- United States

- /

- IT

- /

- NYSE:KD

US Stocks That May Be Priced Below Their Intrinsic Value In November 2024

Reviewed by Simply Wall St

As the United States stock market continues its upward momentum, with the S&P 500 extending its winning streak and major indices near record highs, investors are keenly observing opportunities to identify stocks that may be priced below their intrinsic value. In this environment of optimism and growth, understanding the fundamentals that make a stock potentially undervalued becomes crucial for those looking to capitalize on discrepancies between market price and intrinsic worth.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| UMB Financial (NasdaqGS:UMBF) | $123.13 | $244.43 | 49.6% |

| Oddity Tech (NasdaqGM:ODD) | $43.12 | $85.73 | 49.7% |

| Business First Bancshares (NasdaqGS:BFST) | $27.95 | $55.08 | 49.3% |

| West Bancorporation (NasdaqGS:WTBA) | $24.07 | $46.84 | 48.6% |

| Afya (NasdaqGS:AFYA) | $16.26 | $31.49 | 48.4% |

| Five Star Bancorp (NasdaqGS:FSBC) | $32.58 | $63.90 | 49% |

| Advanced Energy Industries (NasdaqGS:AEIS) | $112.53 | $219.21 | 48.7% |

| WEX (NYSE:WEX) | $181.73 | $345.51 | 47.4% |

| Marcus & Millichap (NYSE:MMI) | $40.58 | $78.67 | 48.4% |

| Vertex Pharmaceuticals (NasdaqGS:VRTX) | $450.37 | $859.69 | 47.6% |

Let's dive into some prime choices out of the screener.

Microchip Technology (NasdaqGS:MCHP)

Overview: Microchip Technology Incorporated develops, manufactures, and sells smart, connected, and secure embedded control solutions across the Americas, Europe, and Asia with a market cap of approximately $34.97 billion.

Operations: The company's revenue segments consist of $5.39 billion from Semiconductor Products and $103.90 million from Technology Licensing.

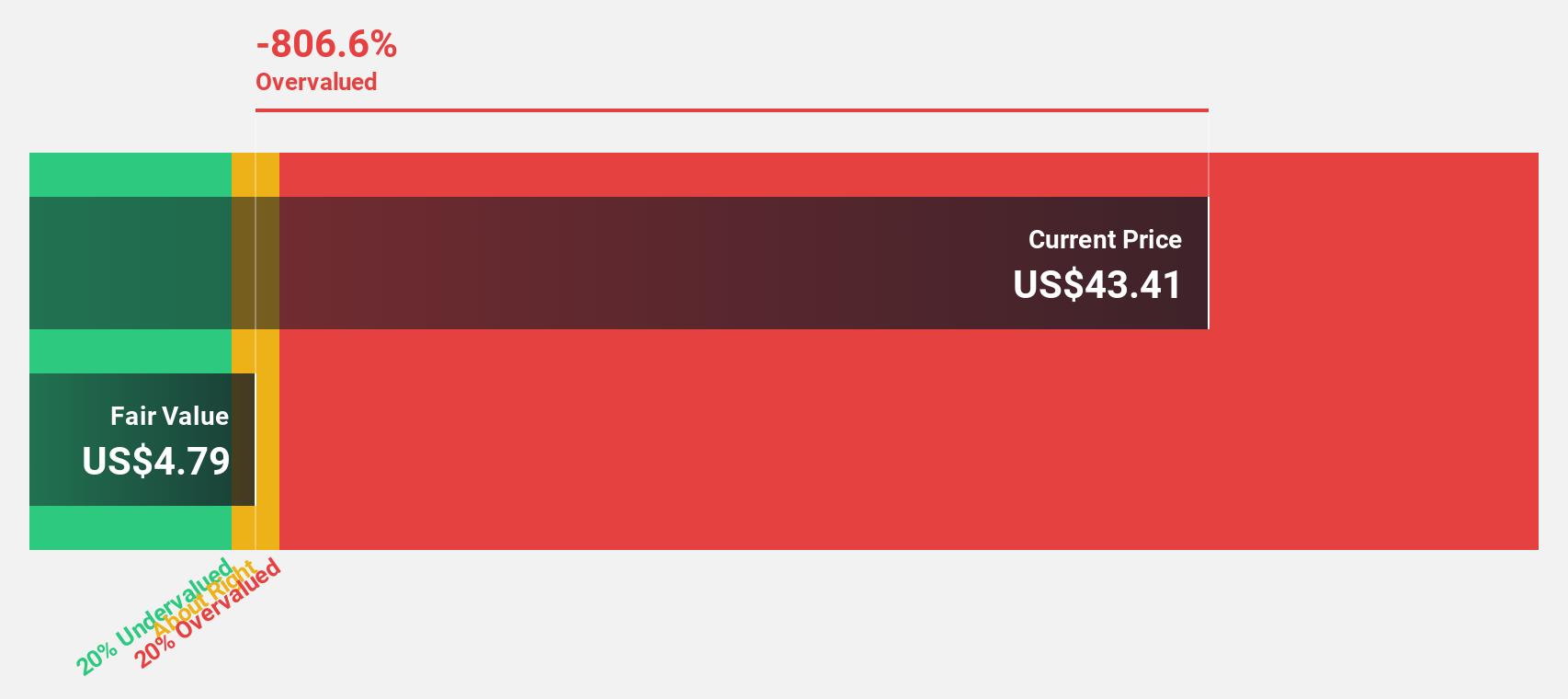

Estimated Discount To Fair Value: 40.6%

Microchip Technology's stock is trading at US$66.51, significantly below its estimated fair value of US$111.97, suggesting it may be undervalued based on cash flows. Despite a decline in profit margins from 28.1% to 14.2%, earnings are expected to grow by over 30% annually, outpacing the broader US market growth forecast of 15.4%. However, high debt levels and a dividend not fully covered by earnings present potential risks for investors evaluating its financial health and sustainability.

- According our earnings growth report, there's an indication that Microchip Technology might be ready to expand.

- Click here to discover the nuances of Microchip Technology with our detailed financial health report.

Inspire Medical Systems (NYSE:INSP)

Overview: Inspire Medical Systems, Inc. is a medical technology company that develops and commercializes minimally invasive solutions for obstructive sleep apnea patients in the United States and internationally, with a market cap of approximately $5.54 billion.

Operations: The company's revenue primarily comes from its Patient Monitoring Equipment segment, which generated $755.59 million.

