- United States

- /

- Banks

- /

- NYSE:GBCI

3 Stocks That May Be Undervalued By Up To 46.1% Based On Intrinsic Value Estimates

Reviewed by Simply Wall St

As the U.S. stock market navigates a flurry of earnings reports and anticipates the Federal Reserve's upcoming meeting on interest rates, major indices like the S&P 500 and Nasdaq have recently hit record highs, reflecting investor optimism about corporate performance and economic stability. In such an environment, identifying undervalued stocks can be particularly rewarding, as these stocks might offer potential for growth when their intrinsic value is not fully recognized by the market.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| TowneBank (TOWN) | $35.70 | $69.58 | 48.7% |

| Sotera Health (SHC) | $12.29 | $24.38 | 49.6% |

| Rapid7 (RPD) | $22.65 | $43.80 | 48.3% |

| Hims & Hers Health (HIMS) | $58.68 | $113.93 | 48.5% |

| Gogo (GOGO) | $16.33 | $32.45 | 49.7% |

| Customers Bancorp (CUBI) | $65.74 | $131.18 | 49.9% |

| Carter Bankshares (CARE) | $17.93 | $35.83 | 50% |

| Camden National (CAC) | $41.46 | $82.80 | 49.9% |

| ATRenew (RERE) | $3.28 | $6.50 | 49.6% |

| Acadia Realty Trust (AKR) | $18.60 | $36.62 | 49.2% |

We're going to check out a few of the best picks from our screener tool.

Hesai Group (HSAI)

Overview: Hesai Group develops, manufactures, and sells three-dimensional LiDAR solutions across Mainland China, Europe, North America, and internationally with a market cap of approximately $2.82 billion.

Operations: Revenue Segments (in millions of CN¥):

Estimated Discount To Fair Value: 46.1%

Hesai Group is trading at 46.1% below its estimated fair value of US$40.65, suggesting it is highly undervalued based on discounted cash flow analysis. The company has demonstrated strong revenue growth, with a forecasted annual increase of 27.1%, outpacing the US market's average growth rate. Recent earnings show improved financial performance with reduced net losses and increased sales, while legal challenges have been resolved favorably, reinforcing its robust intellectual property position.

- Our comprehensive growth report raises the possibility that Hesai Group is poised for substantial financial growth.

- Unlock comprehensive insights into our analysis of Hesai Group stock in this financial health report.

Glacier Bancorp (GBCI)

Overview: Glacier Bancorp, Inc. is a bank holding company for Glacier Bank, offering commercial banking services to individuals, small to medium-sized businesses, community organizations, and public entities across the United States with a market cap of approximately $5.37 billion.

Operations: The company generates revenue of $854.21 million from its banking services, catering to a diverse clientele including individuals, small to medium-sized businesses, community organizations, and public entities in the United States.

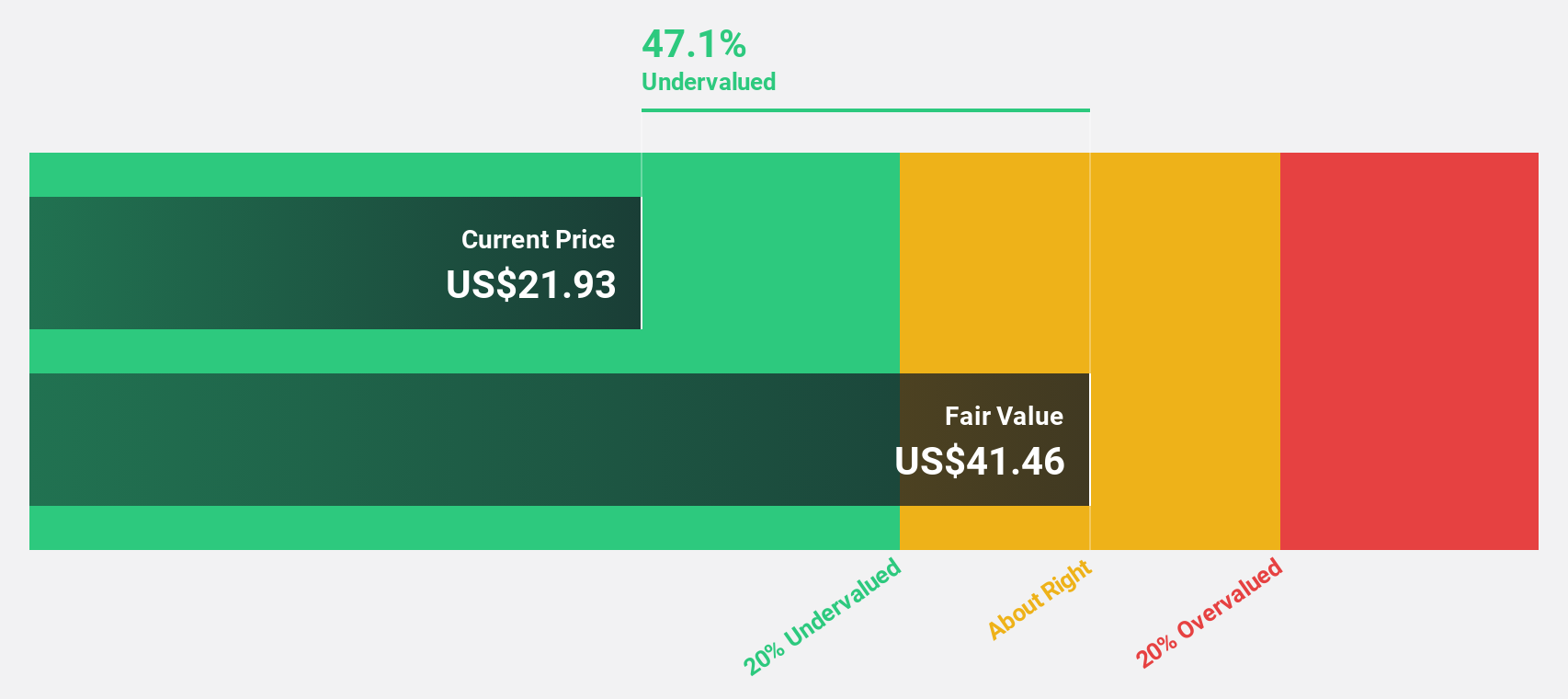

Estimated Discount To Fair Value: 11.8%

Glacier Bancorp is trading at US$46.45, below its estimated fair value of US$52.64, indicating it is undervalued based on cash flows. Recent earnings show net interest income increased to US$207.62 million from US$166.48 million year-over-year for Q2 2025, with net income rising to US$52.78 million from US$44.71 million. Earnings are forecasted to grow significantly at 33.8% annually, surpassing the broader U.S market's growth rate of 14.9%.

- The analysis detailed in our Glacier Bancorp growth report hints at robust future financial performance.

- Get an in-depth perspective on Glacier Bancorp's balance sheet by reading our health report here.

Kyndryl Holdings (KD)

Overview: Kyndryl Holdings, Inc. is a technology services company providing IT infrastructure services across the United States, Japan, and globally, with a market cap of $9.05 billion.

Operations: The company's revenue is derived from four main segments: Japan ($2.36 billion), United States ($3.88 billion), Principal Markets ($5.21 billion), and Strategic Markets ($3.62 billion).

