- United States

- /

- IT

- /

- NYSE:IBM

International Business Machines (NYSE:IBM) Teams With NVIDIA To Enhance Generative AI And Cloud Solutions

Reviewed by Simply Wall St

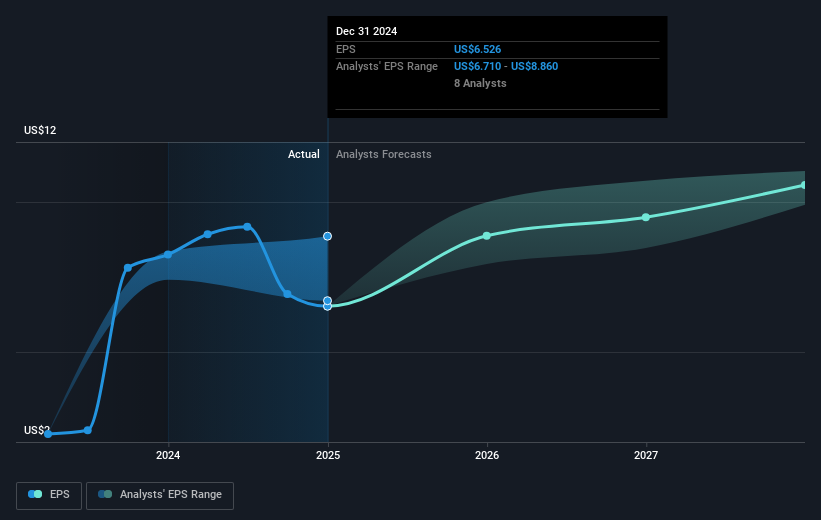

International Business Machines (NYSE:IBM) recently announced a strategic collaboration with NVIDIA to enhance enterprise generative AI workloads through integrated solutions, which may have been a catalyst for the company's share price increasing by 12% in the last quarter. This initiative is part of IBM's broader focus on AI advancements, complemented by the upcoming launch of content-aware storage capabilities to strengthen hybrid cloud infrastructure. Furthermore, IBM's solid dividend payout of $1.67 per share and consistent revenue growth, with fourth-quarter earnings highlighting a slight year-over-year increase, also underscore investor confidence. Despite a dip in net income, these corporate actions may have supported IBM's positive stock performance amid broader market trends. With major U.S. indices like the Dow Jones and Nasdaq posting gains, investor sentiment seems positive, aiding IBM's share price movement in a period marked by heightened anticipation around Federal Reserve decisions and a recovering tech sector.

IBM's shares delivered a total return of 208.14% over the last five years, demonstrating substantial gains for shareholders. Comparatively, the prior year saw IBM outperforming the US IT industry and overall market, both of which posted lower returns. During this period, IBM consistently focused on strategic collaborations, such as the impactful partnership with NVIDIA to advance generative AI capabilities, announced in March 2025, which strengthened its position in the tech landscape.

Other significant developments included the launch of the IBM POWER10 processors announced in August 2020, enhancing hybrid cloud computing capabilities. Furthermore, IBM's partnership with Coca-Cola European Partners and numerous global banks facilitated the expansion of its cloud services. In November 2020, enhancements in IBM Cloud for Financial Services were introduced to secure sensitive operations. Such initiatives, alongside regular dividend payouts, underscored IBM's commitment to innovation and shareholder value during this transformative period.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IBM

International Business Machines

Provides integrated solutions and services in the United States, Europe, the Middle East, Africa, Asia Pacific, and internationally.

Adequate balance sheet average dividend payer.