- United States

- /

- IT

- /

- NYSE:IBM

Is IBM’s Quantum Advantage Enough to Justify Its 31% 2025 Stock Surge?

Reviewed by Bailey Pemberton

If you’re wondering whether now is the time to buy, hold, or rethink International Business Machines, you’re not alone. IBM has made plenty of headlines lately, not just from Wall Street analysts, but from major outlets reporting on its promising momentum in quantum computing and its leadership moves in artificial intelligence. And if you’re tracking performance, the numbers might have caught your eye: IBM’s stock is up 31.0% year-to-date and has notched a 165.7% gain over the last three years. These are not the kind of moves you’d expect from a “dinosaur” of tech.

Much of this growth comes from a renewed sense of excitement and, frankly, a bit of changing risk perception among investors. Reports highlighting IBM’s favorable position in the “Quantum advantage” race, with companies like Google and Microsoft in the mix, have given Big Blue some futuristic sparkle. Shorter-term moves aren’t being left behind either. In the past month, IBM’s stock has soared 11.2%, and even in the last seven days, there’s been a modest 0.5% uptick. It’s not just a bounce; the growth is part of a wider story, where old tech is finding new relevance and investors are taking note.

But what about valuation? On that front, the “scoreboard” says IBM is undervalued in just 1 out of 6 standard checks. That presents an intriguing puzzle. Should you trust the numbers, or are there other factors at play raising IBM’s ceiling? Let’s look at how these traditional valuation methods stack up, and stick around, because by the end, we’ll explore what could be a much smarter way to judge a company’s worth.

International Business Machines scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: International Business Machines Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) method is a popular approach that estimates a company's true value by projecting its future cash flows and discounting them back to today's dollars. In essence, it’s a way of asking: how much are all IBM’s expected future profits worth right now?

For International Business Machines, analysts report current Free Cash Flow at $11.5 Billion. Estimates from multiple analysts suggest cash flows will steadily grow over the next five years, reaching about $18.7 Billion by 2029. Beyond that, projections are extrapolated using modest assumptions to envision FCF crossing $24.1 Billion by 2035. Readers should note that accuracy tends to decrease the further out we go.