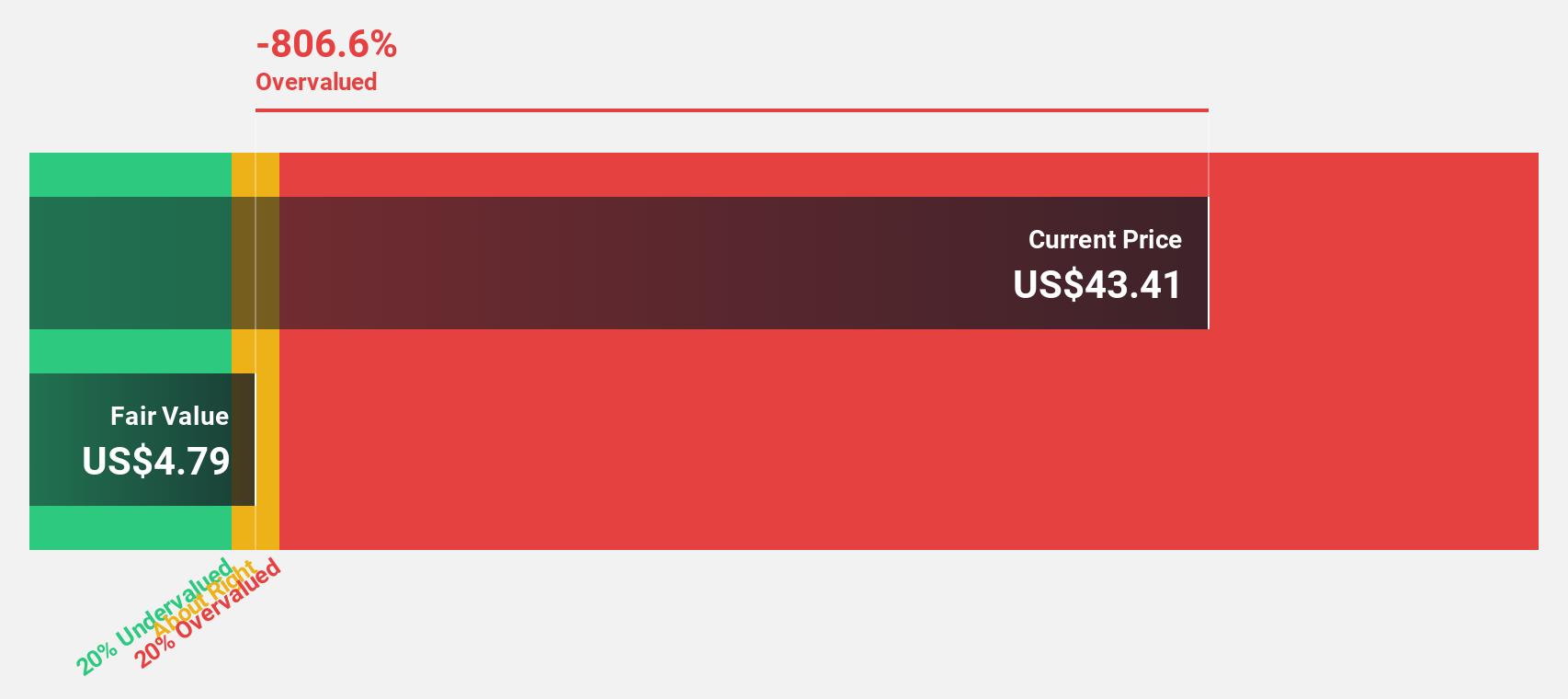

Estimated Discount To Fair Value: 44.1%

Kyndryl Holdings trades at US$39.47, significantly below its fair value estimate of US$70.66, highlighting its undervaluation based on cash flows. Despite a high debt level, Kyndryl's earnings are projected to grow 41% annually over the next three years, outpacing the broader U.S market's 14.9% growth rate. Recent initiatives like the Kyndryl Agentic AI Framework and partnerships with Microsoft and AWS underscore its strategic focus on AI-driven solutions for digital transformation across industries.

- Our earnings growth report unveils the potential for significant increases in Kyndryl Holdings' future results.

- Take a closer look at Kyndryl Holdings' balance sheet health here in our report.

Make It Happen

- Click here to access our complete index of 167 Undervalued US Stocks Based On Cash Flows.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GBCI

Glacier Bancorp

Operates as the bank holding company for Glacier Bank that provides commercial banking services to individuals, small to medium-sized businesses, community organizations, and public entities in the United States.

Flawless balance sheet with high growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives