- United States

- /

- Biotech

- /

- NasdaqGM:MNKD

Exploring High Growth Tech Stocks In The United States October 2024

Reviewed by Simply Wall St

Over the last 7 days, the United States market has remained flat, yet it boasts a remarkable 33% increase over the past year with earnings forecasted to grow by 15% annually. In this context of robust growth and stability, identifying high growth tech stocks involves looking for companies that demonstrate strong innovation potential and adaptability in an ever-evolving technological landscape.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 20.86% | 27.98% | ★★★★★★ |

| Sarepta Therapeutics | 23.58% | 44.12% | ★★★★★★ |

| TG Therapeutics | 28.39% | 43.54% | ★★★★★★ |

| Invivyd | 42.91% | 70.39% | ★★★★★★ |

| Ardelyx | 27.19% | 66.44% | ★★★★★★ |

| Amicus Therapeutics | 20.32% | 62.37% | ★★★★★★ |

| AsiaFIN Holdings | 60.53% | 81.55% | ★★★★★★ |

| Travere Therapeutics | 26.51% | 69.33% | ★★★★★★ |

| Seagen | 22.57% | 71.80% | ★★★★★★ |

| ImmunoGen | 26.00% | 45.85% | ★★★★★★ |

Click here to see the full list of 253 stocks from our US High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

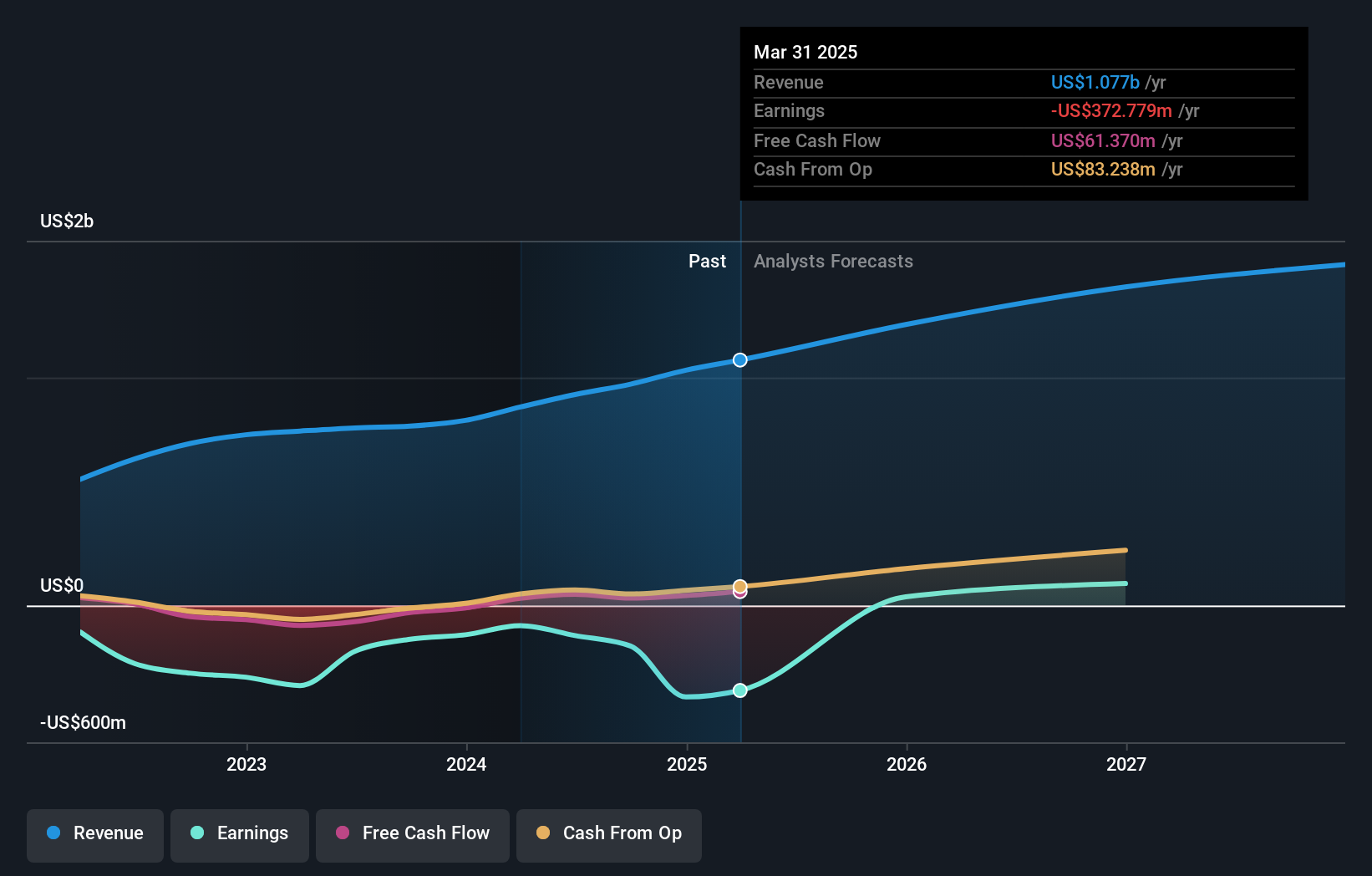

Pagaya Technologies (NasdaqCM:PGY)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Pagaya Technologies Ltd. is a technology company that leverages data science and proprietary AI technology to serve financial institutions and investors across various regions, with a market cap of approximately $717.43 million.