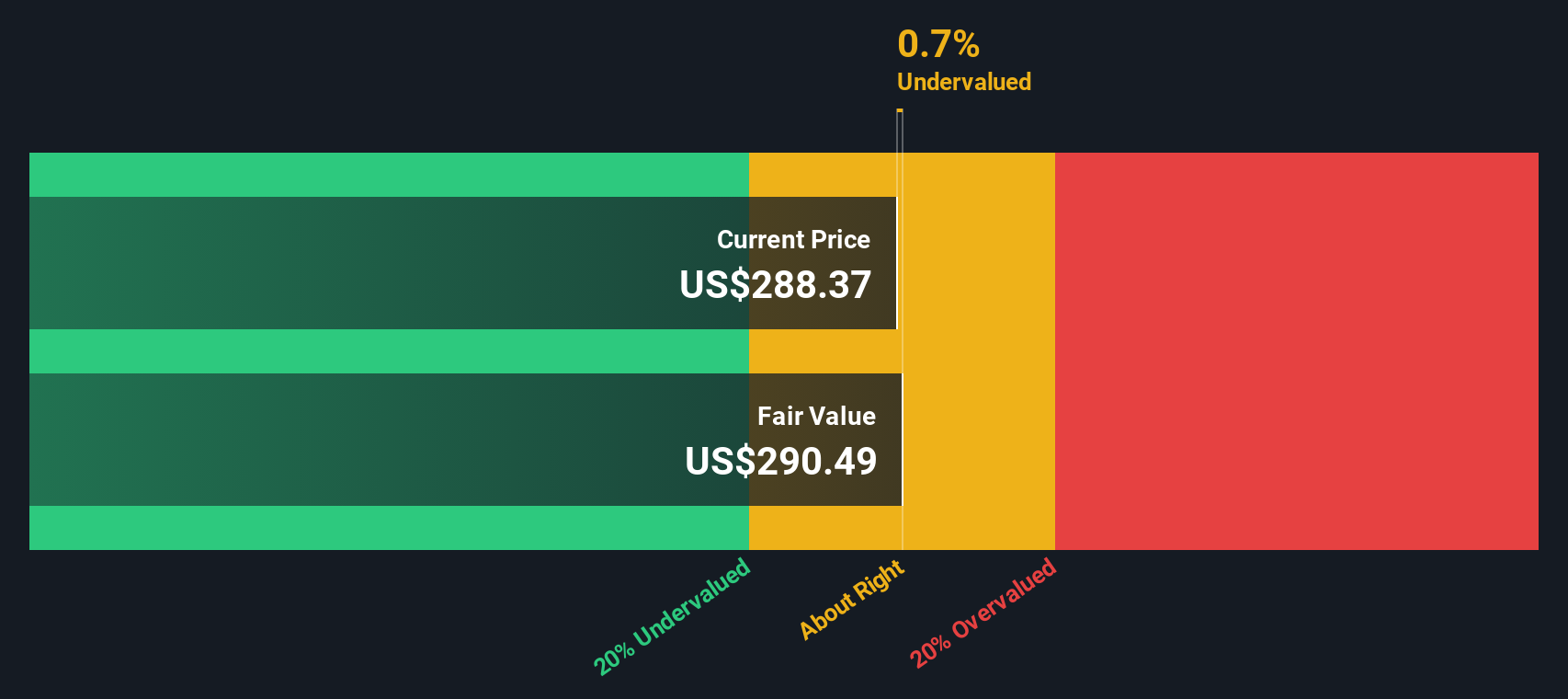

Putting these numbers together using the DCF model, the estimate for IBM’s intrinsic value comes to $290.21 per share. Right now, IBM’s share price is trading just 0.7% below this level, which means the market price is very close to what the model suggests the company is worth.

Result: ABOUT RIGHT

Simply Wall St performs a valuation analysis on every stock in the world every day (check out International Business Machines's valuation analysis). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes.

Approach 2: International Business Machines Price vs Earnings

The Price-to-Earnings (PE) ratio is a tried-and-true metric that offers a quick snapshot of how investors are valuing a profitable company like International Business Machines. The PE ratio is especially useful for companies with steady earnings, as it connects what you pay as an investor to the company’s bottom-line profits. Fast-growing firms with lower risks and wider profit margins often carry higher PE ratios, while businesses with uncertain outlooks or shrinking earnings tend to trade at lower multiples.

