- United States

- /

- IT

- /

- NYSE:IBM

International Business Machines (NYSE:IBM) Partners With Datavault AI To Enhance AI Monetization

Reviewed by Simply Wall St

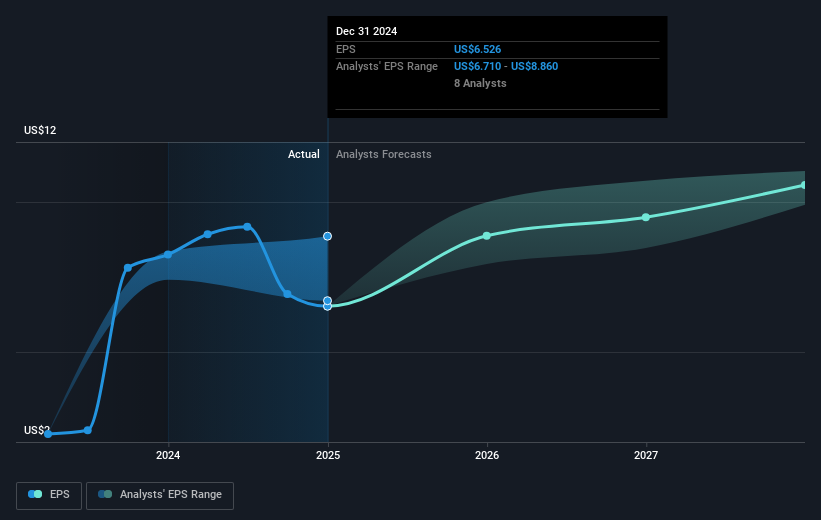

In a robust quarter for International Business Machines (NYSE:IBM), the company's stock saw a notable on-market price increase of 9%. Alignments like the collaboration with Datavault AI Inc. in IBM's Partner Plus program and several key strategic partnerships, such as those with Finastra, NVIDIA, and the Basque Government, may have fueled investor confidence. Despite IBM's mixed earnings results, where revenue slightly increased but net income fell, its prospects for growth through technological advancements in AI and quantum computing appear promising. Market conditions featuring recovering indexes further augmented IBM's favorable pricing environment during the period.

Be aware that International Business Machines is showing 4 weaknesses in our investment analysis.

Over the past five years, IBM has delivered an impressive total shareholder return of 184.22%, reflecting its stock price increase coupled with cash dividends. This robust performance stands out, especially considering IBM's returns over the past year surpassed both the US market and the US IT industry, which returned 8.1% and 8.9%, respectively.

Several factors have contributed to this long-term success. The launch of IBM's z17 mainframe and the development of generative AI have strengthened its leadership in key technology areas. Moreover, consistent quarterly cash dividends, reaching US$1.67 per share by early 2025, have supported shareholder returns. Recent strategic alliances, including collaborations with Datavault AI and Finastra, have bolstered IBM's market position. Furthermore, IBM's investment in expanding its software portfolio through global platforms like AWS has widened its market reach considerably. Analysts, however, have pointed to challenges such as geopolitical tensions and the strong U.S. dollar, which could pose risks to future growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IBM

International Business Machines

Provides integrated solutions and services in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Solid track record established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026