Operations: Pagaya Technologies Ltd. generates revenue primarily through its Software & Programming segment, which amounted to $925.42 million. The company utilizes its proprietary AI technology and data science expertise to cater to financial institutions and investors in multiple regions, including the United States, Israel, and the Cayman Islands.

Pagaya Technologies, amid a turbulent financial landscape, has demonstrated a robust commitment to innovation with its R&D expenditures reaching $113.6 million, reflecting its strategic focus on enhancing AI-driven lending solutions. This investment is critical as it supports the company's technology advancements in a sector where cutting-edge developments are crucial for maintaining competitive edge. Despite recent executive changes and a net loss of $74.79 million in Q2 2024, Pagaya's revenue surged by 15.3% year-over-year to $250.34 million, underscoring potential resilience and adaptability in its business model. The firm’s recent partnership with Castlelake also highlights an expanding influence and strategic depth in financial networks, poised to potentially bolster future performance through innovative capital deployment strategies.

- Dive into the specifics of Pagaya Technologies here with our thorough health report.

Evaluate Pagaya Technologies' historical performance by accessing our past performance report.

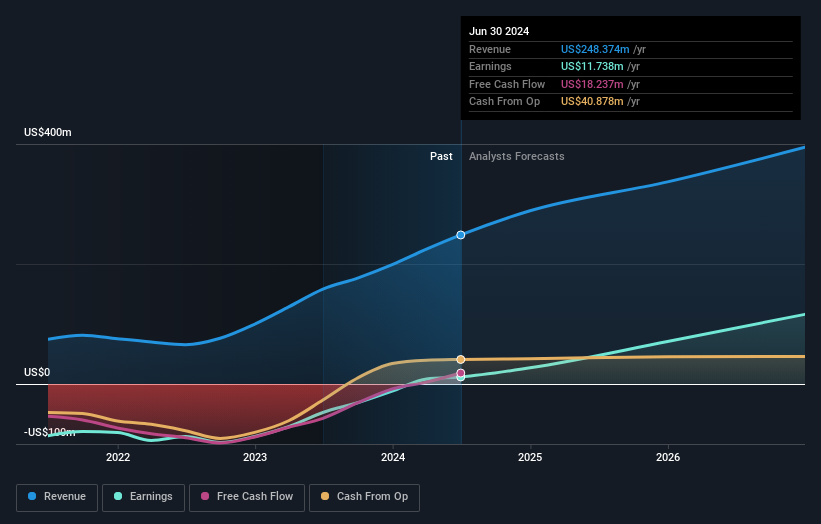

MannKind (NasdaqGM:MNKD)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: MannKind Corporation is a biopharmaceutical company specializing in the development and commercialization of inhaled therapeutic products for endocrine and orphan lung diseases in the United States, with a market cap of approximately $1.77 billion.

Operations: The company generates its revenue primarily from its pharmaceuticals segment, which reported $248.37 million. Its focus is on inhaled therapeutic products targeting endocrine and orphan lung diseases in the U.S.

MannKind Corporation, reflecting a strategic pivot towards high-growth sectors, has recently announced promising results from its INHALE-3 study, potentially boosting its profile in biopharmaceuticals. With R&D expenses underpinning these advancements, the firm's commitment to innovation is evident as it allocated significant resources to develop Afrezza and other pipeline products. Financially, MannKind's revenue trajectory is expected to climb by 14% annually, outpacing the broader U.S. market forecast of 8.7%. Additionally, earnings are projected to surge by an impressive 39.4% per year, highlighting both the risks and opportunities inherent in its developmental strategies. This growth narrative is further supported by recent regulatory approvals in Japan and ongoing global studies that could expand MannKind’s market reach and therapeutic impact.

- Get an in-depth perspective on MannKind's performance by reading our health report here.

Review our historical performance report to gain insights into MannKind's's past performance.

Kyndryl Holdings (NYSE:KD)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kyndryl Holdings, Inc. is a global technology services company specializing in IT infrastructure services, with a market capitalization of approximately $5.28 billion.

Operations: The company generates revenue through its IT infrastructure services, with significant contributions from the United States ($4.12 billion), Japan ($2.30 billion), Principal Markets ($5.75 billion), and Strategic Markets ($3.43 billion).

Kyndryl Holdings, despite its modest annual revenue growth of 1%, is making significant strides in AI integration with its recent expansion of services around Copilot for Microsoft 365. This move is expected to enhance user experience and operational efficiency, showcasing a strategic pivot towards leveraging AI for business transformations. Impressively, the company's earnings are forecasted to surge by 84.7% annually. Furthermore, Kyndryl's R&D commitment is robust, aligning with industry trends where technological innovation through research plays a crucial role in maintaining competitive advantage. This focus on advanced tech solutions positions Kyndryl to potentially capitalize on emerging market opportunities despite current financial underperformance relative to the broader IT sector's growth rates.

- Take a closer look at Kyndryl Holdings' potential here in our health report.

Examine Kyndryl Holdings' past performance report to understand how it has performed in the past.

Key Takeaways

- Click this link to deep-dive into the 253 companies within our US High Growth Tech and AI Stocks screener.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:MNKD

MannKind

A biopharmaceutical company, focuses on the development and commercialization of inhaled therapeutic products for endocrine and orphan lung diseases in the United States.

Reasonable growth potential and fair value.