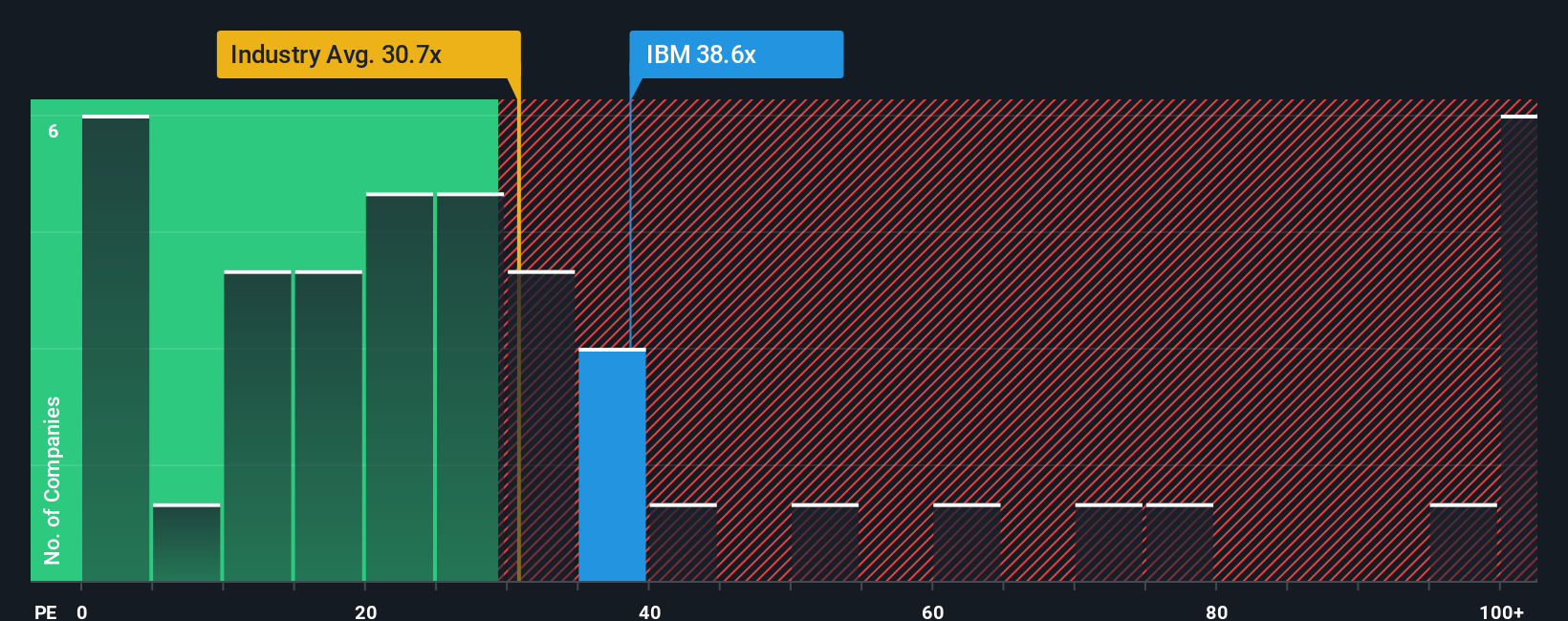

IBM currently trades at a PE ratio of 45.8x, which stands notably above both the average for its IT industry peers at 32.4x and the peer group average at 21.0x. These benchmarks offer context but may not factor in IBM’s unique growth profile, market positioning, or any potential risks attached to its business.

That is where Simply Wall St’s proprietary "Fair Ratio" comes in. The Fair Ratio, calculated as 43.4x for IBM, takes a deeper dive by weighing elements like the company’s projected earnings growth, risk profile, industry, profit margins, and size. This tailored approach is a more nuanced gauge of fair value compared to simply looking at averages, since it aims to capture what makes IBM truly different from its broader peer set.

Comparing IBM’s actual PE ratio (45.8x) with its Fair Ratio (43.4x), the numbers are quite close, with less than a 0.10 difference. This suggests that, at current levels, the stock price aligns well with fundamental expectations.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your International Business Machines Narrative

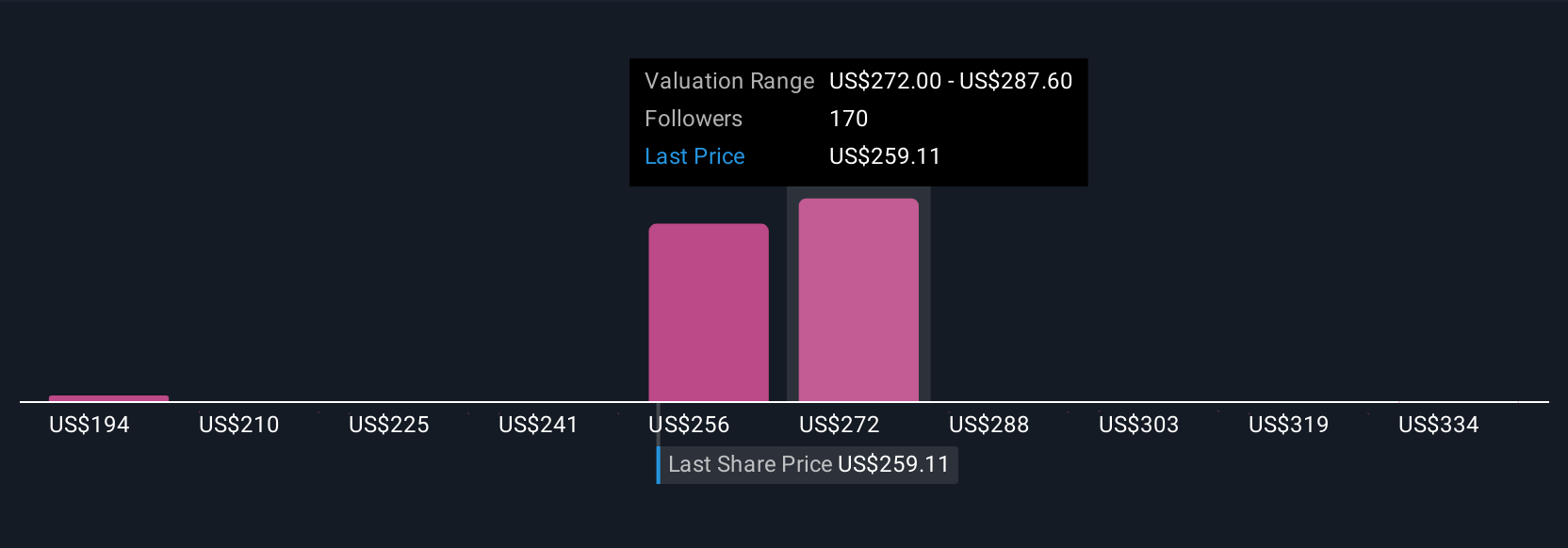

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your story, the unique perspective you have about a company, linked directly to your assumptions behind the numbers: what you believe are reasonable future revenues, earnings, profit margins and fair value. Narratives connect the dots from a company's story to a financial forecast and finally to a fair value, putting you in the driver’s seat on why a stock is fairly priced, overvalued, or a bargain in your eyes.

Narratives are easy to use and available to everyone on Simply Wall St's Community page, used by millions of investors. They make it possible to compare the fair value you assign to International Business Machines with the current share price. This can help you decide if it is time to buy, sell, or hold, based on your outlook. Even better, Narratives update automatically when new earnings or breaking news is released, so your view of IBM is always fresh and fact-based.

For example, some investors see IBM as a transformative leader with a fair value of $350 based on robust AI and cloud growth, while others anticipate competitive headwinds and assign a fair value as low as $198. Narratives let you confidently invest according to your own logic and beliefs, rather than guesswork or hype.

For International Business Machines, we'll make it really easy for you with previews of two leading International Business Machines Narratives:

🐂 International Business Machines Bull Case

Bull Case Fair Value: $350.00

Current price is 17.7% below Bull Case fair value

Expected Revenue Growth Rate: 6.1%

- IBM is positioned for sustained growth and premium valuation due to accelerated AI, hybrid cloud, and digital modernization adoption in regulated sectors, which may drive profitability.

- Integration of key acquisitions and innovation in quantum computing could boost high-margin software, increasing predictable free cash flow.

- Main risks include declining legacy revenues, competition, open-source disruption, talent shortages, and elevated debt levels.

🐻 International Business Machines Bear Case

Bear Case Fair Value (Consensus): $281.32

Current price is 2.4% above Bear Case fair value

Expected Revenue Growth Rate: 5.1%

- IBM’s hybrid cloud, AI, and strategic acquisitions drive client modernization, but macro uncertainty and competition threaten revenue and margin growth.

- Investments in z17 mainframe and generative AI may boost earnings, but volatility in consulting and software segments could dampen prospects.

- Risks include currency fluctuations, competitive pressures, and reliance on discretionary spending and consumption-based services.

Do you think there's more to the story for International Business Machines? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IBM

International Business Machines

Provides integrated solutions and services in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Solid track record established dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026