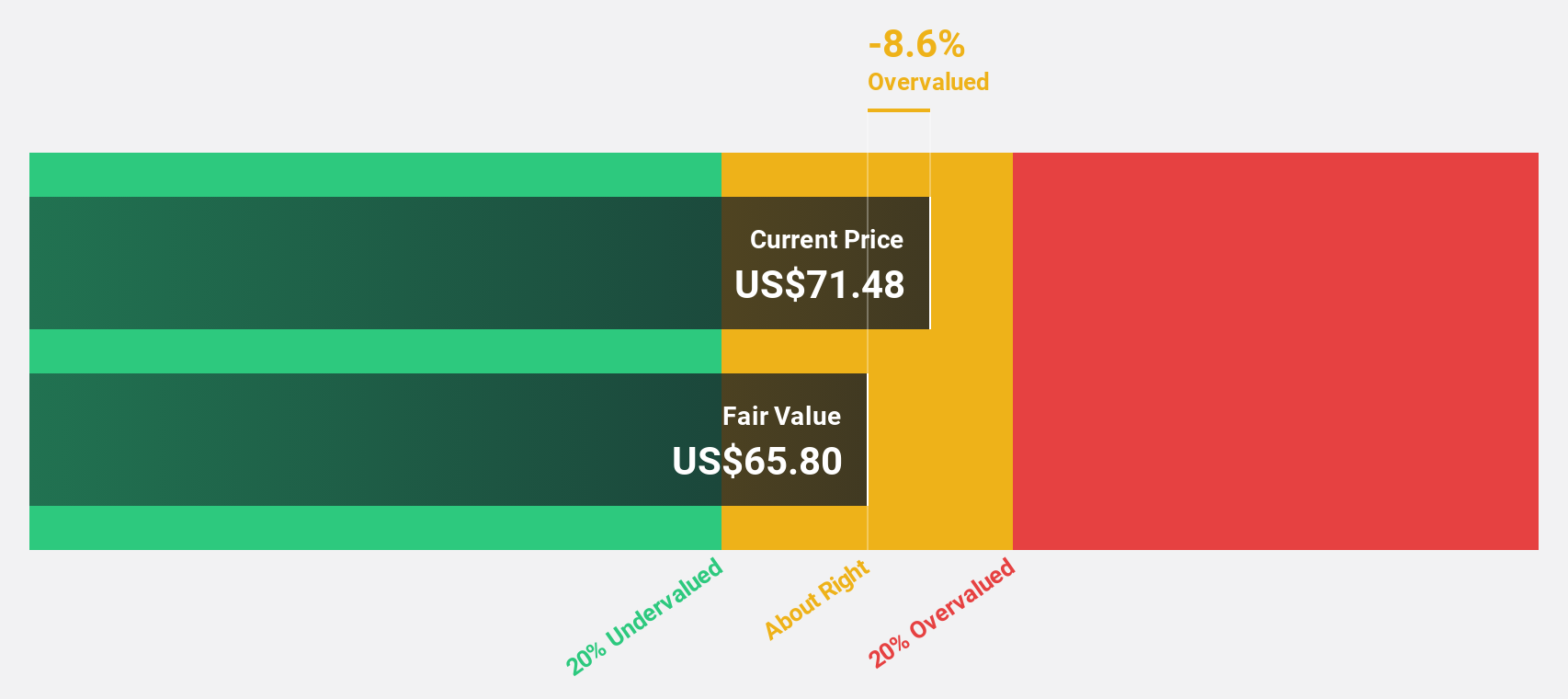

Estimated Discount To Fair Value: 22.1%

Inspire Medical Systems is trading at US$186.19, below its estimated fair value of US$239.03, reflecting potential undervaluation based on cash flows. The company recently turned profitable with a net income of US$18.5 million in Q3 2024 and forecasts suggest earnings growth of nearly 34% annually, surpassing the broader market's growth rate. While revenue growth is projected at 16.1% annually, its return on equity forecast remains modest at 8.5%.

- Our growth report here indicates Inspire Medical Systems may be poised for an improving outlook.

- Get an in-depth perspective on Inspire Medical Systems' balance sheet by reading our health report here.

Kyndryl Holdings (NYSE:KD)

Overview: Kyndryl Holdings, Inc. is a global technology services and IT infrastructure provider with a market cap of approximately $6.63 billion.

Operations: The company's revenue segments are comprised of $2.34 billion from Japan, $3.97 billion from the United States, $5.69 billion from Principal Markets, and $3.31 billion from Strategic Markets.

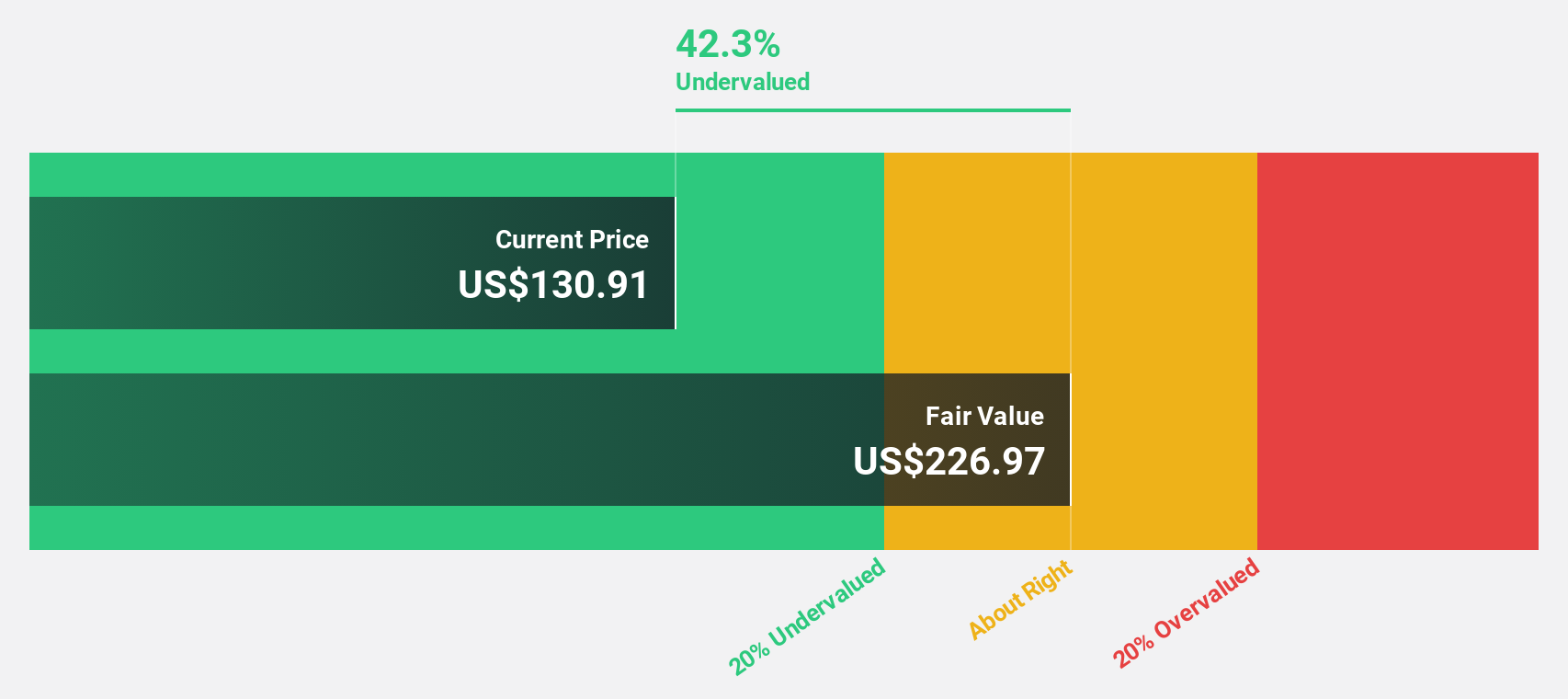

Estimated Discount To Fair Value: 38.1%

Kyndryl Holdings is trading at US$32.49, significantly below its fair value estimate of US$52.48, highlighting potential undervaluation based on cash flows. The company is expected to become profitable within three years, with earnings forecasted to grow substantially by 90.69% annually. Recent initiatives include a US$300 million share buyback and expanded collaborations with Microsoft for cloud modernization services, which could enhance its competitive position and support long-term growth strategies.

- Our comprehensive growth report raises the possibility that Kyndryl Holdings is poised for substantial financial growth.

- Delve into the full analysis health report here for a deeper understanding of Kyndryl Holdings.

Next Steps

- Unlock more gems! Our Undervalued US Stocks Based On Cash Flows screener has unearthed 179 more companies for you to explore.Click here to unveil our expertly curated list of 182 Undervalued US Stocks Based On Cash Flows.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kyndryl Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KD

Kyndryl Holdings

Operates as a technology services company and IT infrastructure services provider in the United States, Japan, and internationally.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Halyk Bank of Kazakhstan will see revenue grow 11% as their future PE reaches 3.2x soon

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026