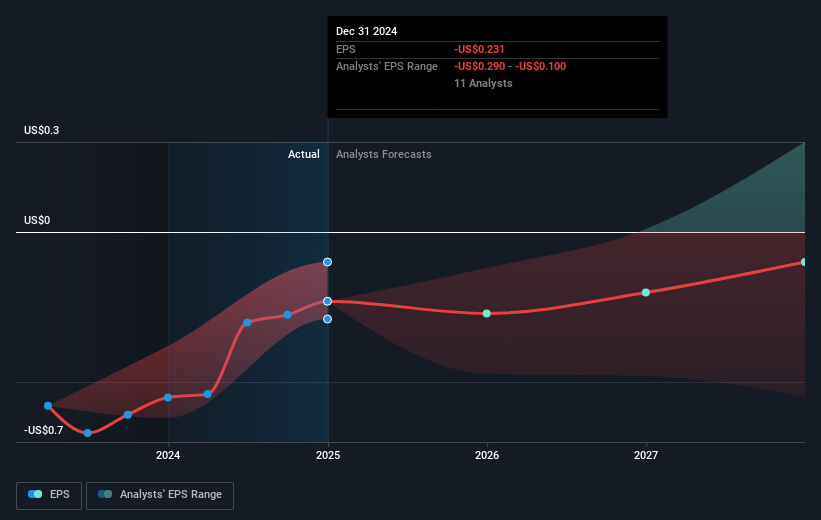

Despite inefficiencies, such as a Price-To-Sales ratio that is considerably higher than the industry average, the company's robust growth strategies, particularly in product and market expansion, likely contributed to its impressive five-year return. In the past year, Cloudflare's stock performance lagged behind the broader US market and the IT industry, which returned 3.3% and 3.5%, respectively.

Understand Cloudflare's track record by examining our performance history report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NET

Cloudflare

Operates as a cloud services provider that delivers a range of services to businesses worldwide.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives